TallyPrime+ Tally.ERP9+GST+Income Tax+TDS (Combo) తెలుగు లో

Why take this course?

🌟 Harness the Power of Accounting & Taxation with TallyPrime, Tally.ERP9, GST, Income Tax, and TDS - All in One Course! 🌟

Course Overview:

Dive into the world of financial expertise with our comprehensive "Manual Accounts, TallyPrime, Tally.ERP9, GST, Income Tax, and TDS Explained in Telugu" course. This all-encompassing package is designed to leave no stone unturned in the realm of accounting and taxation. With expert guidance from Urs Ravi I Vedanta Educational Academy, you'll master the intricacies of Tally accounting software alongside the critical aspects of GST, Income Tax, and TDS.

What You Will Learn:

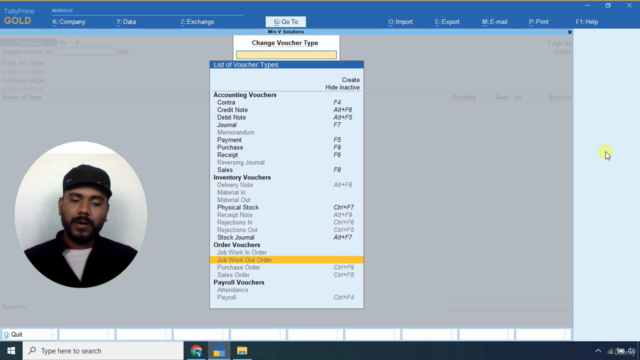

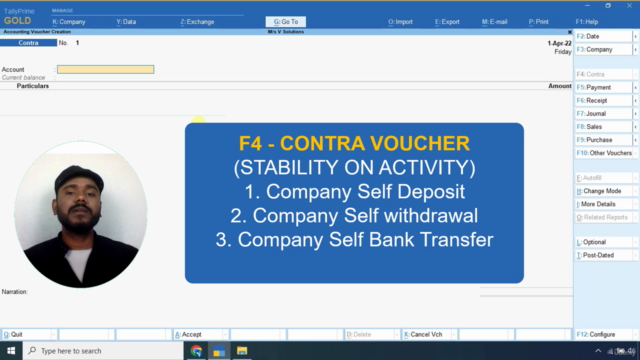

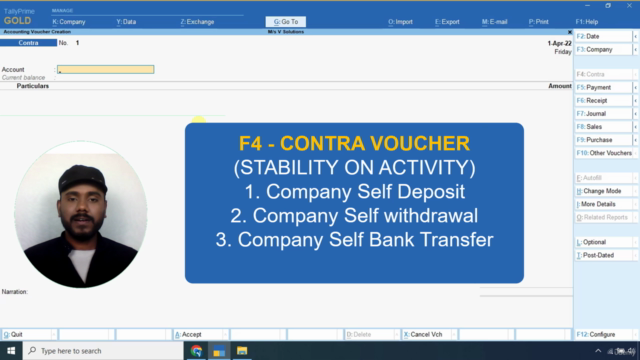

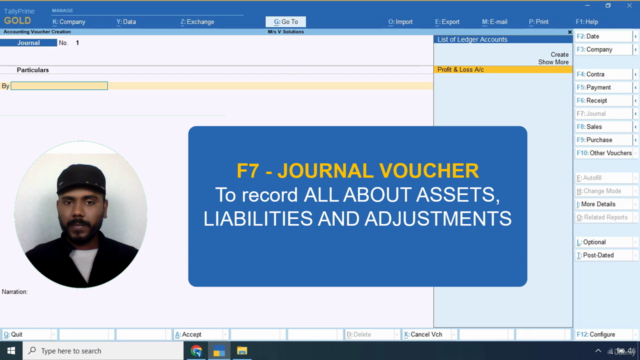

- Tally with GST: Our course covers all essential topics within the Tally application, ensuring you have a complete understanding of this powerful tool.

- GST Essentials: Get comfortable with the Goods and Services Tax (GST) by learning about its introduction, registration process, cancellation, amendments, and how to file monthly and quarterly returns.

- Income Tax & TDS Mastery: Acquire knowledge on Income Tax and Tax Deducted at Source (TDS) procedures like never before.

Course Highlights:

- Expert Faculty: Learn from a faculty member who not only excels in training but also trains the trainers themselves.

- Authorized Tally Institute Faculty: Our instructor is recognized as a TallyGuru and is a GSTN Recognized Tax Practitioner.

- Comprehensive Curriculum: Every topic related to Tally is meticulously covered, leaving no aspect of the software unexplored.

- Practical Learning: Engage with the licensed version of Tally through classes and hands-on practice.

- Real-Time Data Based GST Classes: Enhance your learning with case studies and quizzes for each chapter to solidify your knowledge.

- Extended Access & Support: Enjoy 100 days of unlimited access to the course materials, including reference questions and soft copies.

- Success Assurance: We guarantee that after completing this course, you will be well-equipped to handle all books of accounting and manage the GST portal.

Who Can Enroll?

This course is tailored for a wide array of individuals:

- Anyone with or without a Commerce Background: No prior knowledge in commerce is necessary; our course caters to everyone.

- Aspiring Tally.ERP Users: Whether you're new to Tally or looking to enhance your skills, this course will guide you through.

- GST Enthusiasts: If you aim to master the GST portal, this is the perfect place to start.

- Students, Employees, and Employers: This course is beneficial for all who wish to add financial expertise to their skillset.

- Tax Practitioners & Consultants: Elevate your professional services with advanced knowledge of taxation practices.

Embark on your journey to becoming a financial expert today! With our "TallyPrime+ Tally.ERP9+GST+Income Tax+TDS (Combo)" course in Telugu, you'll gain the skills and confidence needed to navigate the complexities of accounting and taxation with ease. Join us and transform your career prospects! 📊✨

Course Gallery

Loading charts...