Portfolio Management and Optimization in Excel

Why take this course?

🚀 Course Title: Portfolio Management and Optimization in Excel

🎓 Course Headline: Master Portfolio Construction, Risk Management, & Investment Objectives with Excel!

📈 What You’ll Learn:

-

Understand Financial Markets

- Gain insights into financial markets and their participants.

-

Investment Approaches & Portfolio Management Process

- Explore different investment approaches and the portfolio management process tailored to various investor types.

-

Asset Management Industry Deep Dive

- Uncover the range of pooled investment vehicles in the asset management industry.

-

Financial Data Analysis with Excel

- Learn to download and interpret financial data effectively.

-

Statistical Analysis & Risk Assessment

- Calculate mean, variance, and correlation of asset returns, understand correlation and diversification.

-

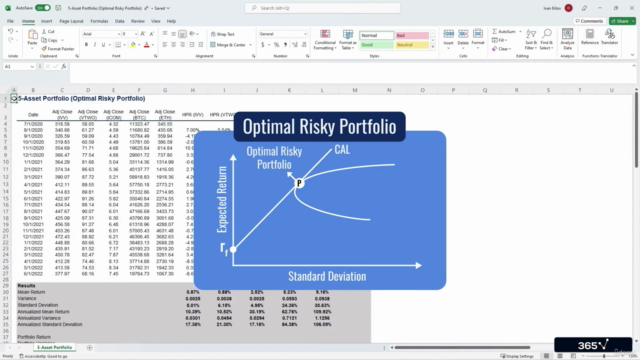

Modern Portfolio Theory & CAPM

- Apply portfolio theory using Excel to build an efficient frontier and identify the optimal asset combination for minimal risk.

-

Performance Measurement Indicators

- Calculate performance indicators like the Sharpe ratio, Treynor ratio, M2, and Jensen’s alpha.

-

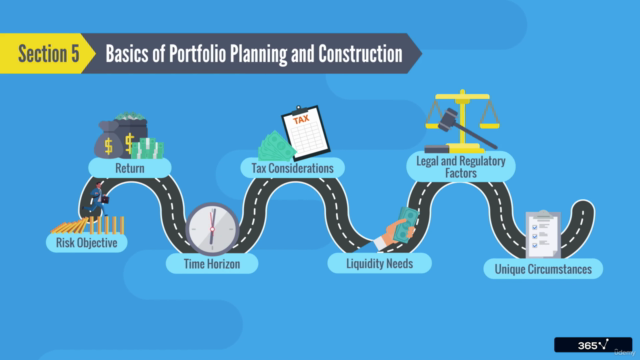

Investment Policy Statements & Risk Tolerance Analysis

- Understand the role of investment policy statements and analyze financial risk tolerance.

-

ESG Investing Integration

- Explore how to integrate Environmental, Social, and Governance (ESG) factors into portfolio planning.

-

Risk Management & Technical Analysis

- Identify and quantify company risks, understand the principles of technical analysis, and examine common indicators.

👨🎓 Course Outline:

-

Introduction to Financial Markets

- Who are the market participants?

- How do markets function?

-

Individual vs. Portfolio Approaches

- Understanding your investment objectives and needs.

- Tailoring asset allocation strategies to different investor profiles.

-

Asset Management Industry Insights

- Explore various investment vehicles and their characteristics.

-

Data Analysis with Excel

- Practical exercises on downloading and interpreting financial data.

-

Statistical Foundations for Portfolio Theory

- Learn how to calculate and interpret statistical measures important for portfolio optimization.

-

Modern Portfolio Theory (MPT) & Capital Asset Pricing Model (CAPM)

- Build an efficient frontier using real-world examples in Excel.

- Estimate expected returns on equity with CAPM.

-

Performance Measurement

- Calculate and understand performance ratios that drive investment decisions.

-

Investment Policy Statements (IPS)

- Learn how to draft and analyze IPS from a practical standpoint.

-

Risk Aversion & Tolerance Analysis

- Understand the concept of risk aversion and its impact on investor profiles.

-

ESG Integration in Portfolio Management

- Learn how to incorporate ESG factors into your investment strategy.

-

Risk Identification & Quantification

- Identify and measure the risks faced by a company.

-

Technical Analysis Overview

- Introduced to technical analysis and its underlying assumptions.

-

** Technical Indicators & Cycle Analysis**

- Examine common technical indicators and their application in cycle analysis.

🛠️ Why This Course?

-

Interactive & Animated Content: Learn with engaging animations and interactive modules designed to enhance your learning experience.

-

Real-World Examples & Challenges: Apply your knowledge through practical scenarios and challenges that mimic real-world investment situations.

-

Unconditional 30-Day Money-Back Guarantee: We believe in the quality of our course, offering a full refund if you're not satisfied within 30 days!

🚀 Enroll Now & Transform Your Career!

🎁 Take advantage of this opportunity to learn advanced portfolio management skills with Excel. Dive into the world of finance and investment with confidence. Start your journey today and become a pro in portfolio optimization and risk management! 🌟

👩🏫 Ready to Elevate Your Financial Skills?

Master portfolio management, leverage Excel for powerful data analysis, and make informed investment decisions with our comprehensive course designed for aspiring financial analysts, investors, and finance professionals. Don't miss out—secure your spot today! 💼✨

Course Gallery

Loading charts...