The Complete Options Course: Calls, Puts, Long, Short & More

Why take this course?

-

In The Money (ITM): An option contract where the underlying asset is trading at a price above the strike price for a call option or below the strike price for a put option.

-

Interest Rate: The rate at which interest accrues on a loan, investment, or deposit; it can affect the pricing of various financial instruments, including options.

-

Intrinsic Value (IV): The intrinsic value of an option is the difference between the current price of the underlying asset and the strike price of the option, without considering time value.

-

Gamma: In options trading, gamma measures how much the delta of an option will change as the price of the underlying asset changes.

-

Theta: Theta represents the rate at which the time value of an option decays as time passes, assuming the other factors remain constant.

-

Vega: Vega indicates the sensitivity of an option's price to changes in volatility, holding all else constant.

-

Rho: Rho measures the effect a change in interest rates has on the price of an option.

-

Delta: Delta represents the rate of change in the price of an option relative to a one-point movement in the price of the underlying asset, keeping all other factors constant.

-

Beta: Beta measures the volatility of an option or a stock relative to the market; a beta greater than 1 indicates that the security's price tends to be more volatile than the market.

-

Lambda: Lambda, also known as vega, measures the sensitivity of the price of an option to changes in implied volatility.

-

Phi: Phi is another term for rho, which measures the impact of a change in interest rates on the price of an option.

-

Omega (or Theta): Omega and theta are often used interchangeably to represent the time decay of an option's price.

-

Strike Price: The strike price is the price at which the underlying asset can be bought (for a call option) or sold (for a put option) upon exercise.

-

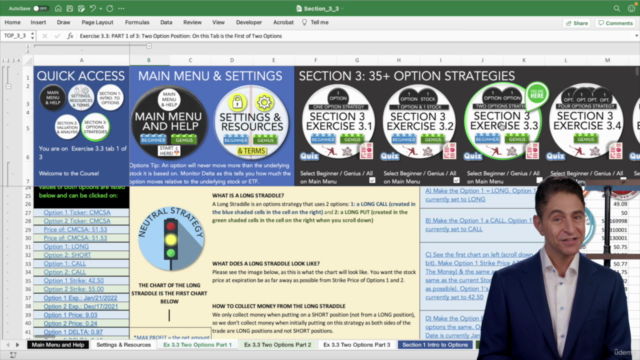

Option Strategies (various types such as covered calls, spreads, straddles/strangles, iron condors, butterflies, etc.): These strategies are used to manage risk, generate income, or speculate on the price movement of the underlying asset. Each strategy has its own risk and reward profile.

-

Implied Volatility: A statistical measure that represents the market's expectation of volatility for an asset, as implied by option prices.

-

Historical Volatility: The standard deviation of price returns for a particular asset over a set period of time.

-

Volatility Skew/Smile: A representation of the differences in implied volatility across different strike prices or expiration dates.

-

Open Interest: A measure of the number of outstanding options and futures contracts that have not been settled by their second trading day (OTD).

-

Trading Volume: The total number of shares, contracts, or units traded over a specified period, which can indicate market activity and potential price movements.

-

Risk Management: Techniques used to limit potential losses in options trading, including diversification, hedging, stop-loss orders, and position sizing.

-

Options Trading Platforms: These platforms provide the necessary tools for analysis, order execution, and account management for traders engaging in options markets.

-

Exotic Options: Non-standard options with special features not found in plain vanilla options, such as barrier options, Asian options, binary options, etc.

-

Options Regulation: Understanding the rules and regulations governing options trading, including those set by financial authorities like the SEC or CFTC.

-

Market Indicators and Technical Analysis: Tools used to predict future price movements based on historical data, trends, and patterns in the market.

-

Economic Factors and World Events: Global economic indicators and geopolitical events that can affect options pricing and trading strategies.

-

Options Pricing Models (like Black-Scholes, Binomial Model, etc.): Mathematical models used to value options and other derivatives.

-

Portfolio Diversification: The process of spreading investments across various asset classes or securities to reduce risk and improve returns.

-

Margin Trading: A trading strategy that allows investors to borrow money from their broker to amplify their investment in the market, with the potential for higher gains and larger losses.

-

Tax Considerations: Understanding how gains and losses on options are taxed in your jurisdiction can impact your investment decisions and strategies.

-

Compliance with Legal and Regulatory Requirements: Ensuring that all trading activities comply with the laws and regulations of the relevant jurisdictions to avoid legal issues and penalties.

This overview provides a foundational understanding of the various components involved in options trading, including terminology, strategies, analysis tools, and market considerations. As with any investment, it's crucial to conduct thorough research and understand the risks before engaging in options trading.

Course Gallery

Loading charts...