The "Best" Startup Pitch Deck - How To Raise Venture Capital

Why take this course?

🎉 Course Title: The "Best" Startup Investor Pitch Deck - How To Raise Venture Capital

🚀 Course Headline: A guide to creating the "best" start-up investor pitch deck and insights into raising venture capital from an actual VC

Why This Course? The "Best" Startup Investor Pitch Deck Methodology has already revolutionized the way thousands of entrepreneurs worldwide approach investors. With over 45,000 views and downloads, it's a methodology that works—taught at top business schools and accelerators globally. Now, you can learn directly from its creator, J. Skyler Fernandes, a Powerlist 100 VC and serial entrepreneur who has the unique insight of both an investor and an entreprener.

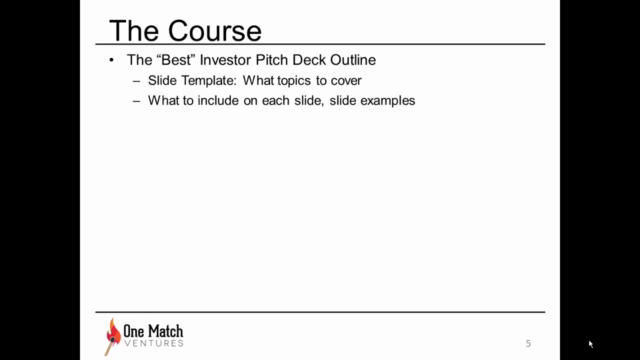

What You'll Learn: This course isn't just about creating a pitch deck; it's about understanding the art behind it. J. Skyler Fernandes, along with guest speakers from the top echelons of venture capital, angels, and successful entrepreneurs, will guide you through:

- 📈 The Anatomy of a Winning Pitch Deck: Learn what goes into each slide, the key elements that captivate investors, and how to articulate your business model.

- 🧠 Investor Psychology: Gain insights into the decision-making process of VCs. Understand what drives an investor's interest and how to align your pitch with their investment thesis.

- 🤝 Storytelling for Startups: Master the narrative arc that connects your vision with investors, making your startup's story both compelling and clear.

- 📊 Data-Driven Decision Making: Know how to back up your claims with solid data and projections that resonate with investors.

- 🤯 Real-World Examples and Case Studies: Learn from real-life successes and failures, gaining a deeper understanding of what makes some pitches soar while others falter.

- 🛠️ Tailoring Your Pitch: Discover how to customize your pitch for different investors, industries, and funding stages.

- 🌟 Q&A Sessions with Industry Leaders: Engage with Sky and guest speakers through live Q&A sessions, gaining direct advice and feedback on your pitch deck.

Who Is This Course For?

- Aspiring entrepreneurs with a business idea or early-stage startup.

- Founders seeking their first round of funding.

- Entrepreneurs looking to improve their current pitch decks.

- Individuals interested in the venture capital ecosystem and how it works.

- Angel investors, startup advisors, and anyone who wants to understand the dynamics of raising venture capital.

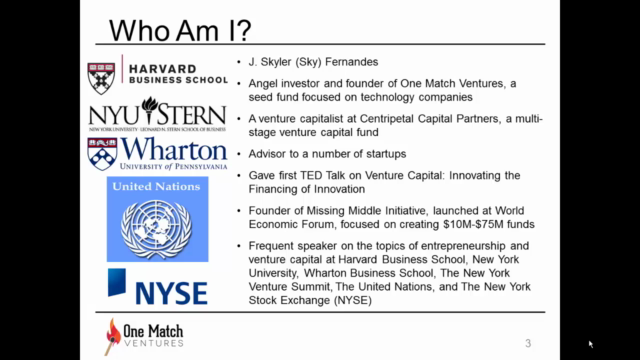

Instructor Profile: J. Skyler Fernandes is not just a Venture Capitalist; he's a seasoned entrepreneur, an active angel investor, and a respected adviser to numerous startups. With his unique position at the intersection of investing and founding, Sky has a 360-degree view of what investors are looking for and how entrepreneurs can present their vision in the most compelling way possible.

Join Us! Embark on your journey to securing venture capital with confidence. Whether you're pitching to angel investors, seed funds, or Series A capital, this course will equip you with the knowledge and tools necessary for success. 🌟

Enroll now and take the first step towards making your startup vision a reality!

Course Gallery

Loading charts...

Comidoc Review

Our Verdict

The 'Best' Startup Pitch Deck course equips budding entrepreneurs with insights into raising venture capital, despite minor drawbacks in production quality and depth. The instructor's expertise and real-world experience make this course a valuable addition to any startup founder's learning arsenal, even six years after its initial launch.

What We Liked

- Provides a comprehensive overview of investment options, including angel investors and venture capitalists.

- Instructs on what investors look for in deals they invest in and how to answer their main questions.

- Ideal for first-time pitch deck creators seeking a solid framework and confidence in the fundraising process.

Potential Drawbacks

- Occasional subpar audio quality and lackluster visuals may hinder the learning experience.

- Some sections could benefit from more depth, as certain students find them rushed.

- Lacks specific examples for low volume-high margin businesses outside of online tech companies.