SAP Asset Accounting - Depreciation Methods

Why take this course?

🌟 Course Title: SAP Asset Accounting - Mastering Depreciation Methods with Production Units & Sum Of Digits 🌟

Course Description:

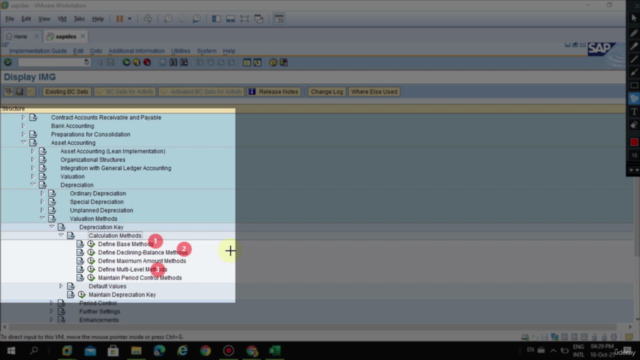

Embark on a comprehensive journey through the intricacies of SAP Asset Accounting with our specialized online course, where we delve into two fundamental depreciation methods: the Production Units Method and the Sum of Digits Method. Designed for professionals seeking to master asset management within SAP systems, this course is tailored to provide you with a deep understanding of business scenarios and their corresponding system configurations.

Overview:

Production Units Method: Learn how to accurately manage depreciation based on production output in SAP systems. You'll discover how to modify the total output quantity or the remaining output for precise period-specific adjustments, which the system will use to calculate unit-of-production depreciation.

- Specify probable output quantities for each depreciation period within open fiscal years.

- Understand the step-by-step calculation process:

Depreciation = Acquisition Value (Net Book Value) / Total Output (Remaining Output) × Period Output.

Sum of Digits Method: Gain insight into this linear depreciation method that calculates a consistent annual depreciation charge, ideal for fixed assets with predictable useful lives.

- Grasp the concept of calculating depreciation based on the remaining useful life of the asset each year, and totaling these figures to determine the depreciation percentage rate.

- Learn how to handle subsequent acquisitions by creating sub-numbers, ensuring compliance with SAP's requirements for the Sum of Digits Method.

- Master the calculation:

Depreciation = APC (Acquisition Price per Unit) × Remaining Useful Life (current period) / Total of Remaining Useful Life (over entire useful life).

Key Takeaways:

- Practical Application: Real-world business scenarios bring abstract concepts to life, allowing you to see how they apply directly to SAP system configurations.

- Expert Insights: Tap into the knowledge of industry experts who will guide you through each step of the depreciation process.

- Hands-On Learning: Engage with interactive examples and exercises that solidify your understanding of both methods.

- Flexible Learning: Access course materials anytime, anywhere, fitting seamlessly into your schedule.

By the End of This Course:

You will be well-versed in all steps required to manage depreciation accurately and efficiently using SAP Asset Accounting. Whether you're handling routine maintenance or complex acquisitions, you'll have the confidence to navigate these scenarios with expertise.

- Confidence: Feel assured in your ability to configure SAP for both depreciation methods.

- Expertise: Become a go-to resource within your organization for all matters related to asset depreciation accounting.

- Skill Mastery: Command the skills needed to manage fixed assets throughout their lifecycle accurately and in compliance with accounting standards.

Who Should Take This Course:

- Finance professionals responsible for fixed asset management.

- SAP system administrators and consultants.

- Accountants and auditors seeking to enhance their understanding of depreciation methods within SAP environments.

Don't miss the opportunity to elevate your skills in SAP Asset Accounting. Enroll now and transform your approach to handling depreciation with the Production Units and Sum of Digits Methods! 🎓💰

Course Gallery

Loading charts...