Multiples Valuation: Theory and Practice

Why take this course?

🚀 Course Title: Master Multiples Valuation: Theory and Practice

🔥 Headline: Unlock the Secrets of Company Valuation with Expert Multiples Valuation Techniques!

📘 Course Description:

Welcome to the definitive course for mastering multiples valuation, a critical skill for investment bankers, financial analysts, and finance professionals worldwide. In this comprehensive guide, we delve into the art of assessing a company's value through the lens of market comparables, which is not only a powerful tool but also an essential part of any financial analysis.

Why Multiples Valuation?

- Practical Framework: Learn how to apply multiples valuation in real-world scenarios, providing you with a versatile skill set that can be applied across various industries.

- Blending Theory and Practice: This course is meticulously designed to not only teach you the theoretical underpinnings of relative valuation but also to provide hands-on experience that will solidify your understanding.

Course Structure:

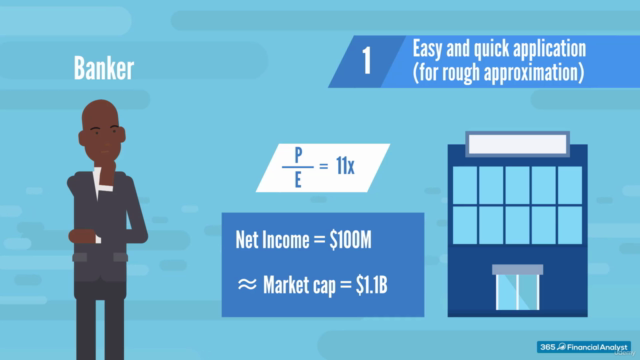

- Introduction to Relative Valuation: We begin with the basics, covering the fundamental assumptions and principles underlying relative valuation methods.

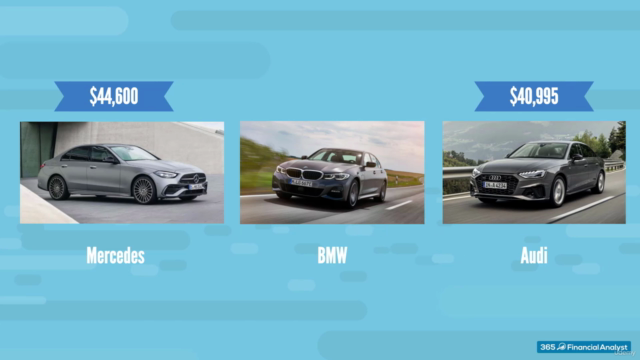

- Understanding Different Multiples: Get up close and personal with various valuation multiples, learning how to interpret trading multiples versus transactional multiples, and when to use each type.

- Key Principles in Relative Valuation: Master the best practices that ensure your company valuations are both accurate and compliant with industry standards.

- (Case Study) Valuing Volkswagen Using Multiples Valuation: A step-by-step walkthrough of a real-world example, highlighting the intricacies and complexities of applying multiples in practice.

- Balancing Precision and Efficiency: Discover how to achieve optimal accuracy in your valuations without overextending your research efforts.

- Complementary DCF Analysis: Learn how to integrate the findings from multiples valuation with the DCF method for a comprehensive analysis.

Who Is This Course For?

- Aspiring Investment Bankers and Analysts: Kickstart your finance career with a skill set that opens doors in competitive banking sectors.

- Seasoned Professionals: Expand your expertise and stay ahead of the curve in an ever-evolving industry.

- Entrepreneurs and Business Owners: Make informed decisions about buying, selling, or scaling your business with accurate valuations.

🎓 Take the Next Step: If you're ready to elevate your financial analysis skills and enhance your career opportunities, enroll in "Master Multiples Valuation: Theory and Practice" today! Dive into a world where theory meets practice, and transform your approach to company valuations.

Enroll now and join a community of forward-thinking professionals who are redefining the landscape of financial analysis. 🌟

See you inside the course, where we'll embark on this enriching learning journey together! Your future self will thank you for taking this step towards mastery in multiples valuation. Let's get started!

Course Gallery

Loading charts...