CPA FAR US GAAP ASC 330: Inventory Accounting

Why take this course?

🌟 US GAAP ASC 330: Inventory Accounting Course 🌟

Course Headline:

US GAAP ASC 330: Inventory Accounting

Course Description:

Master the essential principles of US GAAP ASC 330 with this comprehensive course on Inventory Accounting. Designed for accounting professionals, financial analysts, and business owners, this course unpacks the complexities of inventory measurement, valuation, and reporting under US GAAP. Whether you're looking to sharpen your skills or gain practical knowledge, this course provides the tools you need for accurate and compliant inventory accounting.

What You’ll Learn:

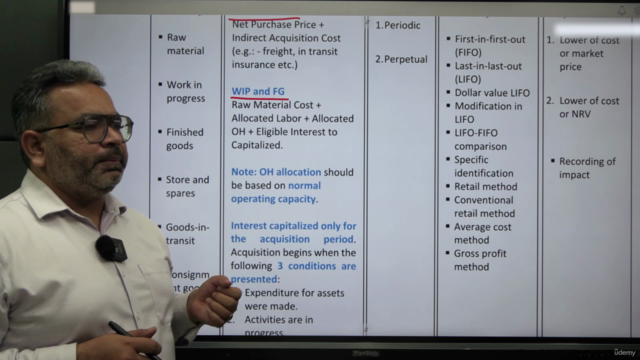

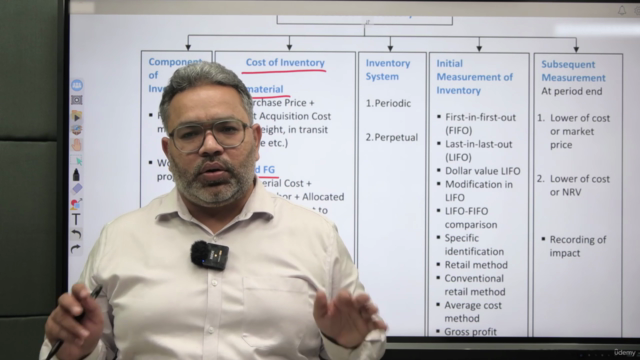

- ✅ Understand the components of inventory and how they influence financial reporting.

- ✅ Explore the periodic and perpetual inventory systems and their applications in real-world scenarios.

- ✅ Learn the initial measurement of inventory, including the Dollar Value LIFO Method and its layering approach for a deeper understanding of cost flow assumptions.

- ✅ Gain insights into the Retail and Conventional Retail Methods for simplified inventory valuation, tailored specifically for retail operations.

- ✅ Apply the Gross Profit Method for estimating inventory in specific scenarios, providing a practical approach to complex situations.

- ✅ Master the subsequent measurement at period-end, focusing on Lower of Cost or Market (LCM) and market price determination to ensure accurate financial statements.

Explore Topics:

- Accounting

- Financial Reporting

- Inventory Valuation

Course Highlights:

Our course is structured with engaging Video Lessons that will take you through each concept step by step:

- Overview - Get started with an introduction to Inventory Accounting and its components.

- Inventory Systems - A detailed exploration of both Periodic and Perpetual Inventory Systems.

- Initial Measurement - Dollar Value LIFO - Learn to use the Dollar Value LIFO Method for adjusting costs and layering inventory based on price changes.

- Retail and Conventional Retail Methods - Simplify inventory tracking and valuation with retail-focused methodologies.

- Gross Profit Method - Understand and apply the Gross Profit Method in estimating inventory.

- Subsequent Measurement at Period End - Dive into Lower of Cost or Market (LCM) valuation and market price determination for a comprehensive understanding of period-end accounting.

By the end of this course, you’ll be equipped to confidently handle inventory accounting challenges, ensuring precision and compliance in your financial reporting. Enroll now to elevate your inventory accounting expertise with US GAAP ASC 330: Inventory Accounting and stay ahead in your financial career! 🎓👏

Course Gallery

Loading charts...