SAP Finance and Controlling

Why take this course?

Based on your extensive list of topics within SAP Finance and Costing, it seems you are looking for a comprehensive training program that covers a wide range of modules and functionalities. Here's a structured approach to master these areas, broken down into key learning objectives and the corresponding SAP modules involved:

-

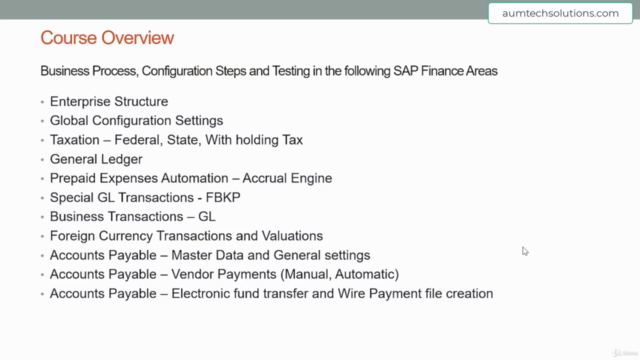

SAP FI (Financial Accounting)

- Depreciation Management

- Straight-line depreciation/declining balance method

- Depreciation runs and year-end closing

- General Ledger (G/L)

- Chart of Accounts

- Financial Document Creation & Posting

- Period End Close Process

- Account Determination

- Company Code

- Controlling Area

- Financial Statement Reconciliation

- Intercompany reconciliation and postings

- Depreciation Management

-

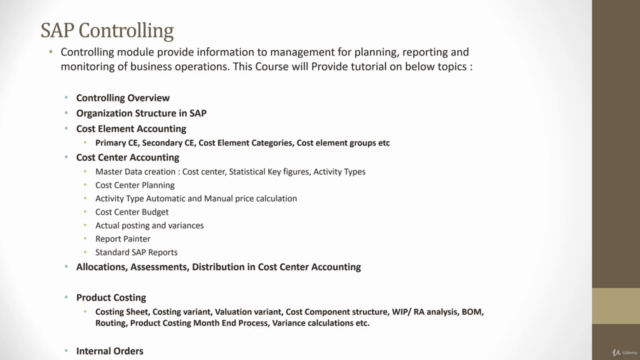

SAP CO (Costing)

- Cost Center Accounting

- Master Data: Cost Centers, SKFs, Activity Types

- Cost Collector & Allocation Procedures

- Budgeting & Variance Analysis

- Product Costing

- Configuration for new products

- Costing runs & variance analysis

- Work-in-Process (WIP) & Raw Material Requirements (RMR) Accounting

- Profit Center Accounting

- Profit Center Structure & Assignment Monitor

- Budget Planning & Actual Postings

- Order Management (Internal Orders)

- Create and manage internal orders

- Budgetary Control

- Cost Planning and Reconciliation

- Cost Center Accounting

-

SAP MM (Materials Management)

- Purchase-to-Pay Process

- Vendor Master Data Maintenance

- Invoice Verification and Automatic Status Change

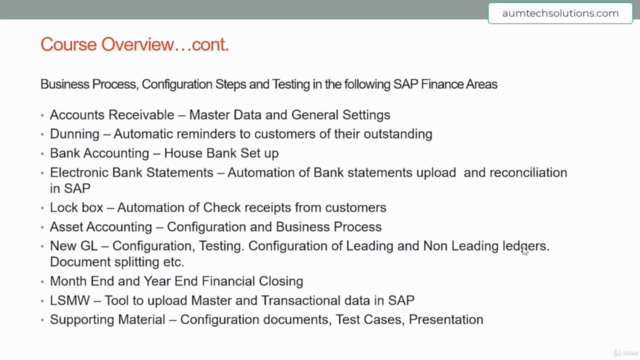

- Dunning Procedures

- Lockbox Configuration & Operations

- Material Master Data Maintenance

- Valuation of Inventory

- Goods Receipt and Invoice Verification

- Purchase-to-Pay Process

-

SAP SD (Sales and Distribution)

- Sales Order Management

- Customer Master Data Maintenance

- Revenue Recognition and Profitability Analysis

-

Electronic Bank Statements (EBS)

- EBS Configuration & Testing

- File Generation & Processing

-

Lockbox

- Lockbox Configuration & Setup

- Automation of Check Clearing Process

- Integration with Bank and Client Systems

-

SAP FI-MM Integration

- Master Data Consistency between FI and MM

- Valuation Levels, Areas, and Classes

- Material Types and Purchasing Groups

-

Controlling (CO-PC)

- Secondary Cost Elements & Activity Types

- Cost Planning for Products/Projects

- Budgeting & Actual Controlling

-

Profit Center Accounting

- Profit Centers, Groups, and Plans

- Profitability Analysis

-

Accruals and Deferrals

- Configuration of Accrual Engine for various types of liabilities

-

Reporting and Analytics

- Utilize Report Painter and other SAP reporting tools to generate financial reports

To master these topics, you should:

- Start with the basics of each module (FI, CO, MM, SD).

- Understand the end-to-end business processes.

- Learn how to configure SAP for these processes.

- Practice setting up master data and performing transactions.

- Perform test runs and simulations to understand the impact on financials.

- Analyze variances and learn how to reconcile discrepancies.

- Learn how to integrate modules (e.g., FI with MM).

- Understand the latest enhancements like electronic bank statements and lockbox automation.

- Practice by working on real-world scenarios or case studies.

For a comprehensive learning experience, you can find courses that cover these topics in detail. These can be self-paced online courses, instructor-led training, or even hands-on workshops where you get to work with SAP systems. Make sure the course you choose aligns with the latest SAP Fiori and SAP S/4HANA updates if you're looking to implement those technologies.

Remember, mastering SAP Finance is a journey that involves understanding not only the technical aspects but also the underlying business processes and controls. It requires a combination of theoretical knowledge and practical experience. Good luck on your learning path!

Course Gallery

Loading charts...