Portfolio Management and the Capital Asset Pricing Model

Why take this course?

🚀 Master Portfolio Management & CAPM with Expert Insights!

🎓 Course Title: Portfolio Management and the Capital Asset Pricing Model (CAPM)

👩🏫 Instructor: Professor Francisco Vigari

Are you ready to dive deep into the world of financial theory and investment strategies? Our comprehensive online course, tailored for students at the undergraduate or postgraduate level in Corporate Finance, offers a rigorous exploration of Portfolio Theory and its practical application through the Capital Asset Pricing Model (CAPM) and the groundbreaking work by Miller and Modigliani.

What You'll Learn:

-

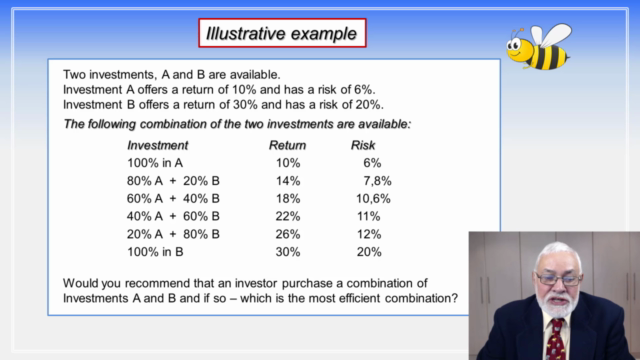

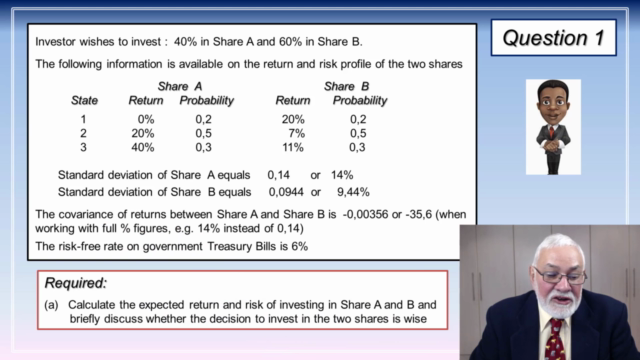

Portfolio Theory & CAPM Model: Gain a solid understanding of how to construct well-diversified investment portfolios, evaluate their risk and expected returns, and apply the CAPM model to real-world scenarios.

-

Graphical Illustration of Portfolios: Learn to graphically represent the combination of two or more investment portfolios, enhancing your ability to visualize and manage risk.

-

Capital Market Line (CML): Discover the derivation and rationale behind the CML, understanding its critical role in portfolio optimization.

-

Diversification & Beta: Explore why diversifying your investments can lower risk and delve into the concept of Beta to assess the riskiness of assets.

-

Security Market Line (SML) vs. Capital Market Line (CML): Understand the nuances between these two lines, their implications for investors, and how to construct the SML.

-

Expected vs. Required Return: Learn to differentiate between expected returns on investment and the required return for investment opportunities.

-

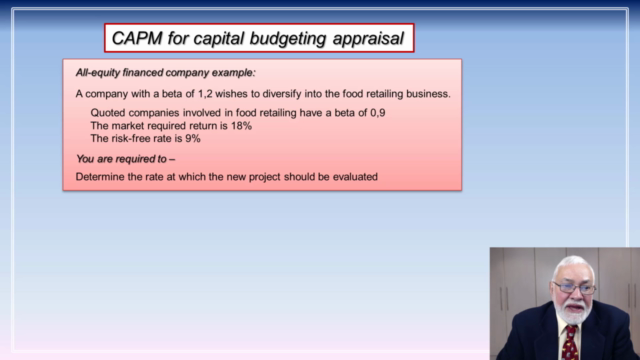

Capital Budgeting & CAPM Limitations: Discuss the limitations of CAPM when it comes to making capital budgeting decisions, and how to navigate these challenges.

Course Breakdown:

📈 Key Modules Covered:

-

Module 1: Introduction to Portfolio Theory

- Understanding the principles of portfolio theory and its importance in finance.

-

Module 2: Diving into CAPM

- Learning the foundational concepts and practical applications of the Capital Asset Pricing Model.

-

Module 3: Miller & Modigliani Contributions

- Analyzing the influential work of Miller and Modigliani on corporate finance theory.

-

Module 4: Portfolio Construction & Risk Assessment

- Constructing portfolios for two projects, calculating their risk and expected return.

-

Module 5: Visualizing Investment Combinations

- Graphically illustrating the combination of two or more portfolios to enhance decision-making.

-

Module 6: Derivation & Rationale of CML

- Explaining why diversification lowers risk and the meaning of Beta within this context.

-

Module 7: CML vs. SML

- Understanding the difference between the Capital Market Line and the Security Market Line.

-

Module 8: Expected Returns & Investment Evaluation

- Constructing the Security Market Line and discussing the distinction between expected and required returns.

-

Module 9: Real-World Applications & Limitations of CAPM

- Discussing the practical applications of CAPM and its limitations, especially in capital budgeting decisions.

Why Take This Course?

By enrolling in this course, you'll not only enhance your understanding of portfolio management and investment theories but also gain practical skills that can be applied to real-world financial decision-making. Whether you're a finance student, a professional looking to expand your knowledge, or simply someone interested in the field, this course will provide you with a strong foundation in modern portfolio theory and its applications.

📅 Enroll Now and take the first step towards becoming a savvy financial analyst equipped with the knowledge of CAPM and portfolio management! 🌟

Course Gallery

Loading charts...