Taxation of Salaried Individual

Why take this course?

🎓 Course Title: Taxation of Salaried Individual

🧭 Course Headline: Master the Intricacies of Taxation for Salaried Individuals in India!

🔍 Course Description:

Welcome to the comprehensive course on Taxation of Salaried Individuals at a Glance – your definitive guide to understanding the Indian Income Tax system as it applies to you. This meticulously crafted course is designed to demystify the complexities of income tax for salaried individuals, ensuring that you gain a clear and lasting understanding of the key concepts without the overwhelm.

Why Enroll?

- Ease of Understanding: We break down the most important provisions of the Indian Income Tax in an accessible manner, suitable for learners at all levels.

- Practical Examples: Our course goes beyond theory by incorporating illustrative examples that will help you apply what you learn to real-life scenarios.

- Lifelong Learning: We aim for our learners to not only grasp the basics of taxation but to retain this knowledge for a lifetime, empowering you to make informed decisions regarding your finances.

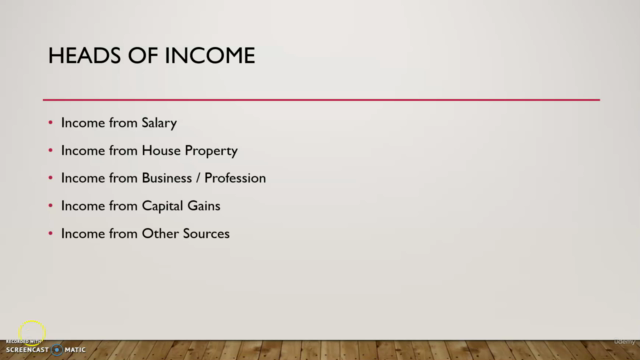

Course Overview: This course will delve into the following topics:

-

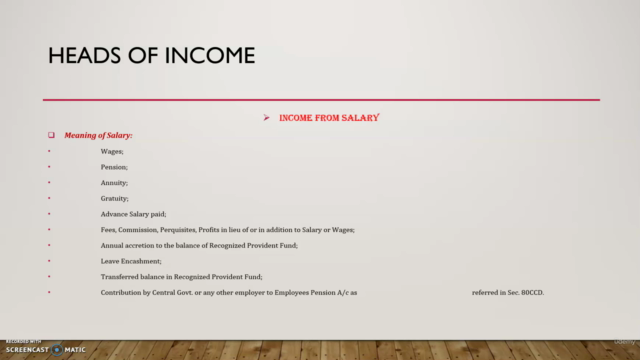

Introduction to Indian Income Tax & Salaried Individuals: Get acquainted with the fundamentals of the Indian tax system and how it specifically affects salaried employees.

-

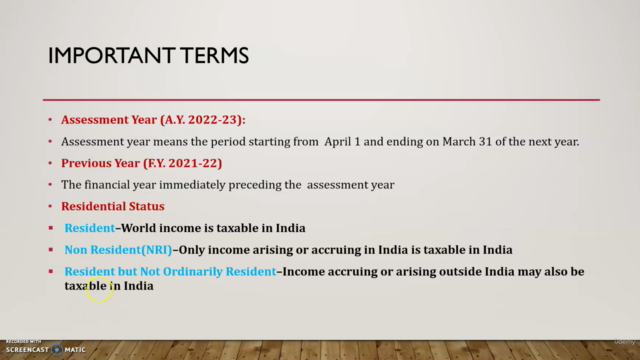

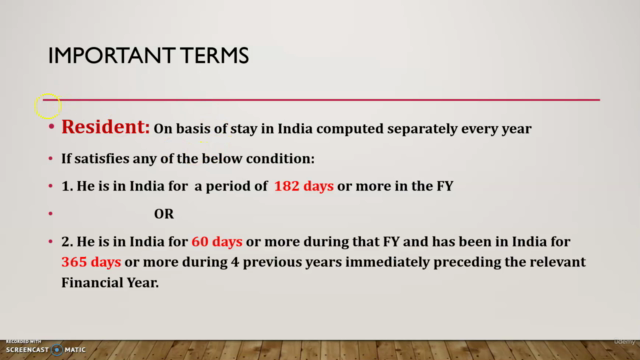

Residential Status Under the Income Tax Act: Understand your residential status and its implications on your tax liabilities.

-

Exemptions & Deductions for Salaried Individuals: Learn about the various deductions and exemptions available to you, enabling you to maximize your savings legally.

-

Navigating Different ITR Forms: An overview of the different forms of Income Tax Returns (ITR) that are relevant to salaried individuals.

-

Tax Saving Investments & Tips: Discover the most impactful investment and deduction options to optimize your tax liability.

What You'll Learn:

- Basic Concepts: A clear explanation of the basic concepts in taxation for a salaried individual, including sources of income, taxes applicable, and more.

- Detailed Guidance: Step-by-step guidance on the provisions that affect your salary as an employee.

- Real-World Application: Practical examples to solidify your understanding and help you apply these concepts when filing your income tax return.

Important Notes:

-

This course is focused on providing a deep understanding of taxation for salaried individuals in India. It does not cover the procedural aspects of filing an income tax return. If you are looking to learn how to file your returns, we recommend supplementing this course with additional resources or guidance.

-

We value your feedback! As we continuously strive to enhance our course content, your suggestions and insights are highly encouraged and will be incorporated into future improvements of the course.

Join Us on a Journey to Tax Clarity: Embark on a learning adventure with us and gain the confidence you need to handle your finances with ease. Whether you're new to managing your taxes or looking to brush up on your knowledge, this course is the perfect stepping stone towards financial literacy.

Best of Luck & Happy Learning! 🎓🎉

We are excited to have you on board and can't wait to see how this course will transform the way you understand and handle taxation. Remember, every step you take towards understanding your taxes is a step towards a more financially secure future. Let's get started! 🚀💪

Course Gallery

Loading charts...