Present value, Future value and Capital Structure

Why take this course?

🧠 Master Corporate Finance with "Present Value, Future Value & Capital Structure"

🚀 Course Headline: Unlock the monetary mysteries behind ordinary shares, preference shares, debentures, and long-term loans to compute the Weighted Average Cost of Capital (WACC) with precision and confidence!

📘 Who Should Take This Course? This comprehensive course is tailored for undergraduate and postgraduate students interested in delving into the world of Corporate Finance. Whether you're just starting out or looking to solidify your understanding, this course will equip you with the tools and knowledge necessary to navigate the complexities of financial decision-making.

🎓 What You'll Learn:

-

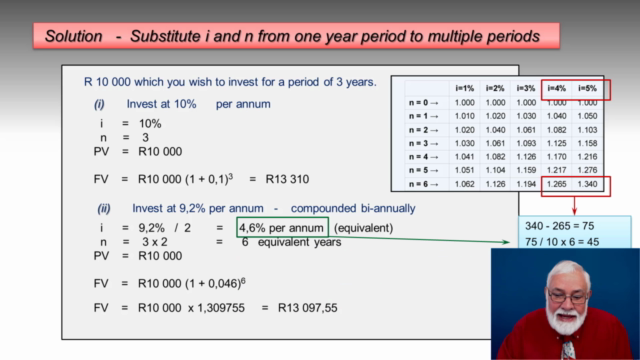

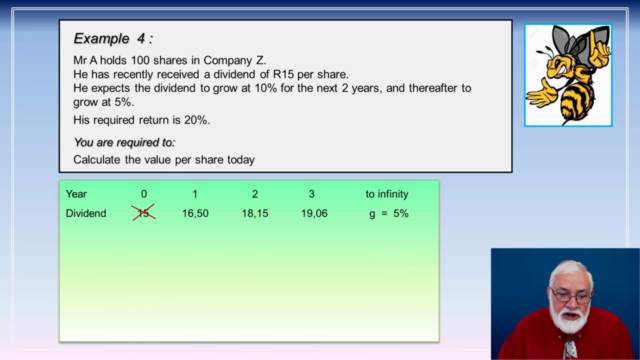

🔹 Future Value & Present Value Computation: Master the art of calculating the future value of a cash flow or an annuity, as well as determining the present value, which are crucial for making informed financial decisions.

-

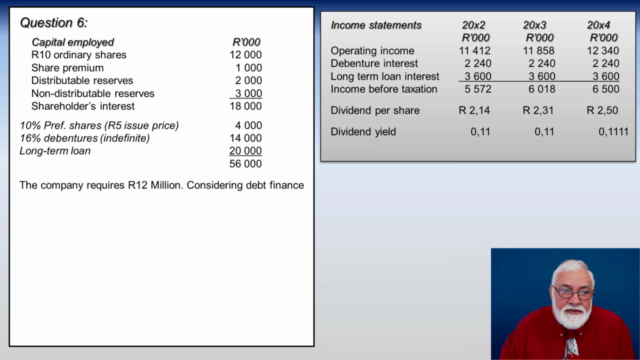

🔹 Financial Risk & Debt Finance: Explore the advantages and disadvantages of using debt finance in your company's capital structure, understanding the implications on financial risk.

-

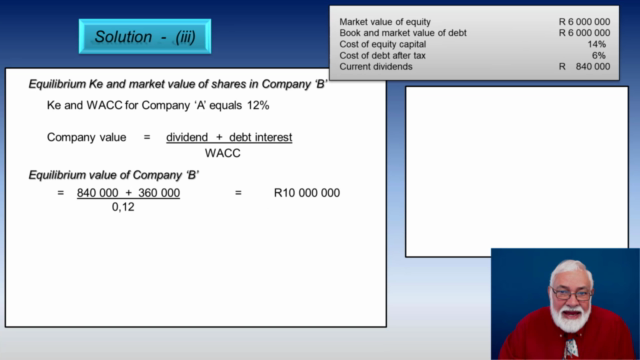

🔹 Weighted Average Cost of Capital (WACC): Dive deep into the meaning of WACC and learn how to compute this critical component of a company's cost of capital.

-

🔹 Theoretical Foundations: Grasp the principles behind both the Traditional theory and the Miller and Modigliani theory, and understand their implications for a company's capital structure.

-

🔹 Equity & Debt Valuation: Learn how to derive the optimal value and required return for both equity and debt within a company's capital structure.

-

🔹 Arbitrage & Shareholder Benefits: Uncover opportunities for shareholders to benefit through arbitrage, ensuring you're thinking critically about financial markets.

-

🔹 Capital Structure Optimization: Derive the optimal capital structure under the Traditional theory and understand how to implement these findings in real-world scenarios.

-

🔹 WACC Calculation: Finally, learn to calculate the Weighted Average Cost of Capital, integrating all the components you've learned into a cohesive model.

📈 Why This Course? In today's competitive business environment, understanding the intricacies of corporate finance is not just beneficial—it's essential. By completing this course, you'll gain:

- A solid grasp of present and future value calculations, which are fundamental to financial planning and analysis.

- Insight into the role and importance of different types of financing in a company's capital structure.

- An understanding of how to calculate WACC, a critical component for evaluating investment opportunities and corporate financing decisions.

- Knowledge of the theories that underpin corporate finance, including the seminal work of Franco Modigliani and Merton Miller.

- The ability to identify and exploit arbitrage opportunities, enhancing your strategic thinking and financial acumen.

📅 Key Takeaways:

- A comprehensive understanding of the tools and models used in corporate finance for valuation, investment evaluation, and decision-making.

- Confidence in applying financial theories and models to real-world business scenarios.

- A competitive edge in your career, whether you're aiming for a role in finance, investment banking, or corporate management.

Enroll now and transform your grasp of finance with "Present Value, Future Value & Capital Structure" – where theory meets practical application! 🌟

Course Gallery

Loading charts...