The Art of Reading Financial Statements - Practitioner Level

Why take this course?

📘 Course Headline: Master the Language of Business with "The Art of Reading Financial Statements - Practitioner Level" 🚀

Course Instructor: Candi Carrerca, Value Investor & Independent Board Director, MBA, INSEAD IDP with PE & VC Experience 🎓✨

Introduction to the Course: Financial statements can appear daunting at first glance. Their complexity and length often overwhelm beginners and even seasoned professionals. It's not just about reading them line by line; it's about understanding what each figure represents and how it tells the story of a company's financial health. This course is designed to demystify financial statements and help you read, understand, and digest them with ease. 📊🧐

Warren Buffett on Accounting: "You have to understand accounting and you have to understand the nuances of accounting. It’s the language of business and it’s an imperfect language, but unless you are willing to put in the effort to learn accounting – how to read and interpret financial statements – you really shouldn't select stocks yourself." 🗣️📈

Course Approach: In this course, I've distilled my own learning experiences, identifying what was missing from my earlier education in accounting and corporate finance. The approach is different and focused on quick comprehension of the essence of a company's financials. We'll delve into the main reading keys that will transform the way you interpret financial statements. 🔍✨

What You Will Learn: Upon completing this course, you will be equipped with the following skills:

- Identify & Understand Accounting Standards (IFRS, US GAAP, Local GAAP) ✅

- Differentiate Between Financial Statements (Balance Sheet, Cash Flow, Income Statement) 📈

- Understand Fundamental Accounting Principles like going concern, fair valuation, principle of prudence, etc. 🏗️

- Understand Corporate Governance elements such as the 1- or 2-tier models, shareholder and board roles 🤝

- Identify Role of Statutory Auditor, including audit opinions 🔍

- Understand Scope of Consolidation & methods of consolidating subsidiaries 🌐

- Perform Vertical Analysis of the Balance Sheet ➡️

- Identify Sources of Capital including long-term debt and equity sources 💰

- Deepen Understanding of Value Creation for Shareholders by exploring ROIC & WACC 🚀

- Analyse Profitability of companies through revenue segments, cash generation assets, operating cash flow, working capital vs financing & investing 💸

- Read Earnings Information such as EPS, NOPAT, EBITDA, EBIT, and net income 📊

Practical Examples: This course is rich with practical examples using real financials from well-known companies like Kelloggs, Mercedes, Telefonica, 3M, Evergrande, Alphabet (Google), Meta (Facebook), Microsoft, Unilever, Wells Fargo, Wirecard, and CostCo. These case studies will bring theory to life and deepen your understanding of financial analysis. 📋🔍

Comprehensive Learning Experience: To ensure a comprehensive learning experience, I will walk you through the complete process of how I read financial statements for three companies (Vonovia, Qurate, Skywest Airlines) at the end of the training. This will give you a clear illustration of how to grasp the essence of companies quickly and effectively. 📊

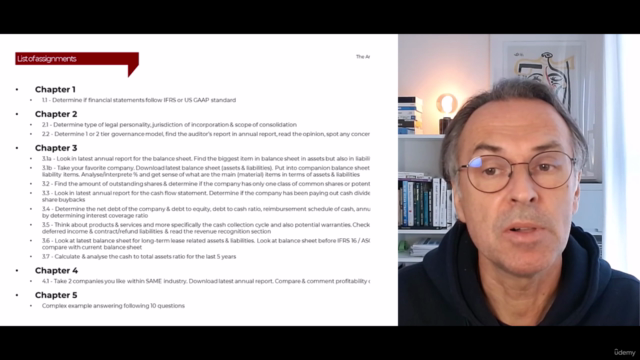

Hands-On Assignments: To solidify your learning, this course includes over 10+ assignments for you to practice as homework. These assignments are designed to be shared with me for review, providing an opportunity for feedback and further understanding. This hands-on approach ensures that you not only learn but also apply the concepts in real-world scenarios. 🖊️👍

Conclusion: I am confident that this training will significantly enhance your skills as an investor, analyst, or corporate professional. It's a commitment to growth and mastery of the financial language that every business leader should understand. Thank you for selecting my course, and I look forward to seeing you succeed! 🌟

With thanks, Candi 💫🚀

Course Gallery

Loading charts...