Practical Oriented Analysis of Financial Statements

Why take this course?

🌟 Course Headline:

🎉 "Practical Oriented Analysis of Financial Statements - A Beginners Course"

🚀 Introduction:

Dive into the world of finance with our comprehensive course, designed for beginners who aspire to decode the language of financial statements. Say goodbye to the intimidating jargon and complex formulas! Our Practical Oriented Analysis of Financial Statements course will guide you through a journey of understanding how each line item impacts the overall health of a business. Get ready to join the ranks of informed investors, analysts, or entrepreneurs who can read between the numbers.

📚 Course Description:

This course is your stepping stone into financial literacy. Practical Oriented Analysis of Financial Statements isn't just about learning the definitions of each element within a financial statement. It's about understanding their significance and how they work in harmony to provide a clear picture of a company's financial health.

🔑 Key Takeaways:

- Foundational Knowledge: Gain an intuitive grasp of balance sheets, income statements, and cash flow statements.

- Real-World Application: Learn with real-world examples, making the abstract concepts tangible and understandable.

- Interactive Learning: Engage with interactive exercises that allow you to apply what you've learned directly to financial statements.

- Analytical Skills: Develop a keen eye for detail and an analytical mindset to discern the quality of earnings, assess liquidity, and evaluate profitability.

- Decision Making: Learn to make informed decisions by understanding the financial narrative behind numbers.

🧠 Course Outline:

-

Introduction to Financial Statements

- Understanding the purpose of financial statements

- Overview of key financial statement elements

-

Balance Sheet Analysis

- Assets: Current vs. Non-Current

- Liabilities: Current vs. Long-Term

- Equity and its significance

- Ratio Analysis: Liquidity, Solvency, and Financial Leverage Ratios

-

Income Statement Deciphering

- Revenue Recognition

- Expense Classification

- Gross vs. Net Profit Margins

- Common-Size Statements for Comparative Analysis

-

Cash Flow Statements Explained

- Operating, Investing, and Financing Activities

- Importance of Cash Flow Management

- Free Cash Flow (FCF) and its relevance

-

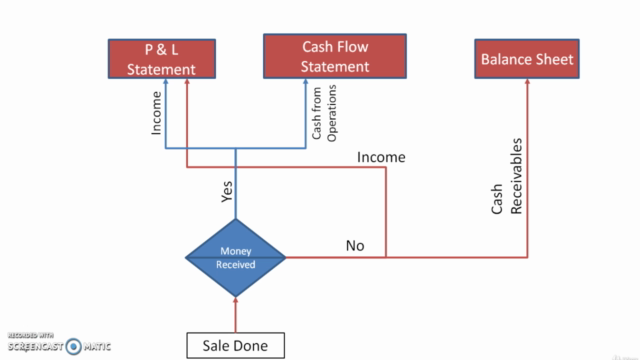

Financial Statement Correlation

- How different financial statements are interrelated

- Cross-statement analysis for a holistic view

-

Case Studies and Real-World Analysis

- Practical application of concepts learned

- Analyzing real companies' financials

-

Final Project:

- A comprehensive analysis of a company's financial statements

- Present your findings and recommendations

🎓 Why Enroll?

- Practical Approach: Tailored for beginners to grasp the practical side of analyzing financial statements.

- Expert Instruction: Learn from Syed Naser Mohiuddin, an experienced instructor with a knack for simplifying complex concepts.

- Engaging Content: Interactive exercises, real-world examples, and case studies make learning enjoyable and effective.

- Flexible Learning: Study at your own pace, anytime, anywhere.

- Community Support: Join a community of learners who support each other's growth and understanding.

📅 Enrollment Details:

Take the first step towards financial fluency today! Enroll now to secure your spot in this transformative course and unlock the potential of financial statements. 🌱

Don't let financial statements intimidate you any longer. With Practical Oriented Analysis of Financial Statements, you'll master the art of interpreting them with confidence! 🎓✨

Course Gallery

Loading charts...