Quantitative Bond Trading on Interactive Brokers' Platform

Why take this course?

Master Quantitative Bond Trading with Interactive Brokers' Python API: A Comprehensive Guide 🚀

Course Instructor: Mayank Rasu

Unlock the Secrets of Fixed Income Trading with Algorithms! 💼🔬

Welcome to an exclusive journey into the world of quantitative bond trading on the Interactive Brokers platform. If you're looking to dive deep into the fascinating realm of fixed income securities and transform data into wealth using algorithmic trading, then this is the course for you!

Course Title: Quantitative Bond Trading on Interactive Brokers' Platform

What You'll Learn:

This comprehensive course is crafted to empower you with the skills necessary to navigate and thrive in the bond market. 📈 Here's what you can expect:

-

Understanding the Fixed Income Market: Gain insights into how bonds work, their types, and their importance within a diversified investment portfolio.

-

Bond Trading Tools on Interactive Brokers: Explore the powerful trading tools that Interactive Brokers offers for bond trading.

-

Basic Bond Math: Learn the essential math behind pricing bonds, understanding yield to maturity, and more.

-

Setting Up Your Workspace: Get familiar with the TWS (Trader Workstation) interface, setting up your account, and accessing essential market data.

-

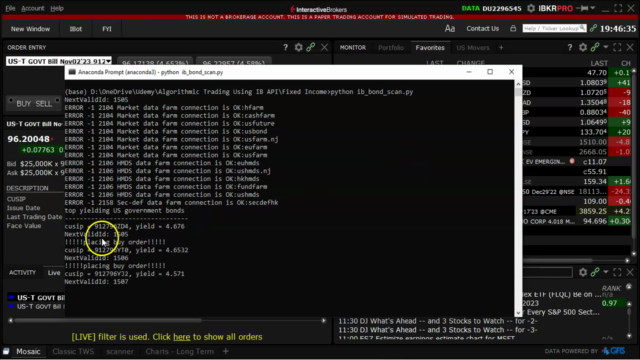

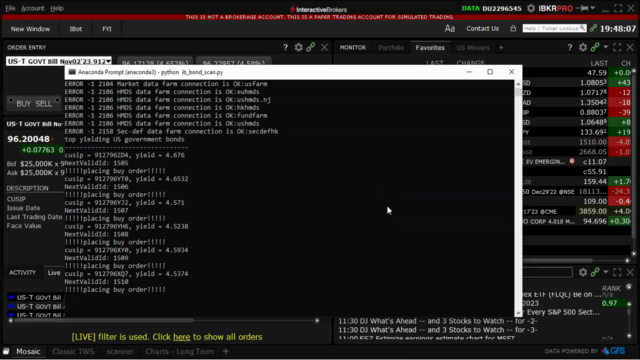

Data Extraction Mastery: Discover how to extract bond details for specific issuers and use a bond scanner to find opportunities.

-

Parallel Programming Techniques: Utilize advanced parallel programming or multi-threading to handle and store massive amounts of bond market data efficiently.

-

Historical Data Analysis: Learn techniques to extract historical bond data for robust backtesting of your trading strategies.

-

Advanced Order Types: Place various types of orders, including the sophisticated One Cancels All (OCA) orders, to manage your trades effectively.

-

Portfolio Optimization with Quantitative Techniques: Apply quantitative methods to optimize your bond portfolio for maximum returns and minimal risk.

Why This Course? 🌟

This is probably the only course in the world that combines the intricacies of algorithmic trading with the nuances of bond trading, all within the robust Interactive Brokers API framework. If you're keen on being part of the cutting-edge algorithmic trading revolution in the bond market, this course will equip you with the necessary tools and knowledge to do so.

For Whom? 👥

This course is designed for:

-

Experienced Bond Traders: Enhance your skills and take your trading to the next level with algorithmic precision.

-

Aspiring Bond Traders: Start your journey into bond trading with a strong foundation in quantitative methods and API integration.

-

Quantitative Analysts: Apply your analytical skills to the bond market, optimizing portfolios with data-driven strategies.

Join Mayank Rasu in This Exciting Journey! 🧭

Mayank Rasu, a seasoned expert in financial markets and API integration, has tailored this course based on valuable feedback from students who are either experienced bond traders or have a strong interest in the field. This course is your stepping stone to automating your bond trading strategies using Interactive Brokers' powerful Python API and harnessing the platform's advanced functionalities to gain an edge in the market.

Enroll Now to Secure Your Spot in the Future of Bond Trading! 🎓✨

Take the first step towards mastering quantitative bond trading with Interactive Brokers' Python API. Sign up for this course and unlock the potential of algorithmic trading in fixed income securities today! 🚀🔥

Course Gallery

Loading charts...