Quantitative Finance with Python

Why take this course?

🚀 Course Title: Quantitative Finance with Python: Master Financial Markets Through Data Science, Machine Learning & Technical Analysis

🎓 Headline: Dive into the World of Quantitative Finance with Python – A Comprehensive Guide for Finance Professionals and Data Scientists!

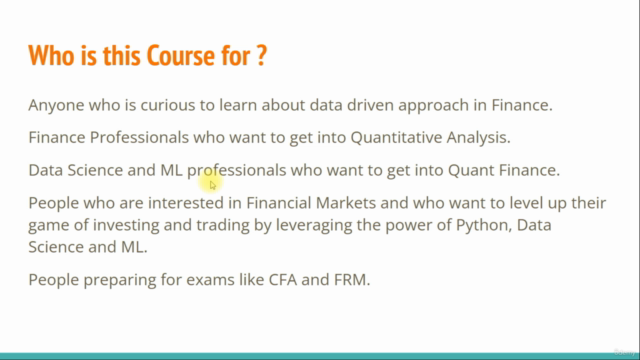

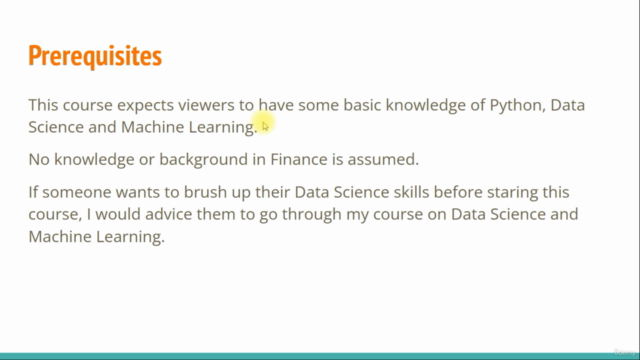

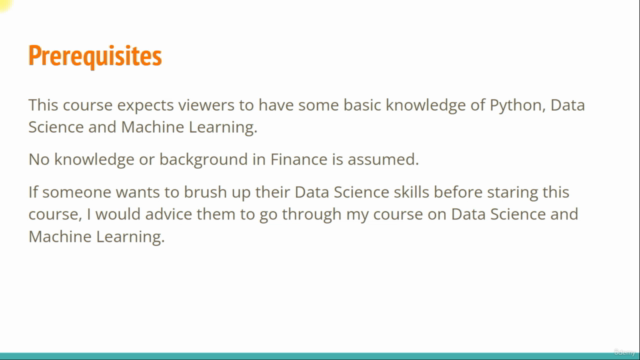

Are you a finance professional or a data scientist 🔬🚀 looking to elevate your skills to the next level? Are you fascinated by the intricate dance of numbers that dictate financial markets, and eager to decode it using the power of Python? If your answer is a resounding 'Yes!', then this course is your golden ticket into the exciting realm of Quantitative Finance!

Quantitative analysts are the maestros of investment banks, hedge funds, and financial institutions. They wield the magic of data science and machine learning to navigate the complex waters of financial markets. If you're already well-versed in Python or have a background in finance/data science/technology/engineering, this course will be your stepping stone to becoming a full-fledged quant.

What You Will Learn:

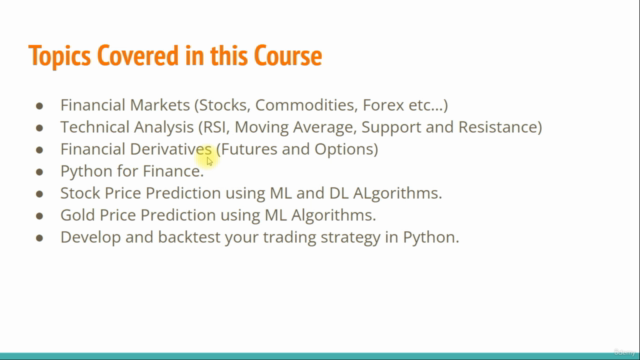

👉 Stock Markets: Master the art of understanding and influencing stock behavior through advanced analytics.

👉 Commodity Market & Forex Trading: Gain insights into commodities trading and forex markets, making informed decisions based on data-driven strategies.

🚀 Cryptocurrency Analysis: Explore the volatile world of cryptocurrencies and how to apply quantitative methods to predict prices.

📊 Technical Analysis: Learn to interpret market trends using technical indicators like Moving Averages, RSI, and Candlestick Charts.

🏦 Financial Derivatives, Futures & Options: Understand the principles of derivatives trading and how to use futures and options to your advantage.

⚛️ Time Value of Money, Modern Portfolio Theory, Efficient Market Hypothesis: Grasp the key concepts that underpin financial decision-making.

🤖 Machine Learning & Deep Learning in Finance: Apply machine learning algorithms and LSTM neural networks to predict stock prices and analyze market behavior.

💰 Gold Price Prediction Using Machine Learning: Learn how to forecast gold prices and why it matters for investment strategies.

💡 Backtesting Trading Strategies in Python: Develop and test your trading strategies using Python, ensuring robustness and profitability.

📈 Algorithmic & Advanced Trading Methodologies: Explore advanced techniques like arbitrage, pair trading, and algorithmic trading to gain an edge in the market.

📉 Capital Asset Pricing Model (CAPM), Sharpe Ratio: Learn how to evaluate investment performance and manage risk effectively.

🧮 Python for Finance: Get hands-on with Python as a tool for financial analysis, data manipulation, and predictive modeling.

🔁 Correlation Analysis & Diversification Strategies: Understand the relationship between different assets and how to diversify your investment portfolio for optimal risk management.

📊 Risk Management & Optimal Position Sizing: Learn the Kelly Criterion and other methods to determine the best allocation of capital to maximize returns.

By enrolling in this course, you will not only acquire a comprehensive skill set but also gain a competitive edge in your quantitative finance career. Whether you're aiming to secure a role as a quant analyst or looking to enhance your trading prowess, this course is your gateway to becoming a master of quantitative finance with Python.

Join Raj Chhabria, an expert in the field, and embark on a transformative learning journey. 🌟 Take the first step towards a career that's as dynamic as it is rewarding! Enroll now and unlock the full potential of your data science skills to dominate the financial markets. Let's make numbers work for you!

Course Gallery

Loading charts...