Understanding FinTech – Part 2 (Financial Service Functions)

Why take this course?

🌟 Course Title: Understanding FinTech – Part 2 (Financial Service Functions)

🚀 Headline: Dive Deep into the Financial Service Functions and Clusters of Innovation in Six Key Areas of FinTech!

About the Course:

Welcome to Understanding FinTech – Part 2, where we explore the intricacies of financial service functions within the burgeoning world of FinTech. This course is your gateway to understanding how innovation is reshaping the financial landscape globally, from Silicon Valley and Wall Street to Europe, Asia, and beyond.

📈 What You Will Learn:

- The Financial Services Value Chain Revolution: Discover how entrepreneurs are leveraging technology to transform every aspect of financial services.

- Promise of FinTech: Explore the myriad benefits that the FinTech revolution brings, including better choices for consumers, new credit opportunities for businesses, and a more productive banking sector.

- A More Resilient Financial System: Understand how innovation can lead to a stronger, more diverse, and more efficient financial system.

- New Forms of Currency: Dive into the world of cryptocurrencies like Bitcoin and their impact on our financial ecosystem.

- Inclusivity in Financial Services: Learn how FinTech is breaking down barriers and making financial services more accessible to all.

Course Structure:

-

Introduction to Part 2: A brief overview of the financial service functions that will be covered.

-

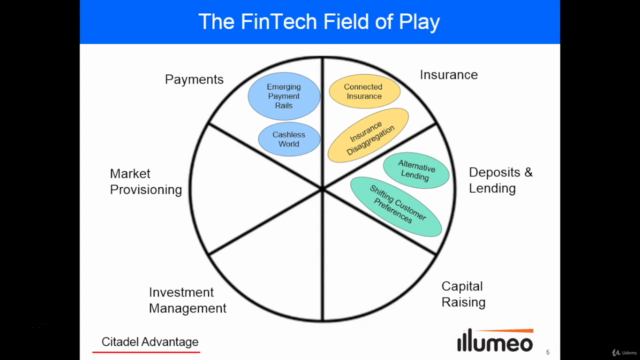

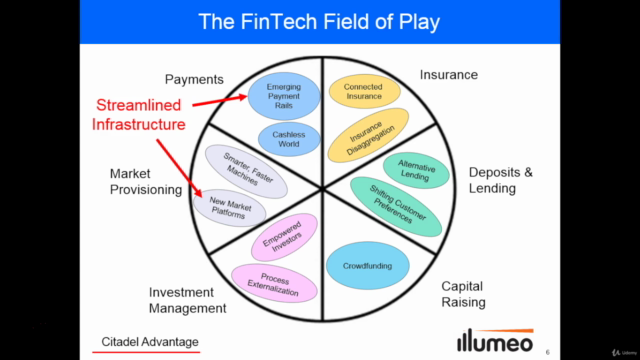

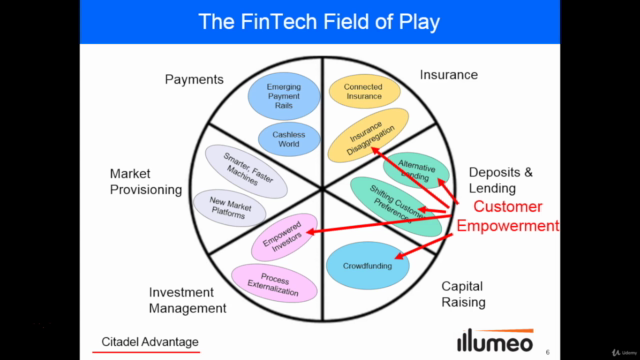

1. Payments:

- Innovations in payment systems and digital currencies.

- The rise of mobile payments and contactless technology.

- Cryptocurrency transactions and their implications for the future of money transfer.

-

2. Market Provisioning:

- Disruptive trends in exchanges, clearinghouses, and settlement systems.

- Regulatory technology (RegTech) and its role in compliance.

- The impact of blockchain on market transparency and security.

-

3. Investment Management:

- Robo-advisors and automated investment platforms.

- Alternative investments and the FinTech facilitation of private equity and real estate markets.

- Crowdfunding and its democratizing effect on investment.

-

4. Insurance:

- InsurTech trends, from parametric insurance to usage-based models.

- The integration of artificial intelligence in claims processing and fraud detection.

- Personalized insurance products powered by big data analytics.

-

5. Deposits & Lending:

- Peer-to-peer lending platforms and their effects on traditional banking.

- The role of big data in credit scoring and risk assessment.

- The potential for FinTech to drive financial inclusion.

-

6. Raising Capital:

- Equity crowdfunding and its impact on startup financing.

- Securities-based financing through digital platforms.

- The evolution of initial coin offerings (ICOs) and tokenization.

Why Take This Course?

Understanding FinTech is not just about keeping up with the latest trends – it's about grasping the fundamental changes that are reshaping the financial industry. Whether you're a business executive, manager, or a technologist looking to understand the practical needs and problems of finance, this course will equip you with the knowledge to navigate the FinTech landscape successfully.

By the end of Understanding FinTech – Part 2, you'll have a comprehensive overview of the financial service functions and how FinTech is innovating within these areas. You'll be well-positioned to leverage these insights to drive innovation, make informed decisions, or simply stay ahead in an industry undergoing rapid transformation.

🎓 Embark on your FinTech learning journey today and be part of the financial revolution!

Course Gallery

Loading charts...