Personal Income Tax in Canada

Why take this course?

🚀 Personal Income Tax in Canada: Good Stuff to Know 🧾

Dive into the Canadian Tax System with Ease!

Whether you're new to filing your taxes or looking to brush up on the latest tax rules, this course is your guide through the complexities of the Canadian income tax system. With a focus on practical knowledge and real-world applications, you'll be equipped with the tools to navigate your personal return more effectively. Remember, while this course provides valuable insights, it's always wise to consult with a professional accountant for tailored advice.

📘 Course Breakdown: What You'll Learn

-

Tax System 101: Get the lowdown on when and how to file your personal tax returns, plus learn which receipts to keep and for how long.

-

Understanding Your Income: From employment earnings to rental and investment income, this course covers it all.

👩💼 Employment Income: Tackle tips, T4s, and job-related expenses with a T2200 form.

💰 Investment Income: Delve into the details of interest, dividends, and capital gains taxation.

☕️ Pension Income: OAS, CPP, RRSPs, and RRIFs demystified. Learn the best time to apply for your pensions and how to maximize your retirement savings.

🏠 Rental Income: Master the tax implications of renting out your property and understand the taxation of selling a cottage.

🧑⚕️ Medical Expenses: Uncover strategies to maximize your medical expense credit and get the most out of your healthcare spending.

💼 Other Credits: Discover how to claim dependants, understand common law status, and find out about tuition credits, as well as fitness and arts tax credits.

📦 Moving Expenses: Learn when you can—and cannot—claim moving expenses and how to handle receipts and carry forward costs.

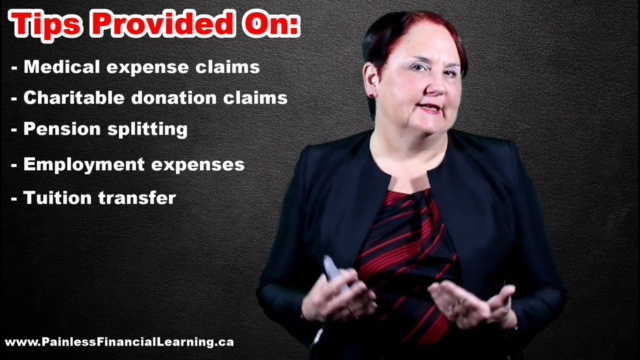

💡 Tips & Tricks: Explore the benefits of pension splitting, transferring tuition credits, and more!

Why Take This Course?

-

Comprehensive Coverage: Each lecture is designed to give you a complete understanding of personal income tax in Canada.

-

Practical Insights: Learn with real-life examples and practical tips that you can apply immediately.

-

Expert Guidance: Gain knowledge from an experienced instructor, Debi Peverill, who will guide you through the complexities of personal taxes.

-

Save Time & Money: By understanding the tax system, you can file your returns with confidence and potentially save on taxes paid.

🎓 Ready to Master Personal Income Tax in Canada?

Enroll in "Personal Income Tax in Canada: Good Stuff to Know" today and transform the way you approach tax season! 🌱

Sign Up Now and start your journey towards becoming a tax pro. Don't forget, knowledge is power—especially when it comes to taxes! Let's get started! 💼💰🚀

Course Gallery

Loading charts...