Payroll Management

Why take this course?

🌟 Master Payroll Management with Confidence! 🌟

Course Title: Payroll Management

Course Headline: Use Free UK Payroll Software to Perform Essential Payroll Management Tasks

🚀 Course Description:

Get ready to dive into the world of payroll management with our comprehensive online course! This course is meticulously designed to guide you through the essentials of payroll, from understanding legal requirements and processing to using free UK payroll software. Whether you're new to payroll or looking to sharpen your skills, this course will provide you with a solid foundation to manage payroll effectively.

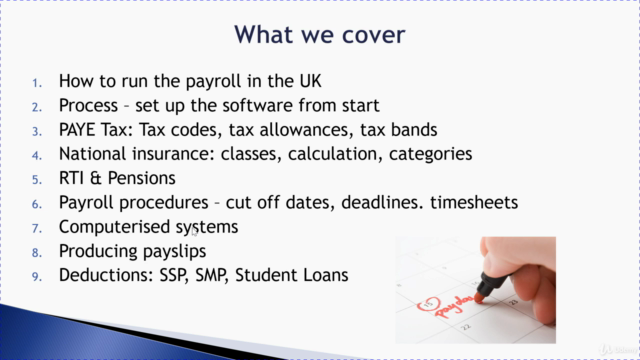

What You Will Learn:

- 📑 Understanding Payroll: The basics, the legalities, and the importance of accurate payroll processing.

- ⚙️ Software Proficiency: Hands-on experience with user-friendly payroll software like BrightPay.

- ✨ Practical Application: Real-life scenarios that you can practice on your own system, reinforced by video tutorials.

- 🤝 Employer Responsibilities: How to register as an employer and comply with HMRC, Student Loans company, and Pensions Regular standards.

- 📈 Calculations & Compliance: Master gross vs net pay, NI, PAYE, cutoff days, attachments of earnings, pensions, and more.

- 📊 Integration with Accounting Software: Learn how to integrate your payroll system with accounting software and understand the reports and journal entries involved.

Course Format & Structure:

- Read & Engage: Start by reading through each module, absorbing the key concepts and requirements of payroll management.

- Watch & Learn: Follow along with our detailed video tutorials to see the processes in action.

- Practice & Apply: Implement what you've learned on your own system, applying the knowledge in a practical setting.

- Revisit & Reinforce: Revisit the videos as needed to solidify your understanding and ensure mastery of each task.

Hands-On Tasks & Assignments:

- Setting up a new starter with their P45 details.

- Calculating opening balances from a previous employer.

- Running payroll for different pay periods: weekly, fortnightly, 4-weekly, or monthly.

- Understanding and applying terms like gross, net, NI, PAYE, and pension contributions.

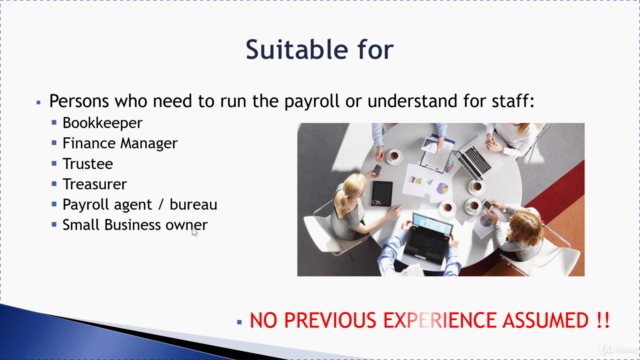

Who This Course is For:

- Entrepreneurs thinking of hiring employees.

- Professionals responsible for managing payroll.

- Individuals seeking to add payroll expertise to their CV.

- Accountants aiming to offer payroll services.

- Business owners wanting to manage their own payroll.

Access to Payroll Software:

You will receive links to access the FREE online version of the payroll software we use throughout the course, which will be sufficient for you to follow along and complete your practical tasks.

Course Materials & Resources:

- A handout outlining your assignment task.

- Instructions on how to access the free payroll software.

Success Criteria:

Upon successful completion of this course, you will achieve a level equivalent to holding a Level 2 certificate in computerised payroll.

Time Investment:

This comprehensive course is designed to take approximately 5 hours to complete, with flexibility to learn at your own pace.

No Previous Experience Required!

This course starts from the ground up, guiding you through the process of becoming an employer and setting up your first payroll, all the way to advanced topics like handling absences, pensions, and year-end processes.

Embark on your journey to mastering payroll management today and transform the way you handle one of the most critical aspects of running a business or managing personnel! 🚀📊✨

Course Gallery

Loading charts...