Online Bookkeeping, VAT and Payroll Training

Why take this course?

🌟 Unlock Your Potential in Accountancy with Our Expert-Led Online Course! 🌟

Your Journey to Mastering Bookkeeping, VAT, and Payroll Begins Here!

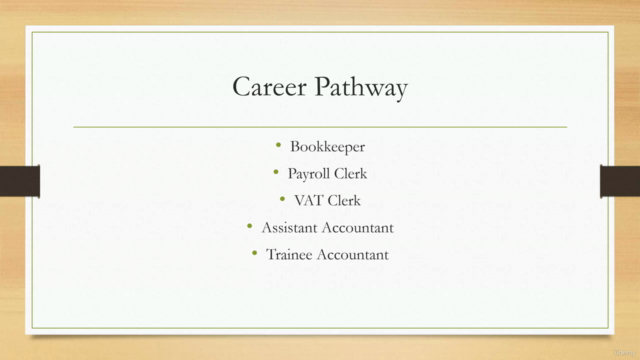

Are you aspiring to kickstart a thriving career in the world of accountancy? Or perhaps you're looking to enhance your existing skills? Our Online Bookkeeping, VAT, and Payroll Training Course is meticulously designed for individuals like you who are eager to delve into the core aspects of financial management. 📊

Course Overview:

- Accredited Training: As an ACCA approved Chartered accountancy firm, we promise top-tier training in accountancy, supported by a robust recruitment facility.

- Comprehensive Curriculum: Our course covers the essentials for Bookkeeping and Payroll positions, ensuring you're well-versed in all job requirements.

- Certification & Reference: Upon completion, you will receive a training certificate and a work experience reference letter to bolster your professional profile.

Software Mastery:

Our course equips you with hands-on experience across the most sought-after software in the industry:

- IRIS Payroll 📋

- QuickBooks 💼

- Bright Pay Payroll 💰

- Xero 🌐

- VAT 123 Sheets 💲

In-Depth Training Modules:

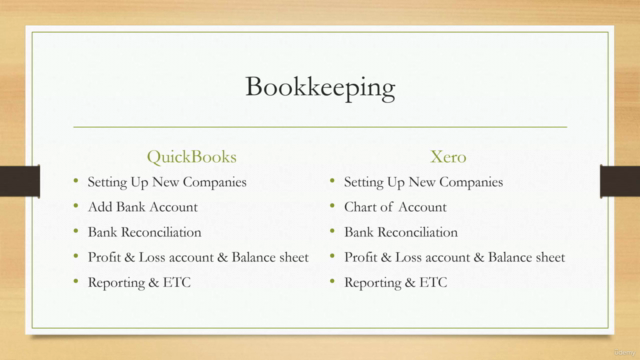

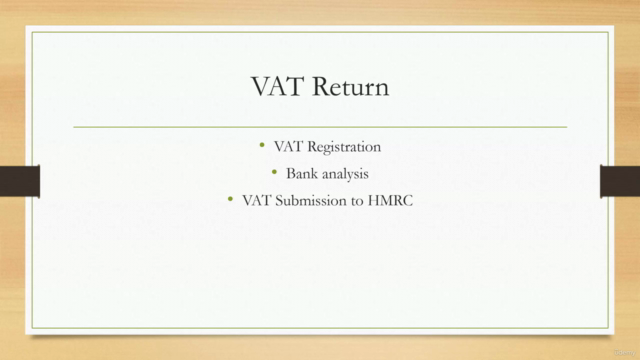

Bookkeeping and VAT (QuickBooks & Xero)

- Choosing and customizing the chart of accounts.

- Applying double-entry accounting principles in software.

- Customizing nominal ledger and nominal codes.

- Maintaining sales and purchase ledgers.

- Processing invoices and credit notes for customers and suppliers.

- Generating reports like aged debtors and creditors.

- Allocating cash transactions.

- Year-end procedures and much more!

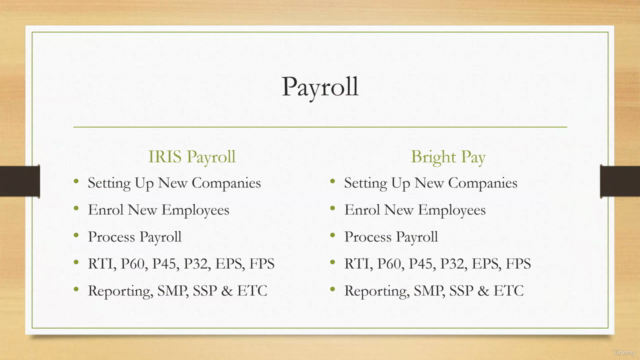

Payroll (IRIS, QuickBooks & Xero)

- Adding employees to payroll software.

- Creating and managing pay elements.

- Understanding year-to-date values and processing payments.

- Generating payslips and statutory payment calculations.

- Managing employee absences and recording leaves.

- End-of-year procedures and issuing forms P45 & P60.

- Real-time information (RTI), Full Payment Submission (FPS), and Employer Payment Summary (EPS) submissions to HMRC.

Why Choose This Course?

- Expert Training: Learn from qualified accountants through practical online training sessions.

- Flexibility: Study at your own pace, choosing the day and time that suits you best.

- Certification: Earn official QuickBooks and Xero certifications to set your career apart.

- Career Support: Benefit from professional CV and interview preparation services.

- References & PER: Receive a professional reference to present to employers and support with ACCA/AAT/CIMA PER.

Join our community of successful accountants! With our comprehensive online course, you'll gain the skills, confidence, and qualifications needed to excel in the dynamic field of accountancy. 🚀

Enroll now and take a significant step towards your dream career in finance! 💼💡

Course Gallery

Loading charts...