AI-Powered Personalized Credit Card Recommendations

Why take this course?

🌟 Course Title: Personalized Credit Card Recommendations in Banking

🎓 Course Instructor: Educonnhub.com

🚀 Course Headline: Boost Customer Satisfaction and Loyalty with Data-Driven, Personalized Credit Card Recommendations in Banking

Introduction: In the fast-paced world of finance, offering personalized credit card recommendations is crucial for banks and financial institutions to stand out and retain customers. Our comprehensive online course, Personalized Credit Card Recommendations in Banking, is meticulously crafted to meet this demand and transform your approach towards customer satisfaction and loyalty.

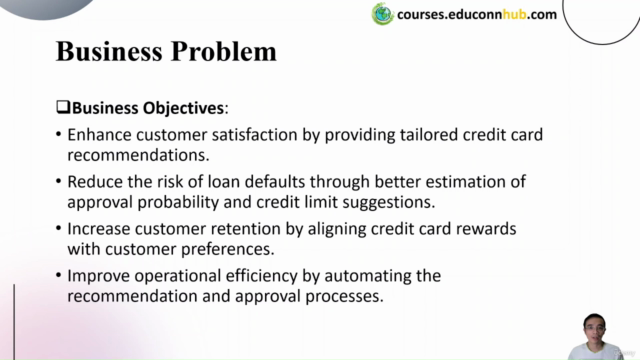

Why Personalization Matters: ✅ Understanding Customer Needs: Learn how personalization is key to understanding and meeting the unique financial needs of each customer. ✅ Crafting Recommendations: Master the art of leveraging customer profiles and transactional data to create tailored credit card recommendations. ✅ Improving Engagement and Loyalty: Explore methods to enhance customer retention by providing relevant credit options that resonate with individual preferences.

Course Breakdown:

- The Essence of Personalization in Banking: Discover why personalized recommendations are a game-changer in the banking sector.

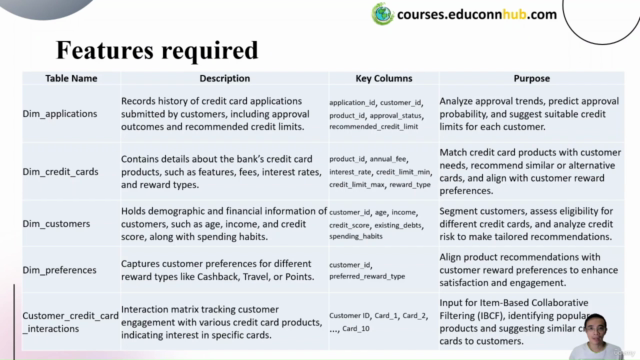

- Challenges in Product Identification: Tackle the hurdles presented when identifying the right products for diverse customer segments.

- Credit History and Spending Habits Analysis: Utilize customer credit histories and spending patterns to predict approval probabilities with precision.

- Risk vs. Satisfaction Balance: Delve into credit limit determination models that keep both customer satisfaction and credit risk in check.

- Reward Optimization: Understand the importance of aligning rewards with customer spending behaviors to foster loyalty and engagement.

Hands-On Learning:

- Apache NiFi Implementation: Get hands-on experience with data flow automation using Apache NiFi for credit card recommendation systems.

- Database Management with MySQL: Learn database management and querying using MySQL to handle complex customer data.

- Machine Learning Techniques: Explore and apply advanced machine learning techniques, such as Random Forest and XGBoost, to predict customer behavior and preferences.

- Building a Recommendation System: Combine all the tools and techniques learned to create a fully automated, data-driven recommendation system.

Course Highlights: 🔥 Real-World Applications: The course is designed with practical scenarios that mirror real-world banking challenges, ensuring you're well-prepared for implementation. 🚀 Cutting-Edge Technologies: Gain knowledge of contemporary technologies and predictive modeling to enhance your technical skill set. 📊 Data-Centric Approach: Learn how to harness the power of data for personalized credit card recommendations, driving customer satisfaction to new heights.

Who Should Take This Course:

- Data Professionals: Expand your expertise in leveraging data for customer-centric solutions.

- Banking Personnel: Acquire the skills to innovate within your institution and contribute to personalized strategies.

- Fintech Enthusiasts: Explore the intersection of finance and technology, and be part of the AI-powered solution revolution in banking.

Conclusion: Enroll now in Personalized Credit Card Recommendations in Banking by Educonnhub.com and unlock the full potential of your data analytics skills. Transform how you approach customer service in banking, build loyalty, and drive satisfaction through personalized experiences tailored to individual needs. 🏦💳✨

By completing this course, you'll not only enhance your professional skill set but also contribute significantly to the financial industry's ongoing innovation journey. Join us today and be at the forefront of data-driven banking solutions!

Course Gallery

Loading charts...