Stock Trading Momentum Based Strategies (Technical Analysis)

Why take this course?

🚀 Course Title: Stock Trading Momentum Based Strategies (Technical Analysis)

🎓 Course Headline: Learn To Trade Multiple Technical Analysis Strategies with Advanced Tools and Complete Case Studies for Stock Trading!

Welcome to the OEdTech Alumni Club! 🌍✨ As a member upon enrolling, you'll gain exclusive access to:

- A vibrant Q&A Section where you can ask any question and get expert advice.

- Discounts on our other courses, keeping your learning journey cost-effective and continuous.

- Exclusive Live Streams to enhance your learning experience with real-time insights.

📈 Dive Deep into Momentum Trading: This course focuses on momentum oscillators that measure the speed and direction of price movements, giving you a powerful edge in trading stocks.

Key Takeaways & Course Structure:

-

Understanding Momentum Oscillators: We'll explore how these indicators can be used to identify potential reversals, divergences, and optimal entry points for both buying and selling.

-

Top 5 Advanced Indicators: Master the art of using:

- Relative Strength Index (RSI)

- Stochastic Oscillator

- William %R

- True Strength Index (TSI)

- Money Flow Index (MFL)

-

These indicators are not just theory; they're a complete system for trading, as used by professional traders worldwide.

Unlock the Secrets of Momentum Trading:

- Relative Strength Index (RSI): Learn how to use this popular momentum indicator to identify overbought and oversold conditions in the market.

- Stochastic Oscillator: Discover this versatile tool that helps in pinpointing potential breakouts and consolidation phases.

- William %R: Understand this oscillator that measures the speed of price movements and its relationship to historical and future price movements.

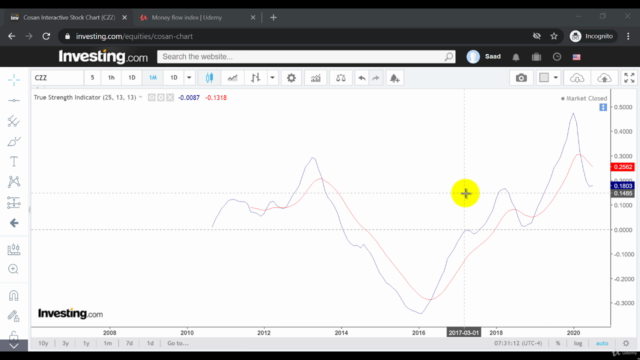

- True Strength Index (TSI): Explore an alternative to RSI which may provide more precise signals for market trend reversals.

- Money Flow Index (MFL): See how this volume-weighted momentum indicator can give you a better understanding of the strength behind price movements.

Why Choose This Course?

- Practical Application: We'll teach you how to apply these indicators in real-world trading scenarios, giving you a solid foundation for making informed decisions.

- Advanced Techniques: You'll learn advanced techniques that turn these indicators into a powerful tool for day trading or analyzing over specific timeframes like daily or weekly charts.

- Complete Case Studies: Gain insights from real market scenarios where these momentum-based strategies were successfully applied.

Join us on this journey to master momentum-based strategies in stock trading. With the knowledge and tools you'll gain from this course, you'll be equipped to trade confidently and make smarter investment decisions. Enroll now and become a pro at technical analysis! 📊💰

Course Gallery

Loading charts...