Stablecoin II: Economics Design for Stablecoin Systems

Why take this course?

Course Title: Designing Robust Stablecoin Systems with Asset-Liability Management Concepts

Headline: Understanding the Economics Behind Stablecoin Survival and Failure

Introduction: The recent collapse of TerraUSD has sent shockwaves through the digital asset community, prompting a reevaluation of stablecoin systems. As we witness the evolution of regulations and the slowdown in the development of private digital assets, it's more crucial than ever to understand the intricacies of stablecoin economics. This course, Stablecoin II: Economics Design for Stablecoin System, will explore the design principles and asset-liability management (ALM) strategies that underpin robust, resilient stablecoin ecosystems.

The TerraUSD Collapse 📉

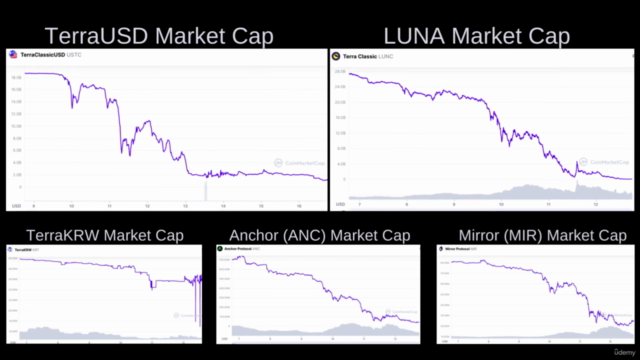

- On May 9th, 2022, TerraUSD (UST), a USD-pegged stablecoin within the Terra ecosystem, lost its peg, spiraling from $1 to less than half a penny.

- The depeg of UST triggered a sell-off in its sister coin, LUNA, resulting in a staggering erasure of more than $40 billion USD in market cap within days.

- Beyond TerraUSD and Luna Coins, the fallout extended to other assets on the Terra platform, including TerraKRW, Anchor Protocol, and Mirror Protocol, causing additional losses amounting to hundreds of millions – if not billions more.

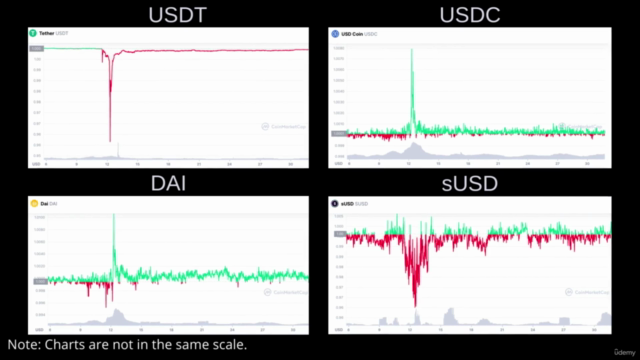

Understanding Market Dynamics 🤔 Amidst the turmoil, it's important to consider that not all stablecoins or crypto assets are valueless. In fact, amidst this market chaos, many other stablecoins like centralized fiat-backed stablecoins (USDC, USDT) and decentralized crypto collateralized stablecoins (DAI), including sUSD on the Synthetix platform, remained stable.

The Anatomy of Stablecoin Failure 🕳️ TerraUSD's failure is not an isolated incident; it joins a list of stablecoins that have collapsed. Understanding why some stablecoins fail while others thrive is crucial for the design and development of stablecoin systems. This course will dissect these failures and analyze the underlying economic principles that govern stablecoins.

Course Highlights:

- Historical Context: Learn from past stablecoin failures and successes.

- Asset-Liability Management: Master ALM strategies to create a resilient stablecoin system.

- Stablecoin Mechanisms: Understand the different types of stablecoins and their operational mechanisms.

- Risk Assessment & Mitigation: Learn how to assess and mitigate risks in stablecoin design.

- Regulatory Environment: Stay informed about the evolving regulatory landscape for stablecoins.

Who is this course for? This intermediate-level course is designed for:

- Cryptocurrency enthusiasts looking to deepen their understanding of stablecoins.

- Blockchain developers and entrepreneurs interested in creating stablecoin systems.

- Financial analysts and risk managers in the digital asset space.

- Regulatory professionals seeking insights into the economic design of stablecoins.

Why take this course? By completing Stablecoin II: Economics Design for Stablecoin System, you will gain a comprehensive understanding of the principles and practices that contribute to the stability and resilience of stablecoin systems. You'll learn from real-world case studies, engage with advanced ALM concepts, and explore the intersection of economics and blockchain technology.

Conclusion: This course is a follow-up to Sam Ghosh's introductory course on Stablecoins, offering a more in-depth exploration of their economics. Whether you're a seasoned professional or just starting your journey into the world of digital assets, this course will equip you with the knowledge and tools needed to navigate and design stablecoin systems that stand the test of time.

Enroll Now and Be Part of Shaping the Future of Stablecoins! 🚀

Course Gallery

Loading charts...