Time Series for Actuaries

Why take this course?

GroupLayout: Time Series for Actuaries - Mastered by MJ the Fellow Actuary 🌟

Course Overview: Unlock the secrets of Time Series analysis with this comprehensive online course tailored specifically for aspiring and seasoned actuaries alike. Dive into the mathematical underpinnings, explore key concepts, and apply your knowledge to solve a real-world problem from the Casualty Actuarial Society's exams (CS2B). With Michael Jordanc (MJ the Fellow Actuary) as your guide, you'll master the essential tools and techniques required to excel in actuarial science. 📊🎓

Why Take This Course?

- Real-World Application: Solve a past paper question from the CS2B exam, reinforcing your understanding in a practical context.

- Expert Led Learning: Learn from MJ, an experienced actuary with a fellowship from multiple actuarial bodies.

- Foundational Knowledge: Cover all the basics from Time Series fundamentals to advanced topics like ARIMA, GARCH models, and more.

Course Highlights:

-

Introduction to Time Series: What are Time Series, and why do they matter in actuarial science? 🕒

-

Stationary and Markov Properties: Understand the conditions that make a Time Series stationary and how these properties impact your analysis. 📈

-

Autocovariance and Autocorrelation Functions: Learn to analyze the relationships within a Time Series over time. 🔍

-

Partial Autocorrelation Functions: Discover how to dissect the contribution of each lag in a Time Series to the explained variance. ⚒️

-

White Noise and Other Common Time Series: Identify the different types of Time Series that you'll encounter, including the nuances of White Noise. 🎶

-

ARIMA Models: Get hands-on with Autoregressive Integrated Moving Average models and understand their components: AR, I, and MA. ✍️

-

Fitting Time Series to Data: Apply your knowledge by fitting Time Series models to real datasets, bringing theory into practice. 📊

-

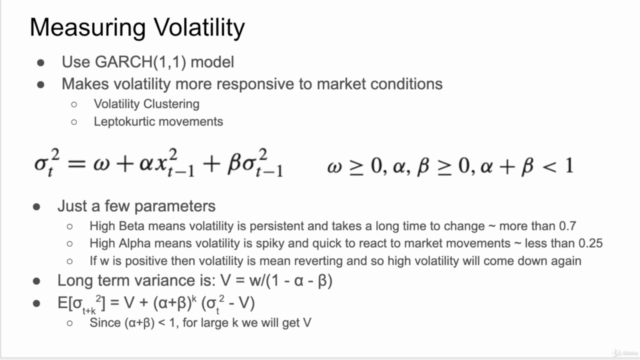

GARCH Models for Measuring Volatility: Dive into Generalized Autoregressive Conditional Heteroskedasticity (GARCH) models and their role in financial modeling. 🚀

-

R Studio Past Exam Question: Work through a challenging question from the CS2B exam, applying all the concepts learned throughout the course. 🧠

Course Outcome: By completing this course, you will have a solid understanding of Time Series analysis as it applies to actuarial work. You'll be equipped with the skills to model and predict future trends using real-world data, making you a valuable asset in any actuarial team. Plus, you'll gain confidence in tackling the complexities of time series models and their applications in risk assessment and financial modeling.

Join us on this journey to become an expert in Time Series analysis for actuaries. Enroll now and step into a future where data tells its story with clarity and precision! 🌐📉✨

Enrollment Details:

- Instructor: Michael Jordanc (MJ the Fellow Actuary)

- Prerequisites: Basic understanding of statistics and calculus

- Materials Provided: Course notes, datasets for practice, and access to R Studio

- Course Format: Self-paced online lessons with interactive exercises and quizzes

- Certification: Upon successful completion, receive a certificate of completion from MJ the Fellow Actuary 🏆

Don't miss out on this opportunity to elevate your actuarial skills. Sign up today and embark on a transformative learning experience with "Time Series for Actuaries"! 📈🎥🚀

Course Gallery

Loading charts...