Real Estate Mortgage Planning and Payments

Why take this course?

GroupLayout: Real Estate Mortgage Planning and Payment 🏠💰

Course Headline: Plan Your Mortgage in Advance

Are you ready to take the leap into homeownership but feeling overwhelmed by the mortgage process? Fear not! With our comprehensive online course, "Real Estate Mortgage Planning and Payment", led by industry expert Zakaria Elbarasi, you'll embark on a journey to navigate the complex world of mortgages with confidence.

Course Description:

Understand Your Financials Before You Sign on the Dotted Line!

Key Takeaways from This Course:

-

📊 Learn to Estimate What Home You Can Afford: Gain insights into assessing your budget and finding out the price range of homes you can realistically afford.

-

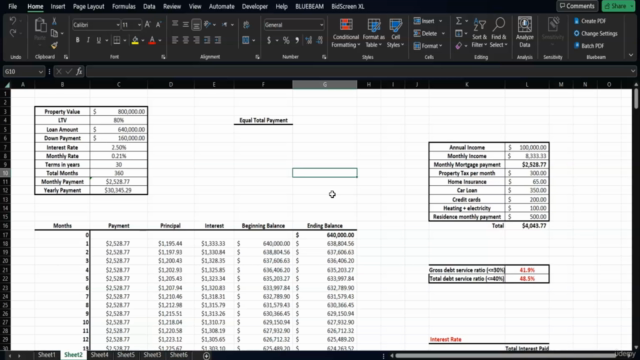

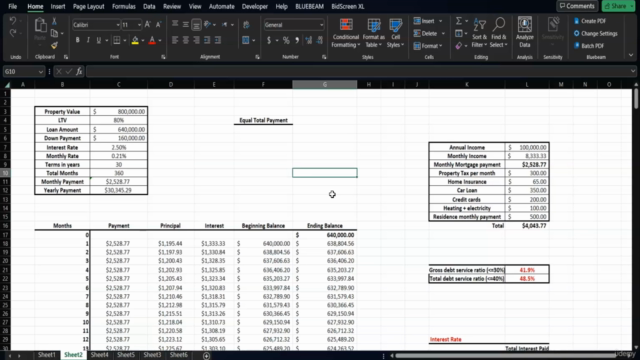

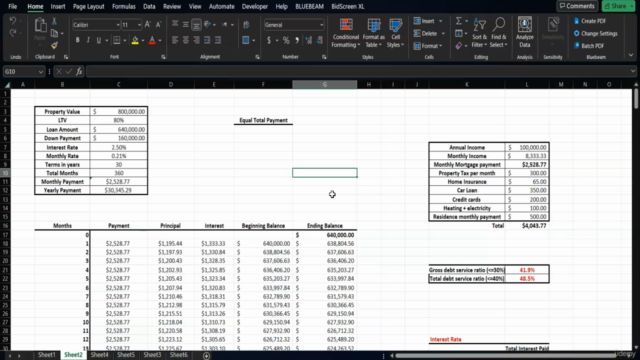

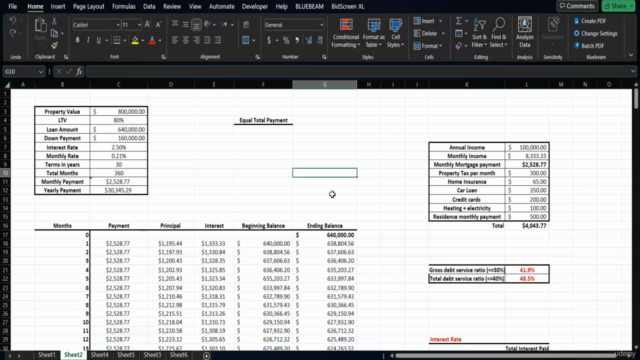

💡 Mortgage Payment Estimation: Discover how to estimate your mortgage payments over the entire loan period, taking into account various interest rates and scenarios.

-

📈 Analyzing Different Scenarios: Understand the impact of different interest rates on your monthly payments and total amount paid over time.

-

⚖️ Fixed vs Variable Rate Mortgages: Explore the pros and cons of fixed-rate and variable-rate mortgages, and decide which option is best suited for your financial situation.

-

📅 Long-Term Financial Planning: Plan effectively to ensure that you can meet your mortgage obligations and work towards becoming debt-free.

Course Breakdown:

-

Introduction to Mortgages: A basic overview of what a mortgage is, the types of mortgages available, and what goes into securing one.

-

Assessing Affordability: Strategies for determining how much house you can realistically afford without overextending your finances.

-

Understanding Mortgage Payments: A deep dive into the components of mortgage payments, including principal, interest, taxes, and insurance (PITI).

-

Scenario Analysis and Budgeting: How to create different financial scenarios with varying interest rates to plan for the future effectively.

-

Choosing the Right Mortgage Type for You: An in-depth look at the differences between fixed and variable rate mortgages, including how they can affect your payments and overall cost.

-

Long-Term Financial Planning: Techniques for planning your mortgage repayments over 20, 25, or 30 years to ensure you stay on track.

Who is this course for?

-

First-time homebuyers eager to understand the mortgage landscape.

-

Individuals looking to refinance their existing mortgages.

-

Real estate enthusiasts who want to invest in properties with confidence.

-

Anyone interested in learning more about managing and planning for mortgage debt.

Join Zakaria Elbarasi in this enlightening course that will empower you with the knowledge and tools necessary to navigate the world of real estate mortgages. Enroll now, and take the first step towards a secure financial future! 🌟

Course Gallery

Loading charts...