U.S. Residential Real Estate, Property & Mortgage Business

Why take this course?

Based on the detailed description provided, it is clear that this course is a comprehensive program designed to cover the intricacies of the U.S. residential real estate market. It is part of a larger curriculum offered by Starweaver, a reputable training provider known for its expertise in delivering high-quality education to financial institutions, technology companies, and various organizations globally.

The curriculum is structured into several modules that progressively build upon each other, starting with an overview of the real estate business and concluding with an understanding of market analysis, property appraisals, and the financial aspects of real estate transactions. The course content includes narrated presentations, exercises, quizzes, and tests to ensure a thorough understanding of the subject matter.

Here's a breakdown of what each module in the curriculum covers:

-

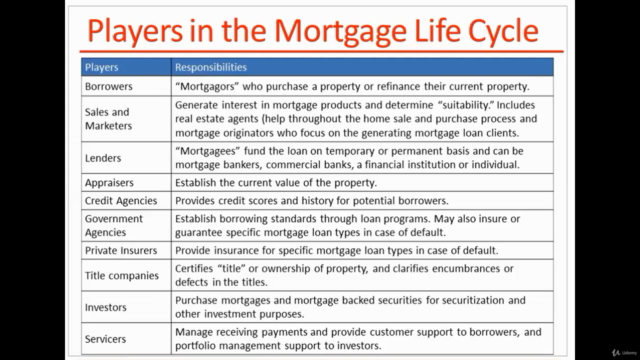

The Real Estate Business: An introduction to the industry, including an overview of the roles and responsibilities within the real estate market.

-

Real Estate Laws, Qualifications, Requirements, and Measurements: A deep dive into the legal framework that governs real estate transactions, licensing, and the precise measurements used in property assessments.

-

Real Property Rights: An exploration of the rights associated with owning real property, including easements, encumbrances, and land use rights.

-

Title, Deeds, and Ownership Restrictions: A detailed examination of title searches, deed types, and the various restrictions that can affect property ownership.

-

Real Estate Contracts: A comprehensive look at the different types of contracts used in real estate transactions and the clauses they contain.

-

Residential Mortgages and Property Financings: An exploration of the various mortgage products, financing options, and how they work.

-

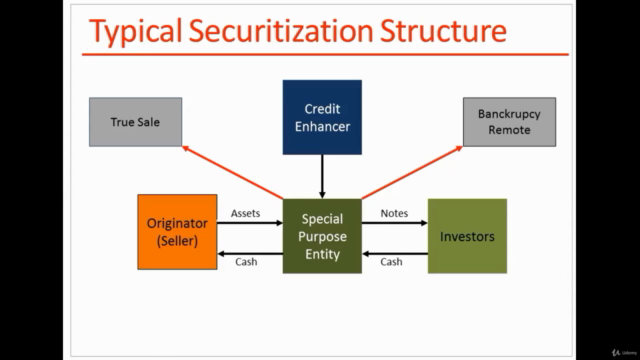

Types of Mortgages and Sources of Finance: A closer look at fixed-rate vs. adjustable-rate mortgages, government-sponsored enterprises (GSEs) like Fannie Mae and Freddie Mac, and other financing sources.

-

Real Estate Deal Closings and Financial Calculations: The process of finalizing a real estate transaction, including the calculation of costs, closing procedures, and understanding amortization schedules.

-

Real Estate Market Analysis and Property Appraisals: Learning how to analyze market trends and appraise properties accurately, using various valuation methods.

-

Planning, Zoning, Environmental Hazards, and Taxes: An overview of local regulations, environmental issues that can impact real estate development, and the tax implications for property owners.

Starweaver's reputation as a training provider is reinforced by its extensive client list, which includes many of the world's leading financial and technology institutions. The courses are designed to cater to various levels of expertise within the field of real estate, from new hires to seasoned professionals looking to expand their knowledge and skills.

If you are interested in this curriculum or similar programs, you can explore Starweaver's offerings further by visiting their website or contacting them directly for more information on course availability, scheduling, and pricing. The provided Google search query will direct you to their platform where you can find additional resources, live streaming education options, and tailored courses based on your learning needs and professional goals.

Course Gallery

Loading charts...

Comidoc Review

Our Verdict

This Udemy course designed for both beginners and people in the middle of their journey does an excellent job breaking down complex topics related to US residential real estate, property & mortgage business. With over 9800 students and a high rating of 4.61, it boasts comprehensive coverage spanning from origination through securitization. Although certain areas could benefit from updated data or additional animated examples for better understanding, the instructor's deep subject matter expertise results in an engaging course. However, those looking for in-depth analytics and practical exercises will have to look elsewhere.

What We Liked

- Covers a comprehensive range of topics in the U.S. residential mortgage market, from origination to securitization

- High-level overview beneficial for those with little to no prior knowledge of U.S. mortgages

- Instructor's commanding subject matter expertise, including seamless and illuminating examples throughout the course

- Well-structured content, easy to follow, and explained in layman terms

Potential Drawbacks

- Lacks practical exercises for more hands-on learners, primarily descriptive focused on processes and documentation

- Certain sections need updating, such as market share of conventional vs. government insured loans and the HUD-1 statement

- Some slides could benefit from additional animated examples or graphs for better understanding

- Occasional video cut-offs or glitches affecting user experience