QuickBooks Self-employed - Are you ready to get organized?

Why take this course?

🚀 Master Your Finances with QuickBooks Self-Employed: The Ultimate Guide for Entrepreneurs! 🌟

Introduction: Are you drowning in a sea of receipts, invoices, and financial records? Do the words "tax season" send shivers down your spine? As an independent contractor or small business owner, financial management can be as daunting as it is crucial. But fear not! Desarie Anderson, CPA, EA, is here to turn your financial chaos into a harmonious symphony with the power of QuickBooks Self-Employed. 🎶

Course Overview: This comprehensive course is designed for self-starters and business owners who are ready to take control of their accounting without the stress. Say goodbye to the tedium of traditional bookkeeping and embrace an automated, streamlined approach that saves you time and money. ⏰💰

Why Enroll? 📁 Organize Your Financial Documents Effortlessly: Learn how to systematically sort and track your business income and expenses. Never scramble again at tax time!

🧾 Capture Every Deduction: Understand how to record all your expense deductions accurately, maximizing your tax savings.

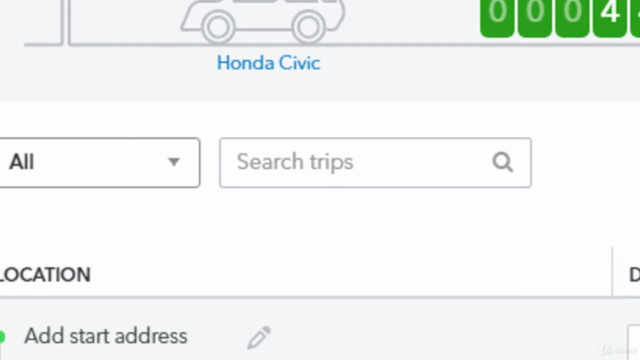

🚗 Mileage Tracking Simplified: Keep track of business mileage with ease, ensuring you're not leaving money on the table.

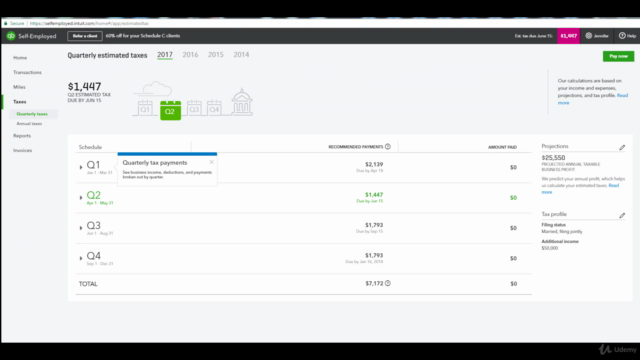

✅ Estimate Quarterly Tax Payments Accurately: Get ahead of your tax obligations and make informed quarterly estimates.

✉️ Invoice Like a Pro: Send invoices promptly from any device, at any time, keeping your cash flow smooth and steady.

🎓 Automate 80% of Your Accounting Process: Discover how to automate the bulk of your accounting tasks, freeing up precious time to focus on what you do best – running your business!

What's in It for You?

- A deep dive into QuickBooks Self-Employed features and benefits.

- Step-by-step guidance from setup to daily use.

- Best practices for maintaining pristine financial records all year round.

- Expert insights from Desarie Anderson, a seasoned CPA, EA with real-world experience.

What You Will Learn:

- Setting Up Your Account: Get your QuickBooks Self-Employed account ready to capture every transaction.

- Linking Bank Accounts and Credit Cards: Seamlessly connect your financial institutions for real-time tracking.

- Categorizing Transactions: Effortlessly sort transactions into the correct business or personal categories.

- Tracking Mileage: Learn how to easily record and manage mileage, ensuring all business trips are accounted for.

- Creating and Sending Invoices: Master the art of issuing invoices that are clear, timely, and professional.

- Managing Receipts and Sales: Keep your sales and expenses organized in one place, making reconciliation a breeze.

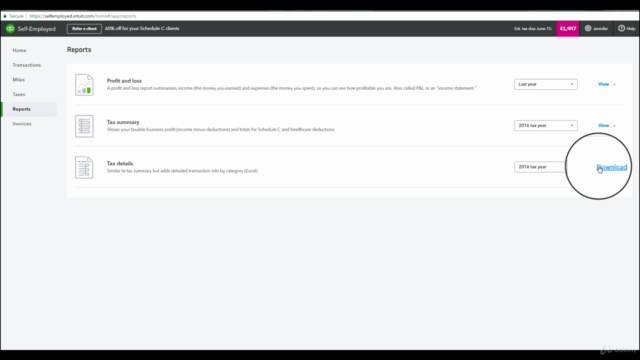

- Understanding Your Finances: Gain clarity on your financial health with easy-to-understand reports and dashboards.

- Staying Compliant: Ensure you're meeting tax obligations throughout the year, not just during tax season.

Who Is This Course For?

- Independent contractors

- Small business owners

- Anyone who wants to streamline their accounting process

- Individuals aiming for a less stressful tax season

- Those seeking to maximize deductions and save time

Ready to Transform Your Financial Management? Join Desarie Anderson in this transformative course and turn your financial administration into a strategic advantage. With QuickBooks Self-Employed, you're not just keeping track of your finances; you're crafting the foundation for sustainable growth and success. 🌱💼

Enroll now and take the first step towards a more organized, efficient, and financially savvy business operation! Let's make financial management something to look forward to, not dread. 🚀💫

Course Gallery

Loading charts...