TallyPrime with GST I Tally Authorized Partner & Faculty

Why take this course?

It seems like you're emphasizing the comprehensiveness of a course on TallyPrime with GST integration. The message you've provided covers all aspects of learning TallyPrime, from understanding the basics to handling complex GST processes such as registration, returns, and amendments.

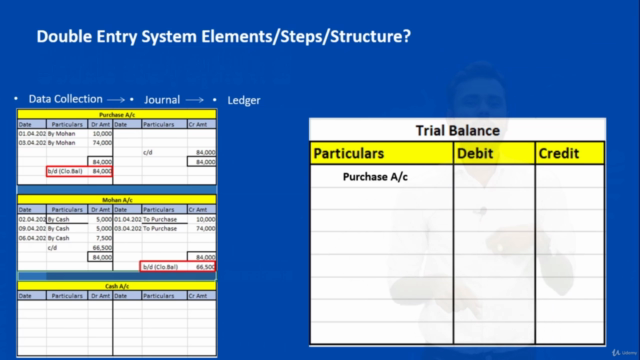

TallyPrime is a powerful business software that offers comprehensive accounting solutions. With the introduction of the Goods and Services Tax (GST) in India, it has become essential for businesses to adapt their accounting practices to comply with this new tax regime. TallyPrime's integration with GST enables users to manage their tax liabilities efficiently and accurately.

Here's a brief outline of what you would typically learn in a TallyPrime with GST course:

-

Introduction to GST: Understanding the concept of GST, its objectives, and how it works in India.

-

GST Registration: The process of registering for GST, including understanding different types of taxpayers (normal, composition, etc.), and the documentation required.

-

GST Return Filing: Learning about the various forms of GST returns (GSTR-1, GSTR-3B, etc.) and how to file these returns using TallyPrime.

-

GST Amendments: Understanding how to make amendments to GST registration details such as address changes, updates to business information, etc.

-

Monthly/Quarterly Returns: Learning the process of generating and filing monthly and quarterly returns within the TallyPrime software.

-

GST Compliance and Reporting: Ensuring that all GST compliance requirements are met as per the Indian tax laws.

-

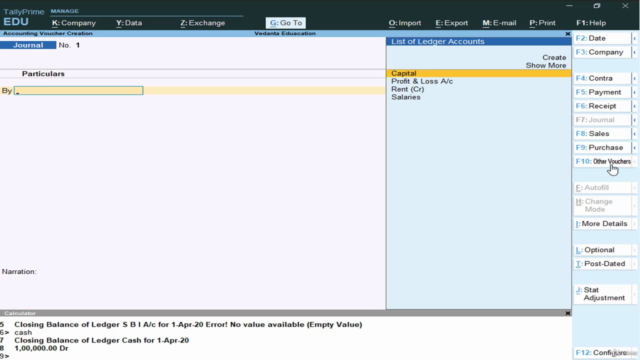

TallyPrime Setup for GST: Configuring TallyPrime to handle GST-related transactions, setting up tax codes, and ensuring accurate tax calculations.

-

GST Audit Trails and Reconciliation: Learning how to maintain a trail of all GST-related transactions for audit purposes and reconciling any discrepancies.

-

Handling GST Invoices and Deductions: Understanding the rules around raising tax invoices, issuing credit notes, and claiming input tax credits (ITC).

-

GST-Related Reports: Generating various reports required for analysis and compliance purposes within TallyPrime.

By completing a course that covers all these aspects, you would be well-equipped to manage your business's finances in accordance with the GST laws using TallyPrime. It's important to stay updated with any changes in tax laws or software updates as both are subject to evolve over time.

Course Gallery

Loading charts...