Options Trading in plain English for beginners

Why take this course?

It looks like you've provided a comprehensive outline for a course on options trading, covering everything from the basics of call and put options to advanced strategies and portfolio management. This course is designed to take traders through a journey where they can learn about options, understand the impact of various market factors, and apply this knowledge to create and manage options strategies effectively.

Here's a brief overview of what each section of the course entails:

- Call Options 101: Understanding the right to purchase an asset at a set price.

- Put Options 101: Understanding the right to sell an asset at a set price.

- Options for Stock Traders: Transitioning from stock trading to options trading.

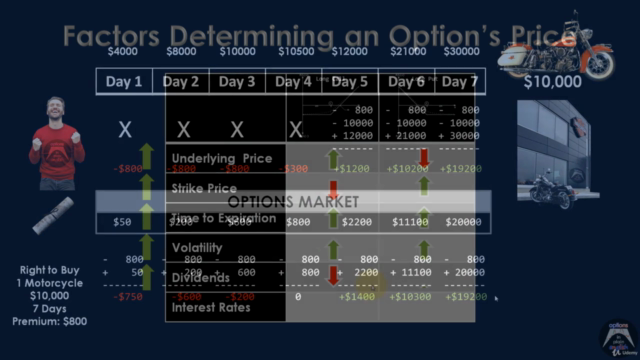

- Basic Option Concepts: Foundational understanding of options, including terms and definitions.

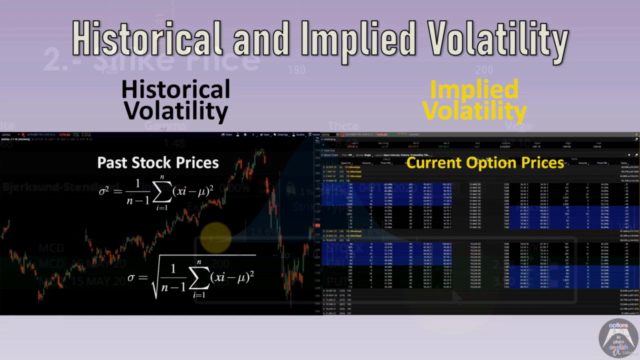

- Volatility: The expected range of price movements for the underlying asset.

- Options Greeks: Delta**: How the option price changes with changes in the underlying asset's price.

- Option Greeks: Theta: How the option price changes with the passage of time.

- Option Greeks: Gamma: How Delta changes as the underlying asset's price changes.

- Option Greeks: Vega: How the option price changes with changes in implied volatility.

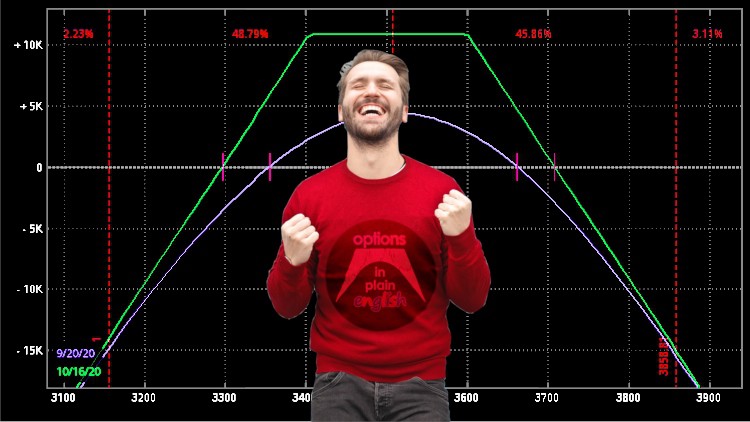

- Getting ready to analyze Options Strategies: Access to a trading platform for practical application. 11-27. Options Strategies: A detailed walkthrough of various options strategies, including long calls and puts, short calls and puts, covered calls, spreads (both vertical and calendar), iron condors and butterflies, strangles, straddles, trading the VIX, advanced concepts, managing dividend risk, adjusting/rolling positions, and portfolio management.

Each section of the course is designed to build upon the previous one, ensuring that by the end of the course, you have a comprehensive understanding of options and how to use them effectively in your trading strategy. The inclusion of quizzes after each section allows for self-assessment and the opportunity to reinforce learning through repetition and practical application.

Remember, options trading can be complex and carries risk. It's important to thoroughly understand each concept before moving on to more advanced strategies. Always use paper trading or a small amount of capital to test your strategies in real-world conditions before committing significant resources.

Lastly, the course emphasizes the importance of understanding the difference between current profit and loss (P/L) and potential expiration P/L, which is crucial for managing positions and expectations effectively.

Course Gallery

Loading charts...