TallyPrime Made Easy – Learn Accounting, GST and Payroll

Why take this course?

🌟 Master TallyPrime with Ease and Confidence! 🌟

Course Headline: A Complete TallyPrime Training to manage accounting, Inventory, orders, GST and payroll in Tally

Overview: TallyPrime stands out as the most preferred accounting software for entrepreneurs, business professionals, and accountants. Its user-friendly interface and robust features make it an ideal choice even for those without IT or accounting backgrounds. This online course is a comprehensive training of 5 hours designed to help you master TallyPrime with practical exercises that align with the latest industry standards. We've tailored this program to ensure you gain hands-on experience and knowledge, so you can effectively manage all financial activities within your business.

What You’ll Learn in TallyPrime Online Training: 🎓

-

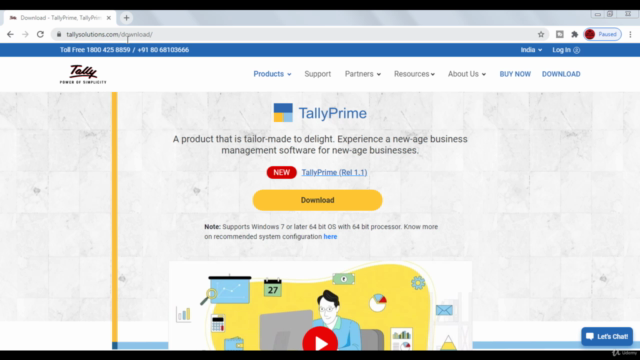

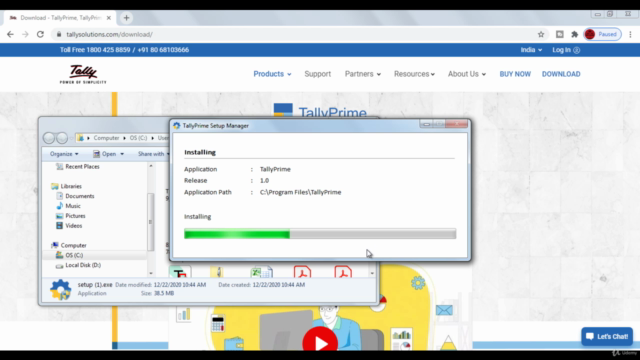

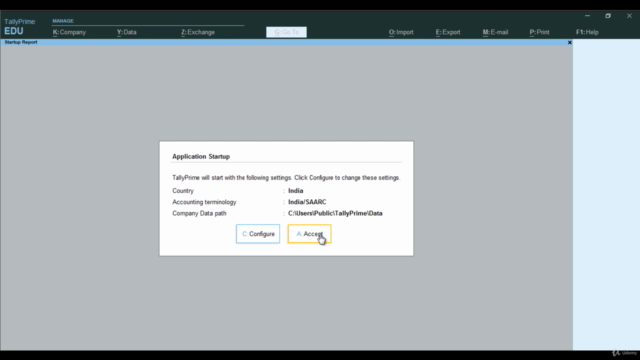

Installation Basics: We start by guiding you through the process of installing TallyPrime on your system, setting up your work environment for success.

-

Company Setup: Master the art of creating, altering, and deleting companies in TallyPrime, which is crucial for maintaining separate financial records for each business entity.

-

User Interface Exploration: Get acquainted with the gateway of TallyPrime, its user interface, and navigate through the software with ease.

-

Voucher Entry Mastery: Learn how to do voucher entries correctly, understand double entry accounting, and manage contra, payment, and receipt vouchers.

-

Ledger Management: Discover how to understand ledgers, create them, manage multiple ledgers, and know when and how to alter or delete them.

-

Groups and Multiple Groups: Understand the role of groups in TallyPrime, learn how to set them up, and configure vouchers accordingly.

-

Practical Examples: Engage with practical examples that bring your learning to life and help you understand how TallyPrime functions in real-world scenarios.

-

GST Compliance: Navigate through the complexities of Goods and Services Tax (GST) with confidence, understanding its implementation within TallyPrime.

-

Cost and Profit Centres: Learn how to implement cost centres and profit centres in TallyPrime for effective reporting and analysis.

-

Financial Reporting: Generate reports on budgets, cost centres, categories, and much more to aid in decision-making processes.

-

Bank Reconciliation: Understand and execute the bank reconciliation process within TallyPrime accurately.

-

Inventory Management: Dive into inventory management with stock group, category, unit of measure, godown creation, and reporting.

-

Order Processing: Learn the A to Z of sales and purchase orders, debits and credits notes, receipt and rejection vouchers, and delivery notes.

-

Manufacturing Journal and Physical Stock Tracking: Gain insights into manufacturing processes, physical stock tracking, and how to use these features in TallyPrime.

-

Payroll Management: Streamline your payroll process with TallyPrime's dedicated tools and features.

-

GST Compliance & RCM: Stay updated with the latest tax regulations like GST and Reverse Charge Mechanism (RCM) within TallyPrime.

Why Choose This Course? 🚀

-

Industry-Relevant Skills: Learn through real-world applications that reflect the practicalities of running a business with TallyPrime.

-

Expert Instruction: Gain knowledge from a seasoned Tally expert, Himanshu Dharc, who brings years of experience to the course.

-

Flexible Learning: Access the course content at your convenience and learn at your own pace.

-

Interactive and Engaging Content: Benefit from interactive modules, practical exercises, and real-life examples to solidify your understanding.

-

Comprehensive Coverage: From installation to advanced features, this course covers everything you need to know to be TallyPrime proficient.

Enroll now and take the first step towards becoming a TallyPrime expert! With this comprehensive training, you'll be equipped to handle all your business financial needs with confidence and precision. 💼🚀

Course Gallery

Loading charts...