QuickBooks Payroll - QuickBooks Online

Why take this course?

🎉 Course Title: QuickBooks Payroll - Mastering QuickBooks Online for Small Businesses

🚀 Headline: Processing QuickBooks Online payroll for a small business, generating paychecks, and mastering payroll tax forms with confidence!

Course Description:

Welcome to the comprehensive guide to managing payroll in QuickBooks Online! This course is meticulously designed for bookkeepers, accountants, and small business owners looking to streamline their payroll process. With Robert (Bob) Steele at the helm, you're guaranteed to gain a thorough understanding of setting up, processing, and troubleshooting payroll within QuickBooks Online.

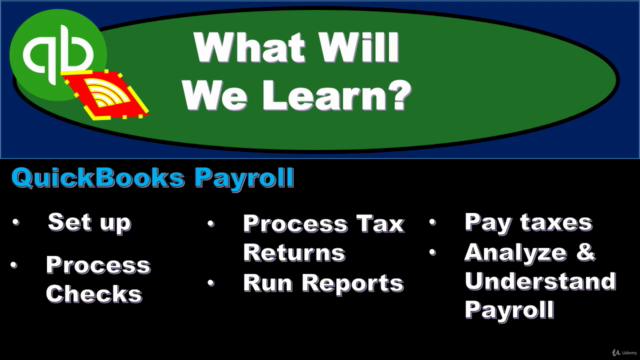

What You'll Learn:

- 🧠 Understanding Payroll Setup in QuickBooks Online: We'll navigate through the essential payroll screens, preparing you to hit the ground running.

- 📜 Compliance with Payroll Legislation: Stay compliant and understand how legislation impacts your payroll calculations within QuickBooks Online.

- 👥 Adding New Employees: Learn the nuances of entering a new employee into the system, including the importance of Form W-4.

- 🧫 Federal Income Tax (FIT) Calculations: Get to grips with FIT calculations and learn how QuickBooks Online can facilitate these complex processes.

- ✍️ FICA & Medicare Calculations: Understand the components of FICA and how QuickBooks Online assists in calculating social security and Medicare contributions.

- 💰 Calculating Employer and Employee Taxes: Gain insight into employer vs. employee taxes and understand the intricacies of payroll tax calculations.

- 📊 Payroll Journal Entries and Financial Reporting: Learn how to make accurate journal entries and understand the impact of payroll on QuickBooks Online reports and financial statements.

- 🛍️ Mandatory & Voluntary Deductions: Master the entry of both mandatory and voluntary deductions within the QuickBooks Online system.

- 🎫 Retirement Plan Options: Explore various retirement plan options, their setup in QuickBooks Online, and their role in calculating net income and payroll taxes.

- 📝 Real-World Application: Engage with a comprehensive, step-by-step problem that takes you through processing payroll for a small business using the powerful features of QuickBooks Online.

Why Take This Course?

- 🎓 Expert Instructor: Bob Steele is an experienced instructor known for his clear and concise teaching style.

- 🤖 Hands-On Learning: Apply your knowledge through real-world scenarios and hands-on practice.

- 🚀 Career Advancement: Equip yourself with the skills to handle payroll confidently, enhancing your career prospects as a bookkeeper or accountant.

- 🛠️ Business Mastery: If you own a small business, learn how to save time and reduce errors in your payroll process, ensuring compliance and peace of mind.

How You'll Benefit:

- ✅ Step-by-Step Guidance: Follow along with detailed instructions and screen captures for each step in the payroll process.

- 👩💼 Practical Experience: Gain practical experience by working through a comprehensive example that grows in complexity, preparing you to handle any payroll situation.

- 🎓 Certification of Completion: Earn a certificate upon successful completion of the course, demonstrating your expertise in QuickBooks Online payroll.

Embark on your journey to mastering QuickBooks Payroll today and transform the way you handle small business payroll! 🌟

Course Gallery

Loading charts...