Mathematical Finance with Python : Theory and Practice

Why take this course?

🧮 Mathematical Finance with Python: Theory and Practice 📊

Course Headline: Dive into the world of financial quantification with Python coding from scratch, master the Black-Scholes model building, navigate through Monte-Carlo simulations, harness the power of Machine Learning, and understand the intricacies of Technical Analysis.

Course Description:

This course is a comprehensive journey into the heart of Quantitative Finance, meticulously tailored to blend Python programming with advanced Mathematical Modelling and Financial Applications. It is divided into four distinct parts that cater to both theoretical understanding and practical application, ensuring a robust learning experience. 🎓

Part One: Python Programming Essentials 🚀

- Python Fundamentals: Dive into the basics of Python, including printing, data types, and control structures like branching and iteration.

- Data Structures: Explore tuples and understand mutability, delve into functions, master recursion, and get to grips with classes and object-oriented programming concepts.

- Capstone Project: Conclude the part by constructing a financial model to calculate mortgage payments, applying your newfound Python skills in a real-world scenario.

Part Two: Python and Mathematics for Finance 📈

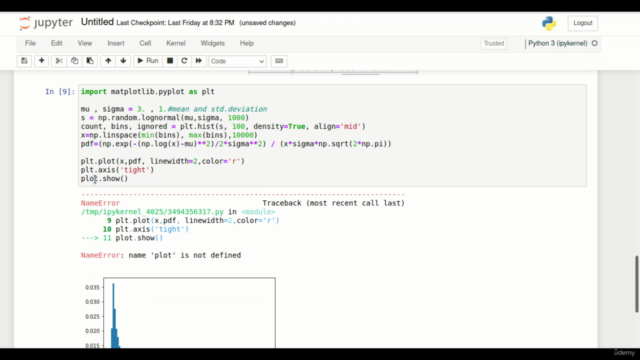

- Core Mathematical Concepts: Gain a deep understanding of exponential functions, logarithmic functions, and Log-normal distributions – the cornerstones of financial mathematics.

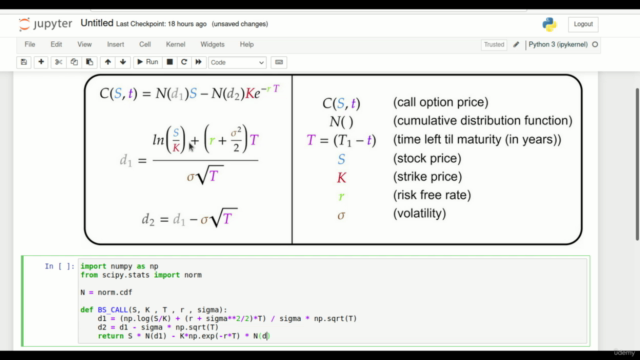

- Financial Modelling with Python: Translate theoretical concepts into practice with hands-on lab sessions, using Python to model options using the Black-Scholes Model and valuating bond instruments.

- Special Focus: Discover how to model Options Greeks, providing a comprehensive view of the factors affecting option prices.

Part Three: Stochastic Modelling for Finance 💫

- Foundations of Stochastic Finance: Establish a strong foundation in stochastic finance and learn the key concepts that are critical in quantitative finance.

- Monte Carlo Simulation Techniques: Engage with an exhaustive exploration of Monte Carlo simulations, applying these techniques to estimate stock prices and options prices.

- Advanced Stochastic Models: Analyze Random Walk Modelling, simulate Geometric Brownian processes, and calculate Pi using Monte Carlo Simulations – all within the context of finance.

Part Four: Machine Learning for Finance 🧠

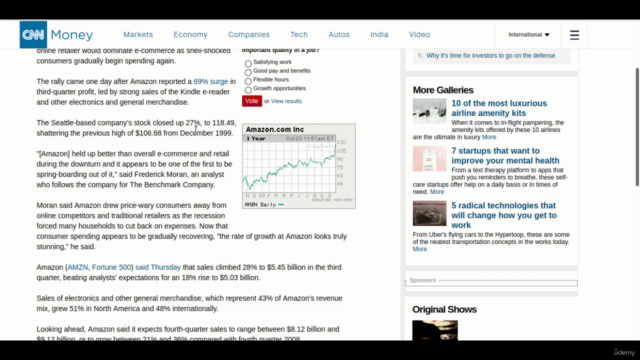

- Technical Analysis: Learn to interpret candlestick charts, OHLC (Open-High-Low-Close) data, and apply these techniques to predict stock price movements.

- Advanced Machine Learning Algorithms: Utilize cutting-edge machine learning algorithms for stock prediction and real-time market research.

- Real-World Application: Integrate your theoretical knowledge with practical tools and techniques to navigate the complexities of modern finance.

Course USP (Unique Selling Proposition): Each concept is explained in a clear, whiteboard-style manner followed by immediate hands-on lab sessions. This unique pedagogical approach ensures that students not only grasp the theoretical aspects but also understand how to apply them using Python coding. 🎨➡️🚀

By the end of this course, students will have a solid understanding of the mathematics behind finance and the ability to implement these concepts in Python, building their own models from scratch. They will gain practical skills that are highly sought after in the field of Quantitative Finance. 🏦💪

Enroll now and embark on a journey to master Mathematical Finance with Python – where theory meets practice, and learning becomes an adventure!

Course Gallery

Loading charts...