Practical Accounts Training A

Why take this course?

📚 Practical Accounts Training: Master Software to Manage & Record 80 Document Types, Interpret 15 Period Reports 🚀

Course Overview:

This comprehensive course is designed with the robust Practice Procedures used in accounting firms. It's an ideal platform for newly qualified accountants looking to gain a competitive edge in the job market, as well as seasoned professionals seeking to enhance their skill set.

What You Will Learn:

🚀 Understanding of Accounting Software: Gain a solid understanding of how accounting software functions in various environments, from mobile to desktop applications.

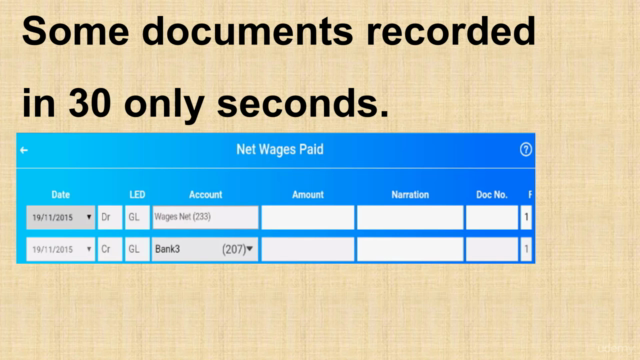

🕒 Time-Saving Training: The course significantly reduces the time required for training by automating the recording of 80 document types and 15 period reports.

📈 Practical & Technical Knowledge: Acquire a blend of practical and technical knowledge essential for modern accounting practices.

Course Components:

- 📱 Mobile & Computerised Accounting: Access to a Practical Accounts Training SW available on Google Play & App Store, bought separately.

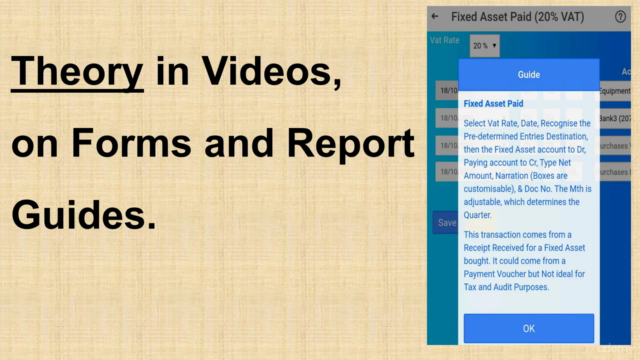

- Recorded Videos: Step-by-step guides and in-depth explanations for complex concepts.

- On Screen Guides: Visual aids to complement the learning experience.

- Live Online Lectures: Interactive sessions with instructors for real-time questions and clarifications.

- Practice Documents: Hands-on materials for practical application of skills learned.

- Checklists: Tools like a 34 Periodic Tasks Checklist & a Year End Reports Checklist to ensure comprehensive coverage of tasks.

- Sample Reports: 90 period reports and year-end reports for reference and practice.

Course Content Highlights:

The course covers a wide range of topics, including:

- Objectives and App Overview

- Tax Return and Chart of Accounts (COA)

- Recording Basics

- Starting Features and Settings

- Miscellaneous Facilities

- Recording Receipts & Refunds

- Purchases & Refunds Recording

- Fixed Assets Recording

- Payments Recording

- Loans & Credit Card Recording

- Creditors Facilities

- Debtors Facilities

- Opening & Pre-VAT Recording

- Post VAT & Reconciliation

- Period Reports including a VAT Return

Skills You Will Acquire:

On completion of this course, trainees will be able to:

- 📁 Identify and Interpret 80 types of business documents.

- Record 80 types of Transactions.

- Identify and Interpret 15 Periodic Reports.

- Verify & Reconcile 15 Periodic Reports.

- Present and Explain 15 Periodic Reports.

- Develop a deeper appreciation and understanding of accounting.

This course is your gateway to becoming an efficient and effective accounting professional, adept at handling diverse accounting tasks with confidence and precision. Enroll now and take the first step towards mastering accounting software and transforming your career! 🎓💪

Course Gallery

Loading charts...