Understand Financial Risk from Banking

Why take this course?

🚀 Course Title: Understanding the Financial Risks from Banking: An Introduction to Bank's Business Model & Risk Management

Course Headline:

An introduction to bank’s business model: financial risk management (interest rate risk, liquidity risk and credit risk)

Course Instructor: Michiel van den Broek

Why Take This Course? Michiel van den Broek has been designing financial training programs since 2005. His passion for simplifying complex financial concepts has helped thousands of professionals in the financial sector enhance their understanding and skills. Whether you're in banking, working with pension funds, insurance companies, or investment firms, this course is tailored to support your career by providing a comprehensive overview of bank risk management.

About the Course: Are you intrigued by the world of finance but find it daunting? Finance isn't rocket science—it's about understanding the mechanics and principles that drive the financial industry. This course is designed to demystify the complexities of banking for you, making it accessible and understandable.

Course Overview: This online course is an essential guide for anyone looking to deepen their knowledge of the banking industry's business model, with a special focus on financial risk management. The course is structured to take you through the key concepts and practices involving:

-

Bank Core Activities: A primer on payments, intermediation, and proprietary trading as fundamental functions within banking operations.

-

The Art of Transformation: Explore the critical role of transformation in large commercial banks and why it's the most important core activity.

-

Navigating Financial Risks: Delve into the management of three primary risk exposures:

- Liquidity Risk

- Interest Rate Risk

- Credit Risk

Key Takeaways:

-

Risk Management Fundamentals: Understand the basics of managing financial risks, which are central to a bank's stability and profitability.

-

Asset & Liability Management (ALM): Introduced to the Asset & Liability Committee (ALCO) functions and how risk management is an integral part of ALM.

-

Risk Factory Perspective: Banks as risk factories, where balancing risk with return is a key competence for bankers.

Course Benefits:

-

No Prior Financial Knowledge Required: Whether you're new to finance or seeking to refresh your knowledge, this course will provide the insights and tools you need.

-

Engaging Learning Experience: With a blend of theory and practical examples, this course promises an engaging learning journey that goes beyond theory.

-

Free Course Part Access: Dive into a sample of the course content before you commit to ensure it aligns with your learning goals.

Who Should Enroll? This course is perfect for:

- Aspiring bankers or current banking professionals looking to advance their understanding of risk management.

- Finance and investment professionals interested in enhancing their knowledge of banking operations.

- Individuals aiming to join the Asset & Liability Committee (ALCO) and require an insight into ALM.

- Any professional keen on understanding the complexities and nuances of the financial industry's risk management.

Join Michiel van den Broek in this comprehensive course to unlock the secrets of bank risk management. Get ready to transform your career and become a confident decision-maker in the world of finance! 🏦💰

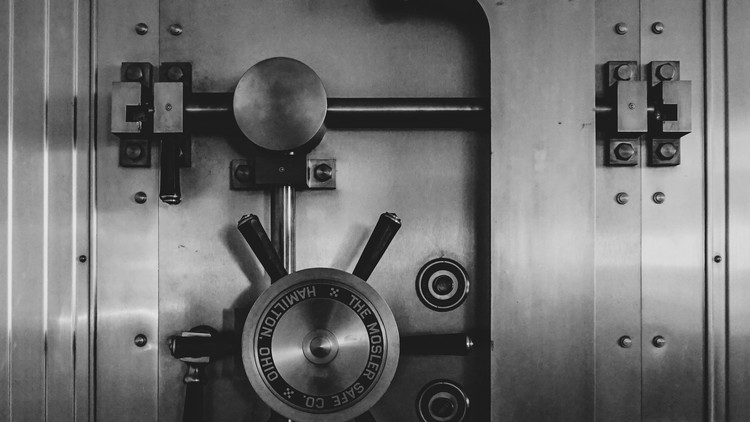

Course Gallery

Loading charts...