Complete Financial Modeling for Project Finance in Excel

Why take this course?

🎉 Complete Financial Modeling for Project Finance in Excel 📊✨

🚀 Course Overview: Master the art of financial modeling with our comprehensive online course tailored for analyzing project finance transactions within the infrastructure sector. This course will guide you from a blank Excel workbook to a sophisticated financial model suitable for investment analysis, debt structuring, and operational scenario evaluation.

🏗️ What You Will Learn:

- The fundamentals of Project Finance and its significance in infrastructure investments.

- How to construct financial models for complex, real-life project finance transactions.

- Techniques to sculpt debt to achieve the desired Debt Service Coverage Ratio (DSCR).

- Developing best practice macros and VBA codes to resolve circularities within your model.

- Modeling Debt Service Reserve Account (DSRA) and Maintenance Reserve Account (MRA) as per industry standards.

- Handling Shareholder Loans, Revolvers, and understanding Blended Equity Internal Rate of Return (IRR).

- Building comprehensive Excel models that encompass the full lifecycle of a project.

- Conducting valuation analysis using Discounted Cash Flow (DCF) and IRR methods.

- Ensuring your financial models meet F.A.S.T. standards and are trusted by investors and financiers alike.

💡 Key Benefits of Enrolling:

- Realistic Training: Engage with over 9 hours of instructor-led video content, tailored to real-world project finance scenarios.

- Affordability: Save up to $1500 compared to similar courses offered elsewhere.

- Flexible Learning: Study at your own pace, from anywhere in the world, through our online platform.

🔍 Course Structure:

- Project Finance Theory Review: Understand the essential components of project finance transactions.

- Case Study & Modeling Methods: Work through a toll road project case study and learn efficient Excel modeling techniques.

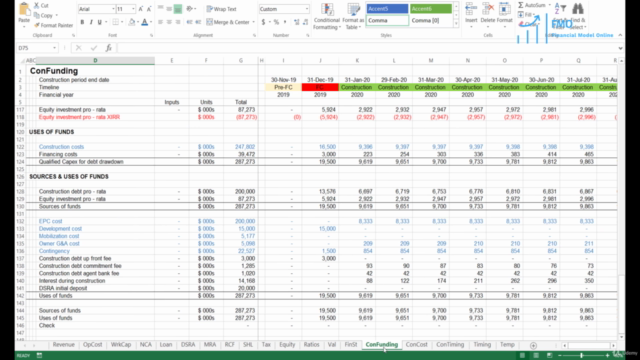

- Financial Model Construction: Build an integrated 3-statement financial model, including income statements, balance sheets, and cash flow statements.

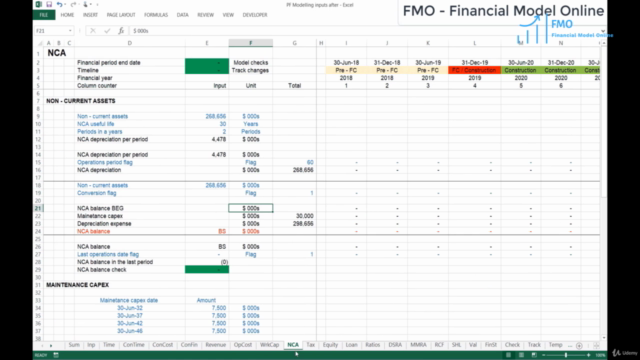

- Detailing Financial Components: Model coverage ratios, debt sculpting, DSRA, MRA, revolver, shareholder loans, and conduct DCF and IRR valuations.

- Advanced Topics: Explore equity first funding methods, automation of debt sizing and DSRA, and perform scenario analysis.

🌍 Who Should Take This Course? This course is designed for financial analysts, managers, senior managers, associate directors, financial advisors, financiers, CFOs, and project company representatives from investment banks, private equity, and infrastructure funds.

🧠 Course Prerequisites:

- Exposure to Excel in a financial modeling context is essential.

- Basic knowledge of investment concepts such as NPV and cash flows is recommended.

Join us to elevate your financial modeling skills for project finance and infrastructure valuation! 📈🚀

Course Gallery

Loading charts...

Comidoc Review

Our Verdict

Though the course shows room for improvement in certain areas, its well-rounded approach to project finance modeling makes it a valuable resource. Students should expect some prior knowledge of Excel functions and be prepared to revisit some sections for clarity. Nonetheless, the detailed tutorials and abundant resources offer a solid foundation for financial professionals looking to enhance their skillset.

What We Liked

- In-depth coverage of project finance modeling from scratch using a toll road project case study.

- Clear explanations of complex topics like DSCR, Debt Service Reserve Account, Maintenance Reserve Account.

- Comprehensive explanation of financial modeling tools and techniques, appreciated by beginners and professionals alike.

- Valuable insights into industry best practices, macro usage, and VBA codes.

Potential Drawbacks

- Occasional discrepancies between 'before' and 'after' files, causing confusion in the modeling process.

- Instructor's assumption of prior knowledge related to some functions and concepts.

- Infrequent use of latest Excel features such as xlookup and logic ifs.

- Limited elaboration on more complex concepts and their corresponding excel formulas.