Tally Prime : Beginner to Advanced Tally ERP with GST 2025

Become Accounting and Tally Expert with Real Examples used in Day to Day Accounting.

4.20 (1556 reviews)

8 644

students

13.5 hours

content

Mar 2025

last update

$29.99

regular price

Why take this course?

🎓 Master Tally Prime with Our Comprehensive Accounting Course!

Course Title:

🌟 Tally Prime: Step by Step Guide to Accounting using Tally 🌟

High Quality Course on Compliant Accounting in Tally

🔥 Covering Basic to Advanced GST and Much More! 🔥

Outcomes:

By enrolling in this course, you will:

- 🏫 Master Tally like a professional.

- ✔️ Meet all your bookkeeping requirements efficiently.

- 📈 Gain a solid foundation of Tally to handle accounting for your business.

- ✅ Maintain complex accounts with ease and confidence.

- 🔁 Enjoy the peace of mind that comes with a 30 Days Refund from Udemy, ensuring your satisfaction.

What You Will Learn:

- Accounting Basics such as debits and credits, enabling you to post entries confidently.

- How to use Tally effectively in the middle of a financial year and transfer accounts data from physical Trial Balance to Tally.

- Set up intricate details for stock tracking, like filtering reports to know: "How many laptops with i5 processors are available in your store?"

- Perform Bank Reconciliation by matching bank statement entries with your records of bank entries.

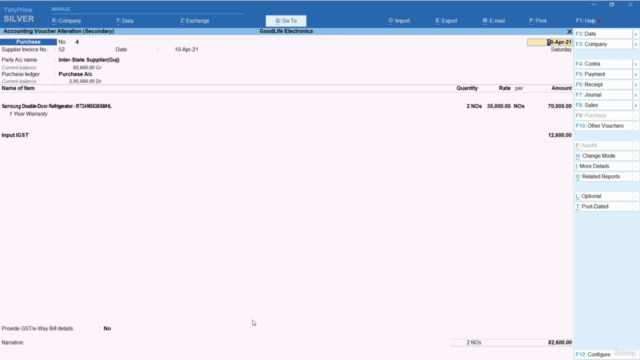

- Implement essential and advanced GST topics like GST Set-Off, Reverse Charge, Goods Transport Agency (GTA) and enter their related multiple journal entries in Tally.

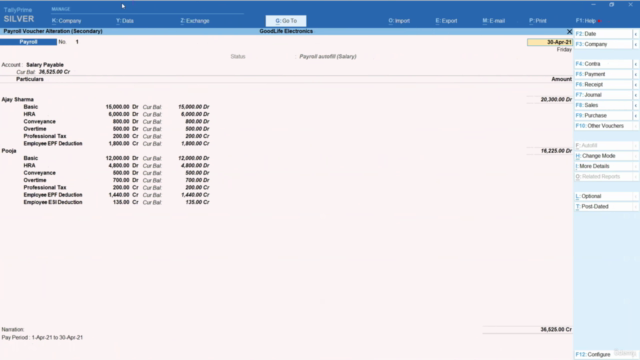

- Understand the complete setup for Corporate Payroll (Employee attendance) that complies with Government prescribed deduction rates.

- Learn about the Manufacturing Process to calculate the cost of an item, considering various parts/components involved.

- Customize sales invoice number formats like "BN/001/19-20" and more.

- File GSTR 1 and GSTR 3B with tax payment from Bank and record those entries in Tally.

- Engage with content that is comprehensive, avoiding courses that only touch on basics or take longer than necessary.

- Learn to maintain compliant bookkeeping practices, not just use Tally.

Student Testimonials:

- "It is a very good course. I was able to learn all the aspects of accountancy, inventory, cost center analysis, and TDS, which will be very beneficial for my official life." 🌟 — Krishnan Jaishankar

- "Exactly what I was looking for with regards to Tally learning! Nice Course Cheeeeers!!!!" 🎉 — Chandra Shekar

- "The course was very simplified for a beginner like me, which helped me better understand the process. Also, the repetition of processes helped to retain them. The doubt solving mechanism was beyond expectation as it allowed me to maintain my pace of learning." 🎓 — Abhinav Garkhail

- "GREAT TO LEARN BASIC THINGS AND EXPLAINED IN VERY EASY WAY WITH GOODS INDUSTRIAL EXAMPLES COMPLETING ALL DEPARTMENTS!" 🚀 — Nirmal Balayar

- "Teaching is clear. Easy to understand." 📚 — Durga Devi Murugan

Note:

This course is intended for learning purposes and does not serve as advice with regard to accounting/corporate compliance. Please consult a professional accountant or legal advisor for business-critical decisions.

Happy Learning! We're excited to support you on your journey to mastering Tally Prime and accounting practices. Let's embark on this path together towards financial expertise and success! 💼🎉

Course Gallery

Loading charts...

Related Topics

2465786

udemy ID

18/07/2019

course created date

19/02/2020

course indexed date

Lee Jia Cheng

course submited by