The Art of Company Valuation - Complete course

Why take this course?

🌟 Course Title: The Art of Company Valuation - Complete Course

Course Headline: Learn from a real value investor & independent board director, MBA, INSEAD IDP with PE & VC experience

🚀 Course Description:

Are you ready to master the art of company valuation and make informed investment decisions with confidence? In today's dynamic marketplace, knowing the intrinsic value of a company is crucial for any investor. This course will transform you into an autonomous evaluator, armed with a comprehensive toolkit of valuation methods suitable for public equity, private equity, or venture capital investments.

Key Takeaways:

-

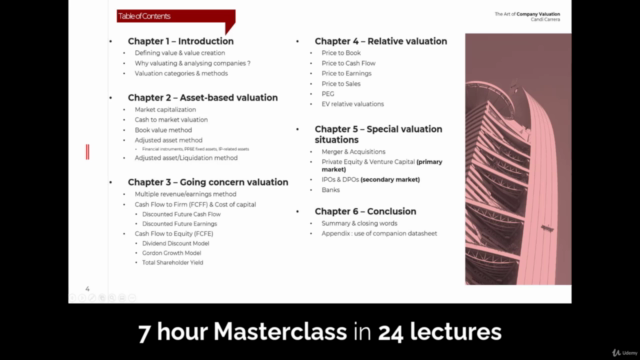

Absolute Valuation Techniques: Dive deep into asset-based valuation methods such as cash to market cap, book value, modified book value, and liquidation value. These are the bedrock of understanding a company's worth from an asset perspective.

-

Going Concern Valuation Methods: Learn various revenue/earnings multiples, Free Cash Flow to Firm (including Discounted Cash Flow - DCF & Direct Free Cash Flow - DFE, Discounted Economic Benefits - DEB), Free Cash Flow to Equity (including Dividend Discount Model - DDM, Gordon Growth Model, and Total Shareholder Yield.

-

Relative Valuation Techniques: Grasp the financial strength of a company by understanding metrics like P/B, P/CF, P/S, P/E, PEG ratio, and Enterprise Value (EV). These relative valuation techniques are invaluable for comparing companies within the same industry.

📈 Hands-On Learning:

This course is not just theoretical; it's designed to be practical. We will apply all absolute & relative valuation methods to 4 real companies:

- Two luxury companies: Richemont & Kering

- Two tech giants: Apple & Microsoft

Additionally, we will explore special valuation situations such as venture capital investments, IPOs/DPOs, and bank valuations using case studies like Fitbit, GoPro, Etsy, Bank of America, and Wells Fargo.

🎓 Why Choose This Course?

-

Advanced Level Content: This course is tailored for investors who are serious about deepening their understanding of valuation methods and ready to elevate their investment analysis skills to an advanced level.

-

Expert Guidance: With 20 years of experience as an investor running my own investment fund, I've distilled my knowledge into a comprehensive curriculum that will rapidly move you ahead in your investing journey.

-

Real-World Application: By practicing valuation methods on real companies, you'll gain practical skills that are directly applicable to the real world of business and finance.

📅 Enroll Now!

Join me, Candi Carrera, for an enriching journey into the world of company valuation. With my guidance, you'll learn to see beyond the surface and understand what drives a company's true worth. Investing in stocks can be life-changing, and with this advanced knowledge, you'll be equipped to make smarter, more informed investment decisions that could redefine your financial future.

Don't wait to become the fully independent investor you aspire to be. Enroll in "The Art of Company Valuation - Complete Course" today and step into a world of informed investment opportunities! 💡

- Candi Carrera, MBA, INSEAD IDP, PE & VC Experience

Course Gallery

Loading charts...