UNDERSTAND MONEY MARKETS: calculations and products

Why take this course?

🎉 Understand Money Markets (Securities, Repos): Master Day Count Conventions, Yields & Calculations! 💹

Welcome to Your Financial Odyssey!

Hello Finance Enthusiasts! I'm Michiel van den Broek, your guide on this financial journey. With over three decades in finance and a passion for simplifying complex concepts, I've been designing financial courses since 2005. My mission is to make finance accessible and understandable to everyone. If you're curious about how money markets operate and the role they play in our economy, you've come to the right place!

In my previous course, Understand Banks and Financial Markets, I helped thousands of students gain a solid understanding of banking mechanisms. Now, it's time to dive deeper into the world of Money Markets with this comprehensive course: Understand Money Market.

Course Overview:

- Duration: More than 1,5 hours of engaging mp4 video content.

- Materials: Extensive downloadable pdf documents totaling 20 pages, along with quizzes to test your knowledge.

- Quizzes: A total of 34 multiple choice questions across various sections to ensure you're grasping the concepts.

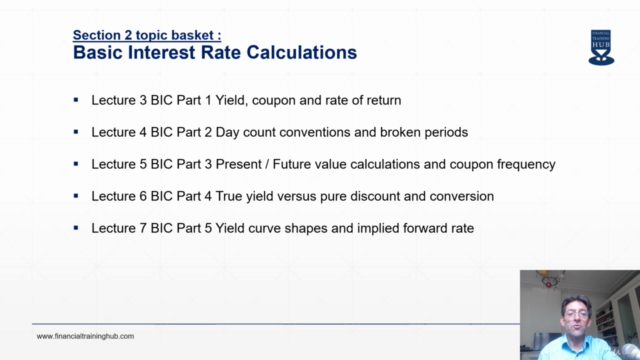

Section 1: Interest Rate Calculations 📊

- Learn about Day Count Conventions and how they impact financial instruments.

- Understand how to calculate single interest coupons.

- Master present and future value calculations.

- Discover how to compare yields under different coupon frequencies or day count conventions.

- Explore the differences between pure discount and true yield.

- Analyze the Yield Curve and its implications on forward rates.

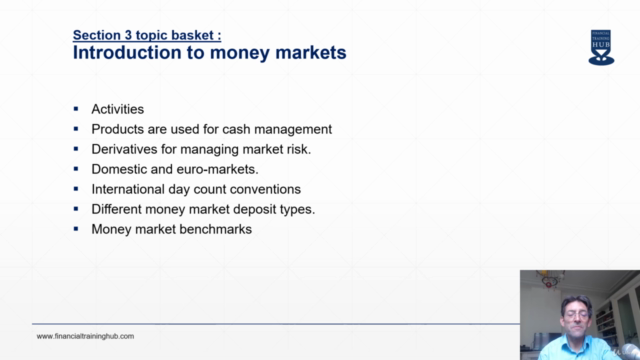

Section 2: Money Markets Benchmarks & Products 🏦

- Understand the practical use of money market products in the financial world.

- Get familiar with domestic and Euromarket activities.

- Learn about various deposit types and their significance.

- Gain insights into LIBOR and new overnight money market benchmarks.

Section 3: Tradable Money Market Securities 📑

- Explore the characteristics of key securities: treasury bills, certificates of deposit (CDs), and commercial paper.

- Learn how to calculate the initial consideration at issue date.

- Understand the maturity consideration and interest rate calculations for different types of instruments.

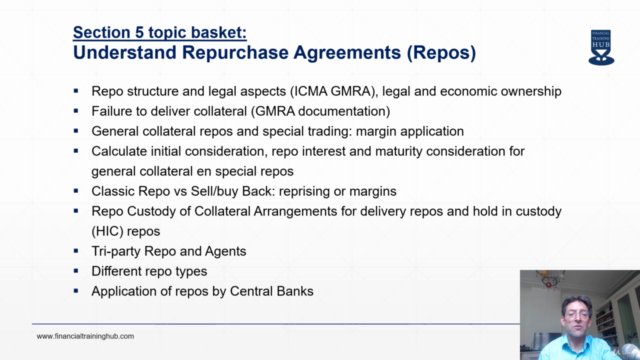

Section 4: Repurchase Agreements (Repos) 🤝

- Dive into the legal and economic ownership aspects of repos.

- Examine various types of collateral used in repo transactions.

- Learn about GMRA documentation, including handling failure to deliver collateral scenarios.

- Discover special trading features within repos.

- Understand sell/buy back transactions, reprising versus margins.

- Get to know the role of repo agents and the use of hold in custody repos (HIC) by central banks.

This course is designed to provide you with a thorough understanding of money markets, their securities, and repurchase agreements. With practical examples, real-world applications, and hands-on quizzes, you'll be well-equipped to navigate the complex world of financial markets.

If you have any questions or need further clarification on the course content, don't hesitate to reach out. I'm here to ensure your learning experience is both enriching and rewarding.

Thank you for your interest in Understand Money Markets (Securities, Repos)! Let's embark on this financial adventure together. 💡

- Michiel van den Broek

Course Gallery

Loading charts...