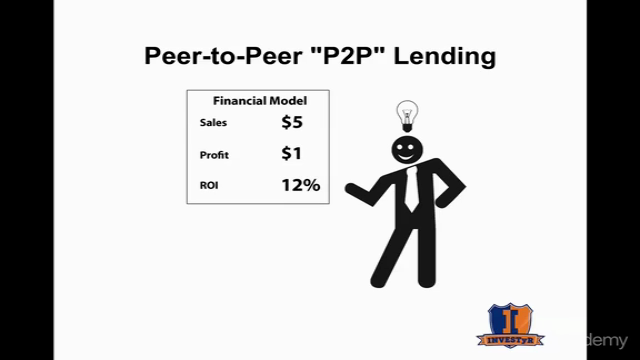

Peer To Peer Lending Revealed

Why take this course?

🚀 Course Title: Peer To Peer Lending Revealed

🎓 Headline: Unlock the Potential of P2P Lending for Short-Term Business Funding!

Introduction to Peer-to-Peer Lending:

Peel back the layers of traditional banking and step into the dynamic world of Peer-to-Peer (P2P) Lending. This innovative financial model directly connects individual borrowers with lenders, streamlining the lending process by removing the need for a bank as an intermediary. 🤝 This not only simplifies transactions but can potentially reduce your funding costs significantly.

Why P2P Lending?

- Direct Connection: Forge a direct link between your business and potential lenders, creating opportunities that might have been out of reach with conventional loans.

- Cost Efficiency: Save on the overhead typically associated with bank loans, making P2P a cost-effective funding alternative.

- Flexibility: Explore different financing options tailored to your unique needs, whether it's for short-term cash flow support or bridging the gap until other investments mature.

Course Highlights:

-

Understanding P2P Lending: Learn the ins and outs of P2P lending, from the basics to advanced strategies.

-

Credit Scores & Collateral: Discover how personal credit scores and collateral still play a critical role in this direct lending process.

-

Strategic Use of P2P Platforms: Explore the potential for using P2P platforms not just for funding but as a tool to grow your network of supporters, including followers, friends, and fans.

-

Real-World Applications: Get practical insights on how you can implement P2P lending into your business strategy. 📈

Key Takeaways:

-

Funding Flexibility: Learn how to leverage P2P lending for different financial scenarios, from short-term needs to long-term investments.

-

Risk Management: Understand the risks associated with P2P lending and learn strategies to mitigate them effectively.

-

Platform Navigation: Gain confidence in choosing the right P2P platform for your funding goals.

-

Regulatory Compliance: Ensure you stay within legal boundaries while engaging in P2P lending activities.

Who Should Enroll?

This course is perfect for entrepreneurs, small business owners, and investors looking to expand their financial literacy and explore alternative funding sources. If your business could benefit from an additional influx of cash, or if you're interested in passive income opportunities through P2P lending, this course will equip you with the knowledge you need.

Enroll Today!

Join the INVESTyR DealTeam and embark on a journey to master the art of Peer-to-Peer Lending. With expert guidance, interactive content, and real-world examples, you'll be ready to navigate this exciting financial landscape. 🎓✨

Don't miss out on this opportunity to diversify your funding options and take charge of your business's financial future. Sign up for "Peer To Peer Lending Revealed" now and start leveraging the power of P2P lending today!

Course Gallery

Loading charts...