Stock Valuation & Financial Modelling for Stock Investing

Why take this course?

🎓 Stock Valuation & Financial Modelling for Stock Investing 🚀

Course Headline: Master the Art of Valuing Stocks with Relative & Absolute Valuation Methodologies for Value Investing!

Course Description:

Dive deep into the world of stock valuation with our comprehensive online course, designed to equip you with the essential techniques for both relative and absolute valuation methodologies. This course is a goldmine for beginners and seasoned investors alike who wish to refine their skills in value investing. 📈

What You'll Learn:

-

Ratio Analysis: Get started with the basics of stock selection through a comprehensive overview of key financial ratios, including P/E (Price-to-Earnings), P/BV (Price-to-Book Value), and P/S (Price-to-Sales) ratios. Learn to interpret these ratios against industry benchmarks and historical trends to identify potential investment opportunities.

-

Relative Valuation Techniques: Understand how to evaluate a stock's value in relation to other similar companies, industries, and over time. Gain insights into the different approaches for relative valuation and learn how to make informed decisions based on your findings.

-

Absolute Valuation Fundamentals: Delve into the world of absolute valuation by learning the intricacies of determining a company's intrinsic value. This course will teach you about intrinsic valuation models, including the Dividend Discount Model (DDM) and the Discounted Cash Flow (DCF) analysis. 💼

-

Financial Modelling Techniques: Master the art of financial modelling to create realistic models that can predict a company's future cash flows and help you estimate its intrinsic value. This section will provide you with practical skills to build your own financial models from scratch.

Course Highlights:

-

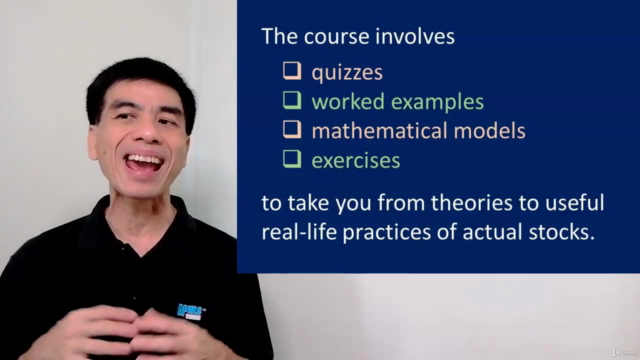

Interactive Learning: Engage with real-world examples, exercises, and financial quizzes that reinforce key concepts and principles.

-

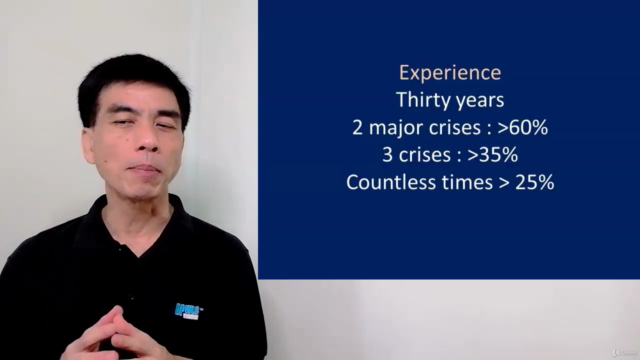

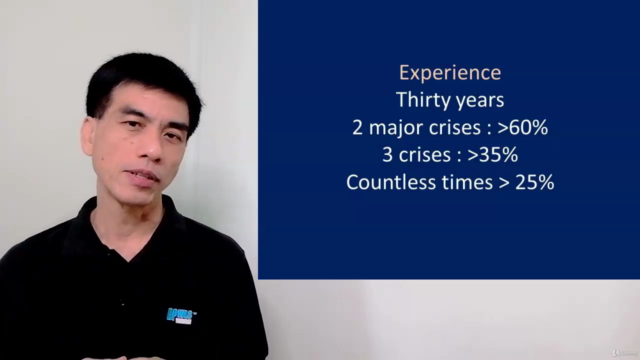

Expert Guidance: Learn from industry expert, Brennen Pak, who will guide you through each step of the valuation process.

-

Data Acquisition Skills: Discover where to find reliable data and how to apply it effectively in your financial models.

-

Practical Applications: Apply what you've learned with hands-on practice that prepares you for real-life investment decisions.

Key Takeaways:

-

Valuation Techniques Comparison: Learn how to compare different valuation methods and select the most appropriate one based on the context of your investment.

-

Intrinsic Value Estimation: Understand the importance of buying stocks at or below their intrinsic value to maximize investment returns.

-

Investment Decision Making: Develop a framework for making informed investment decisions using both relative and absolute valuation techniques.

Enroll now and take your first step towards becoming a savvy stock investor with the knowledge and skills to analyze stocks like a pro! 🌟

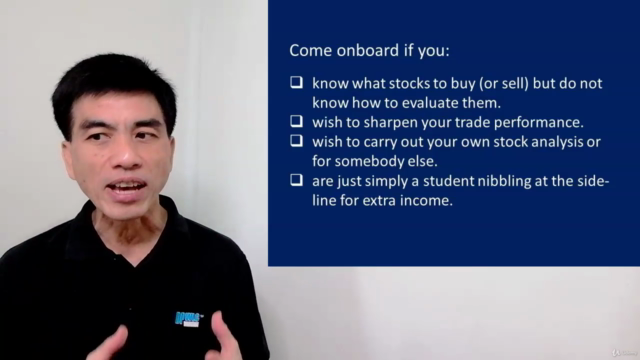

Who is this course for?

- Aspiring investors looking to build a strong foundation in stock valuation.

- Current investors seeking to enhance their valuation techniques.

- Finance professionals aiming to expand their expertise in investment analysis.

- Anyone interested in understanding the principles of value investing and financial modelling.

Course Gallery

Loading charts...