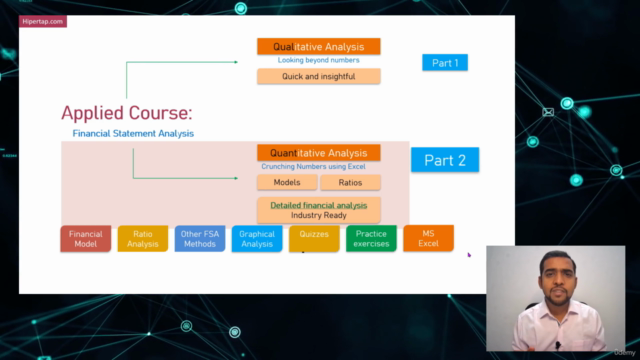

Quantitative - Financial Statement Analysis

Why take this course?

🌟 Course Title: Quantitative - Financial Statement Analysis 🚀

Headline: Master Financial Analysis, Dive Deep into Financial Models & Ratios! 📊

Course Description:

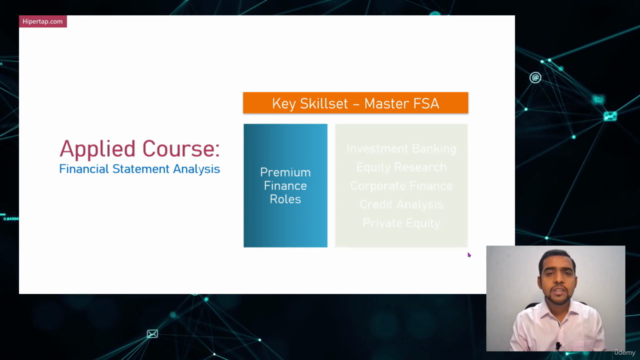

Are you ready to elevate your financial analysis skills and secure a premium role in the finance industry? If your answer is a resounding yes, then our Quantitative - Financial Statement Analysis (FSA) part-2 course is tailor-made for you! This advanced course is designed to equip you with the knowledge and expertise required in high-stakes financial roles such as investment banking, equity research, credit analysis, corporate finance, and private equity.

📈 Key Features of the Course:

- Industry-Standard Skills: Learn to perform detailed financial statement analyses, a critical skill for any finance role.

- Real-World Application: Analyze real company financials to gain practical experience and insights.

- Comprehensive Coverage: Dive into the nuances of profit and loss statements, balance sheets, notes to accounts, and annual reports.

- Innovative Methods: Go beyond traditional techniques and learn newer methods to extract deeper business insights.

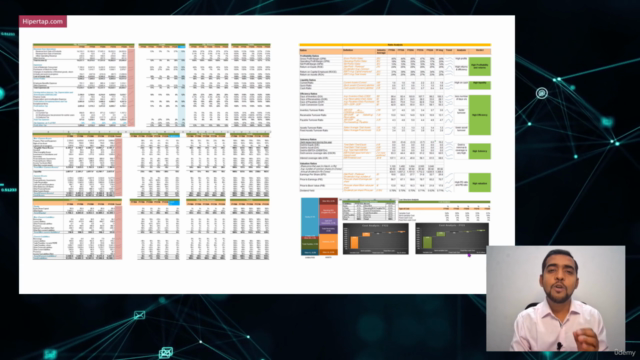

- Hands-On Approach: Engage in building financial models on MS Excel, calculate financial ratios, and interpret graphs and patterns.

- Extensive Practice: Master the art with numerous quizzes and practice exercises.

- Self-Sufficient Learning Path: No prior knowledge of FSA part-1 required; this course covers all essential concepts in detail.

- Practical Resources: Gain access to downloadable Excel files for practice exercises.

- Full Instructor Support: Get the guidance you need to succeed throughout your learning journey.

What You Will Learn:

- 📑 Detailed Financial Analysis: Learn to read and understand complex financial statements with ease.

- 🛠️ Financial Modeling: Construct comprehensive financial models on Excel to forecast company performance and valuation.

- ✨ Financial Ratios: Calculate key financial ratios that provide insight into a company's operational, liquidity, solvency, and profitability.

- 📊 Graphical Analysis: Use graphs to visualize data and identify critical business trends and insights.

- 🔍 Risk Assessment: Understand the structure of a company and assess financial risks it may face.

Why Enroll in This Course?

- Career Boost: Transition or advance your career in finance with industry-ready skills.

- Practical Knowledge: Learn through hands-on exercises that reflect real-world scenarios.

- Self-Paced Learning: Study at your own pace, with full access to course materials and instructor support.

- Interactive Content: Engage with content that includes downloadable resources for a more immersive learning experience.

Don't wait any longer to unlock your potential in financial analysis. 🌟 Enroll now and take the first step towards becoming an expert financial analyst! With our comprehensive, hands-on approach, you'll be ready to tackle any financial challenge that comes your way.

Preview the Course to see what you can expect, and join a community of learners who are already on their path to financial analysis mastery. We're excited to have you on board! 🚀💼

Course Gallery

Loading charts...