UAE VAT Basic to Advance Training 2025

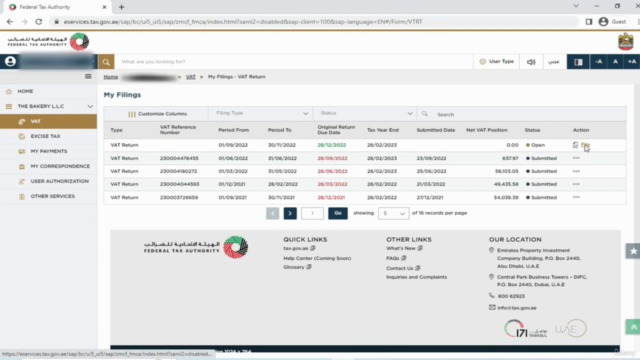

Master UAE VAT Step-by-Step – Registration, VAT Invoicing, Filing Returns, & Filling VAT Returns on EMARA Tax Portal

4.89 (32 reviews)

185

students

2 hours

content

Jun 2025

last update

$19.99

regular price

What you will learn

Understand the scope and structure of UAE VAT

Know when VAT is applied and who is responsible for compliance

Register, deregister, and manage VAT registration requirements

Handle VAT for imports, exports, and international trade transactions

Apply VAT to special sectors like real estate, construction, entertainment, and catering

Work with Reverse Charge Mechanism and VAT on Discounts

Understand VAT invoicing (detailed & simplified) and VAT control accounts

Learn how to properly file VAT returns and submit them using EMARA Tax Portal

Avoid VAT penalties and ensure proper tax planning and compliance

Build confidence in handling day-to-day VAT accounting and reporting tasks

Course Gallery

Loading charts...

6680297

udemy ID

20/06/2025

course created date

24/06/2025

course indexed date

Bot

course submited by