Valuation

Why take this course?

🎓 [Valuation: Como Avaliar Ações] GroupLayout: Learn the art of valuation with our expert-led course!

Course Headline:

Valuation: The Science Behind Value Investing 🚀

Introduction: Welcome to Valuation: Como Avaliar Ações, where you'll unlock the secrets to assessing the true value of stocks. This course is a game-changer for anyone looking to invest with confidence and precision.

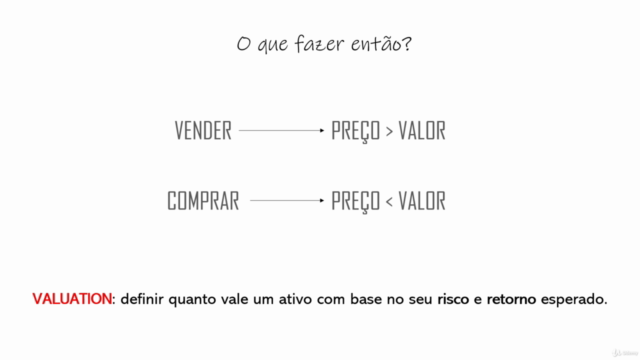

Why Learn Valuation? 🎯 Understanding Value: It's not just about buying low—it's about ensuring you're getting a piece of the market at a fair price or better.

📈 Investment Decisions: With valuation skills, you can make informed decisions, whether you're buying, selling, or holding onto your investments.

🧠 Financial Mastery: Learn to read and understand financial statements like a pro, and gain insights into the economic moats that protect companies from competition.

Course Breakdown: This course is designed to take you through the intricacies of valuation in a clear, step-by-step approach:

-

Valuation Basics: Learn the fundamental concepts and terminologies used in financial analysis.

-

Financial Statements: Dive deep into income statements, balance sheets, and cash flow statements to extract the key figures that will influence your valuation.

-

Discounted Cash Flow (DCF): Master the art of projecting future cash flows and discounting them at an appropriate rate to find a company's intrinsic value.

-

Multiples Analysis: Understand how to benchmark a company against its peers by using multiples like P/E, EV/EBITDA, and P/B.

-

Comparable Companies Analysis (CCA): Learn how to compare a company's performance with similar companies in the same industry.

-

Real-World Case Studies: Apply what you've learned by analyzing real stocks, gaining insights from expert analyses and industry reports.

Key Takeaways:

- Understand the various methods used in valuation and when to use each.

- Learn to interpret financial statements for better decision-making.

- Evaluate companies' performance and growth prospects.

- Apply valuation techniques with confidence and precision.

- Make informed investment decisions based on sound fundamentals.

Who Is This Course For? This course is ideal for:

-

Beginner Investors: If you're new to the stock market, this course will give you a strong foundation in valuation.

-

Experienced Investors: Elevate your investment strategy with advanced valuation techniques and gain a competitive edge.

-

Finance Professionals: Add to your skill set, whether you're in banking, corporate finance, or any other financial sector.

Instructor Profile: Edson Esteves Perroni is a seasoned finance professional with years of experience in the investment world. His expertise in valuation has helped countless investors make smart decisions and achieve their financial goals. With Edson as your guide, you'll learn not just the theoretical aspects but also practical applications of valuation.

Join us in Valuation: Como Avaliar Ações and transform the way you invest. Whether you're aiming to become a value investor or simply want to make more informed financial decisions, this course will equip you with the knowledge you need to succeed. 📚💫

Enroll now and take your first step towards mastering stock valuation!

Course Gallery

Loading charts...