Real Estate Development in Excel (Includes Template)

Why take this course?

🏠 Real Estate Development in Excel (Includes Template) 🎉

Course Headline: 🚀 Learn Industry Standard Analysis and Valuation Techniques For Real Estate Development 🚀

Unlock the Secrets of Real Estate Financial Modeling with Excel! 🗓️💡

Course Description: Are you ready to dive into the world of real estate development finance? Our comprehensive course is designed to equip you with the skills to create a robust financial model for multi-family real estate projects using Excel. With this course, you'll gain immediate access to a state-of-the-art, downloadable Excel model tailored for multi-family developments. This model is user-friendly and adaptable, requiring minimal effort to customize it for your specific project needs.

Why Choose This Course? 🌟

-

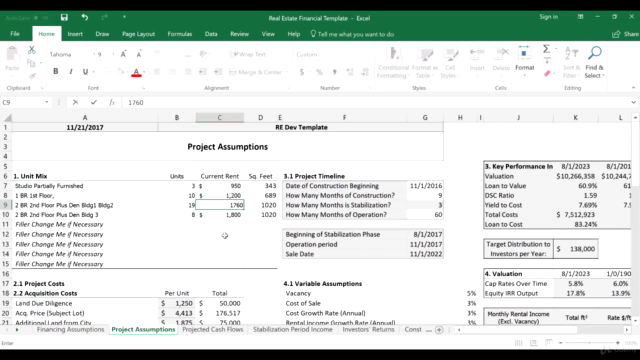

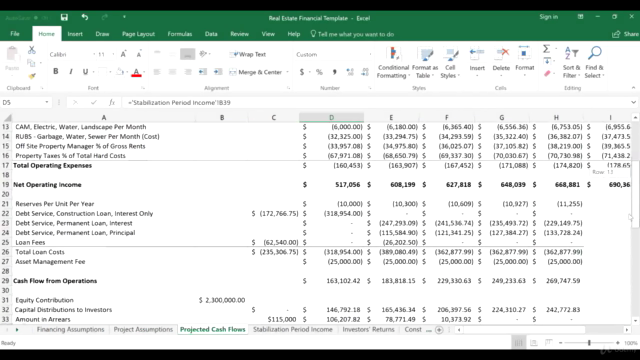

Dynamically Calculated Metrics: The Excel model dynamically calculates critical metrics such as IRR (Internal Rate of Return), Debt Service Coverage, Yield to Cost, Loan to Cost, and Project Valuation, allowing you to understand the financial impact of your decisions.

-

Industry-Ready Model: This model is not just for learning; it's used by professionals in the industry for actual real estate projects.

-

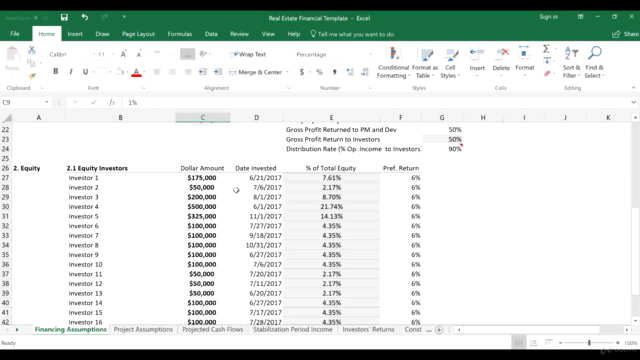

Equity Analysis: Designed to model equity investors' perspectives for syndicated projects, showing detailed IRRs and returns.

-

Debt Management: The model accounts for construction loans, take-out permanent loans, balloon payments, and all debt service payments throughout the development process.

-

Amortization Tables Included: With integrated amortization tables, you can quickly analyze loan terms and their implications on your project's finances.

Ease of Adaptation: The video content in this course is meticulously crafted to guide you through adapting the model to any variety of unit mixes, stabilization periods, rent scenarios, loans, and exit dates. This ensures that whether you're working on a 36-unit apartment complex or another type of multi-family project, you can apply these skills with confidence.

Real World Application: This course will walk you through the financial modeling process from start to finish for a hypothetical 36-unit apartment complex development. You'll learn how to handle equity contributions, construction periods, lease-ups, and eventually the sale of the project, all while using the provided Excel model as your financial compass.

Welcome to Your Journey in Real Estate Development Financing! 🤝 With "Real Estate Development in Excel," you're not just learning a set of skills—you're gaining a powerful toolkit for success in the competitive world of real estate development. Enroll now and take the first step towards mastering financial modeling with confidence and precision.

Course Features:

-

Complete Excel Model Template: A ready-to-use, comprehensive model specifically designed for multi-family real estate developments.

-

Detailed Video Instructions: Step-by-step guidance to ensure you understand every aspect of the model and its application.

-

Real-World Scenarios: Apply what you learn in a variety of scenarios that reflect the complexities of real-world projects.

-

Expert Instructor: Learn from industry expert Daniel Daviscourse, who brings years of experience to your learning journey.

Embark on Your Financial Modeling Adventure Today! 🌟 Join a community of aspiring and seasoned real estate professionals who are ready to elevate their financial modeling skills to new heights with Excel. Sign up for "Real Estate Development in Excel" and transform your approach to real estate development finance!

Course Gallery

Loading charts...