Open Banking

Why take this course?

🏦 Course Title: Open Banking: Unlocking the Future of Digital Financial Services

🎓 Headline: Understanding Open Banking and Digital Banking in the Age of Financial Innovation

Programme Title: Open Banking

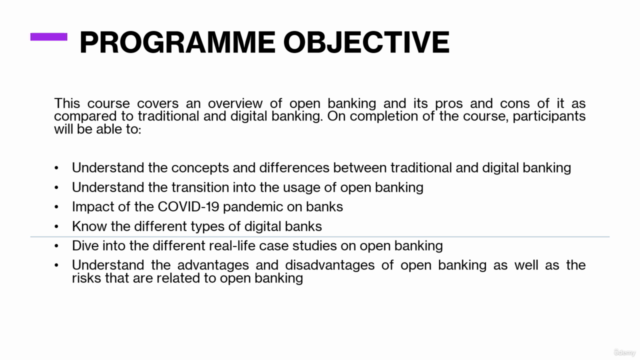

Programme Objective: Dive into the transformative world of open banking, where digital innovation is reshaping the financial landscape. This course is designed to provide you with a comprehensive understanding of how open banking platforms are revolutionizing the industry, offering new avenues for product development, business models, and customer experiences. By the end of this programme, participants will gain insights into the core concepts, enabling technologies, and the broader implications of open banking on financial services across the globe.

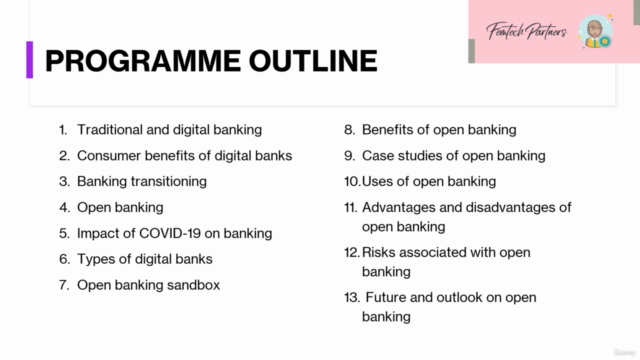

Programme Outline: Upon completion of this course, you will:

- 🔍 Grasp the Basics: Learn the fundamental concepts of open banking and how it differs from traditional banking models.

- 🚀 Explore the Technology: Delve into the technological underpinnings that drive open banking, including APIs, data analytics, and secure data sharing.

- 🏗️ Understand Key Pillars: Examine the essential components that support open banking's infrastructure and functionality.

- 🌐 BaaS vs. Open Banking: Compare and contrast Banking as a Service (BaaS) with open banking, understanding their roles in the evolving financial ecosystem.

- 🏫 Discover Platform Banking: Explore platform banking as a new business model, its advantages, and how it's reshaping the industry.

- 🌍 Assess Impact: Analyze the effects of open banking on financial services and how it is promoting innovation and competition.

- 🤝 Financial Inclusion: Investigate the role of open banking in fostering financial inclusion in various economies.

- 🛡️ Risk Awareness: Identify and understand the potential risks associated with open banking.

- 🌍 Global Perspectives: Gain insights into how different regions, such as Singapore, Asia, and Europe, are embracing open banking.

Training Methodology: Engage in a dynamic learning environment through:

- Live Webinar sessions featuring interactive theory, thought-provoking polls, enlightening case studies, and stimulating group discussions.

- Multimedia sharing to enhance understanding and retention of key concepts.

Intended For: This course is meticulously crafted for:

- Banking Professionals looking to stay ahead of the curve.

- CEOs and Finance Managers aiming to navigate the new banking landscape.

- Consultants, Strategists, and Financial Regulators seeking to understand the regulatory implications.

- Risk Officers focused on managing open banking risks effectively.

- Heads of Start-Ups and FinTech Professionals eager to explore new opportunities in the digital banking space.

Whether you're a seasoned expert or new to the field, this course is designed to equip you with valuable insights into the burgeoning world of open banking. Join us to unlock the full potential of digital financial services! 🌟

Course Gallery

Loading charts...