Mortgage Backed Securities (MBS): Basic to Advanced

Why take this course?

🏡 Mastering Mortgage Backed Securities (MBS) with Starweaver Instructor Team 🚀

Embark on a comprehensive journey through the intricate world of mortgage-backed securities with our expertly crafted online course, "Mortgage Backed Securities (MBS): Basic to Advanced." Dive deep into financial markets and gain an in-depth understanding of asset securitization, mortgage loans, cash flows, Collateralized Mortgage Obligations (CMOs), and Pass-Through Securities (PTS). 📊

Course Overview:

This course is your gateway to mastering the complex concepts behind MBS and will equip you with the knowledge to assess their attractiveness. With a focus on practical application, you'll learn through engaging content structured into four comprehensive sections:

-

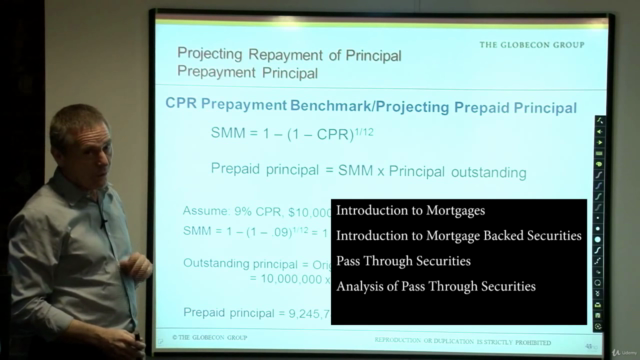

Introduction to Mortgages and Mortgage Backed Securities 🏘️

- Understanding the fundamental concepts of mortgages and their transformation into MBS.

-

Pass Through Securities 🔄

- Explore the mechanics and characteristics of pass-through securities, including their benefits and risks.

-

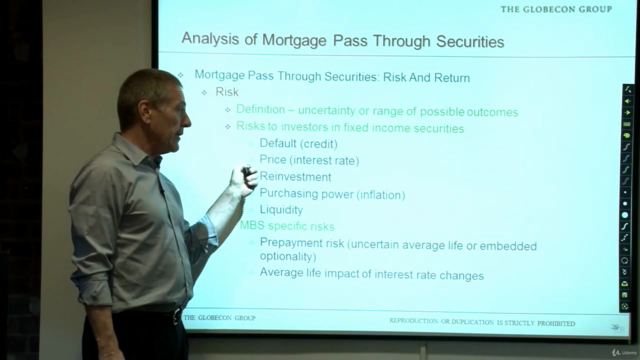

Analysis of Pass Through Securities 📈

- Learn to analyze pass-through securities with tools and techniques that will help you make informed investment decisions.

-

Collateralized Mortgage Obligations (CMOs) 🏦

- Delve into the structure, components, and management of CMOs, understanding how they are priced and traded.

What Sets This Course Apart?

- Expert Instruction: Led by a seasoned capital markets professional with extensive hands-on experience in sales, trading, and analysis within financial markets.

- Real-World Relevance: Designed to provide practical knowledge that can be applied in the real world, this course is ideal for investors, analysts, and anyone interested in the financial sector.

- Starweaver Excellence: Part of a long line of successful training programs delivered by Starweaver, a leading provider of educational content to top financial institutions and tech companies globally. 🌟

Why Choose Starweaver?

Starweaver's reputation as a top-tier training provider is unmatched, with clients including:

- Ahli United Bank

- Mashreqbank

- American Express

- ANZ Bank

- And many more!

With a track record of delivering over 1000 live in-person and online education sessions, Starweaver's courses are tailored for new hires, mid-career professionals, and leaders seeking to enhance their expertise. Our journey builder platform is designed to cater to various learning styles and paces, ensuring a personalized and effective educational experience. 🎓

Ready to Advance Your Knowledge in Mortgage Backed Securities?

Take the first step towards becoming an MBS expert by enrolling in this comprehensive course today. Whether you're interested in live streaming education or you want to understand what courses are best for you, Starweaver is here to guide your learning journey. 🌐

Visit starweaver[dot]com to learn more about our offerings and how we can help you achieve your professional goals.

Happy learning, and we look forward to welcoming you to the Starweaver community! 🎉

Course Gallery

Loading charts...