US Business Taxation: Advising Business Taxpayer

Mastering U.S. Business Taxation: Expert Strategies & Advisory

234

students

1 hour

content

May 2025

last update

FREE

regular price

What you will learn

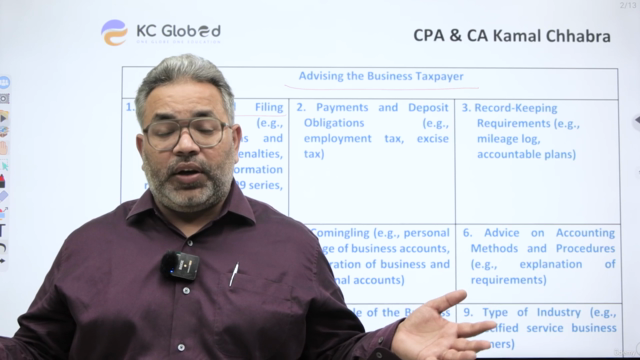

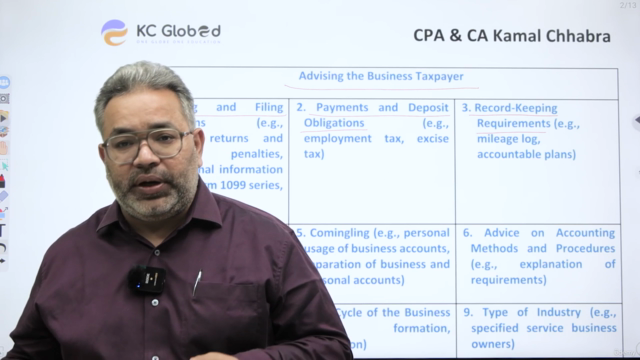

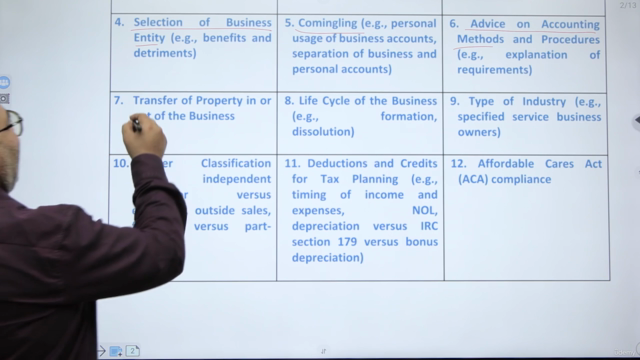

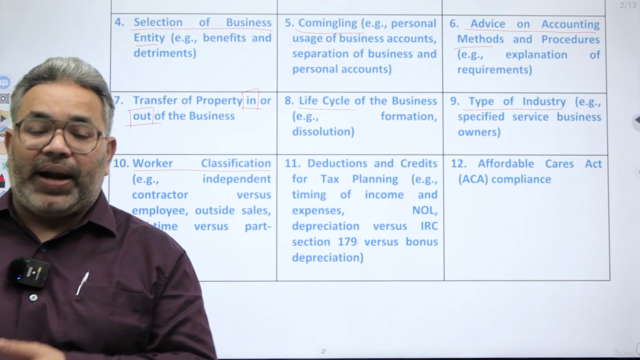

How to advise business taxpayers, including Sole Proprietorships, C Corporations, S Corporations, and Partnerships

Reporting and filing extended tax returns, understanding potential penalties, and handling international information returns (Form 1099 series)

Managing payment and deposit obligations, including employment and excise taxes

Best practices in record keeping for tax compliance

Providing sound advice on accounting methods and principles

Understanding and addressing issues of commingling funds

Guiding clients in selecting the right business structure

Tax implications and procedures for the transfer of property

Course Gallery

Loading charts...

6634191

udemy ID

25/05/2025

course created date

28/05/2025

course indexed date

Bot

course submited by