Reversal Candlestick Trading Strategy - Forex/Stock Trading

Why take this course?

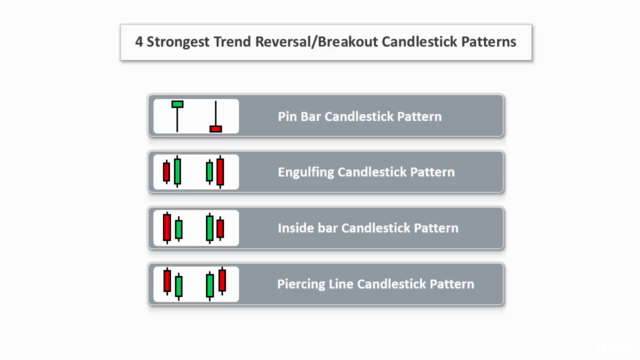

It seems you've provided a comprehensive overview of a course focused on trading forex and stocks using four specific candlestick patterns: Pin bars, Engulfing patterns, Inside bars, and the Piercing Line (with its bearish counterpart, the Dark Cloud Cover). The course emphasizes the importance of understanding not just the structure of these patterns but also their context within market sentiment, proper trade entry positioning, setting stop losses, targeting profits, and filtering out invalid trades.

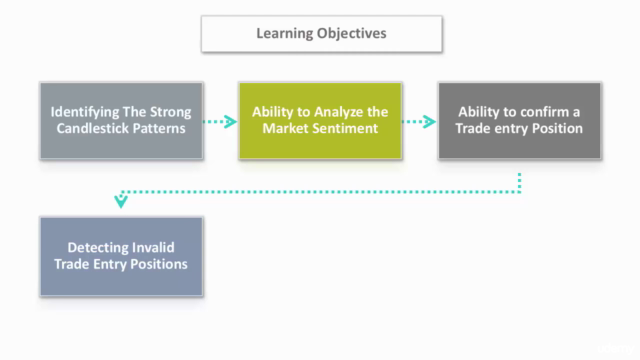

The key points of this course are:

- Selectivity: Focus on a limited number of candlestick patterns that are most effective for trend reversals rather than trying to master every pattern.

- Timeframe Independence: These patterns can be applied across various timeframes, from scalping to daily charts.

- Indicator-Free Trading: The course advocates for a pure price action approach without the reliance on technical indicators.

- Market Sentiment Awareness: Recognizing whether a candlestick pattern indicates a trend reversal or continuation is crucial.

- Risk and Reward Management: Understanding how to set stop losses and target profits effectively to maximize the potential for consistent profits while minimizing losses.

This course is designed for traders who are looking to refine their skills and strategies, particularly those interested in price action trading without the use of complex indicators. It aims to empower traders with the knowledge to identify high-probability trade setups and to trade both forex and stocks with confidence.

If you're interested in learning more about these candlestick patterns or improving your trading strategies, this course could be a valuable resource. Remember that in trading, education and continuous practice are key to developing a consistent approach that works for you and adapts to market conditions.

Course Gallery

Loading charts...

Comidoc Review

Our Verdict

Reversal Candlestick Trading Strategy - Forex/Stock Trading offers a solid introduction to candlestick formations for swing, day trading or cryptocurrency. The course excels at delivering theoretical knowledge, presented in an easy-to-understand manner by Syed Rahman who adds real-world insights. However, students may benefit from more practical examples and instruction on avoiding false signals. Consider supplementing this course with additional resources or expert guidance focusing specifically on those objectives.

What We Liked

- Comprehensive coverage of reversal candlestick patterns, their behavior, and trading psychology.

- Syed Rahman's step-by-step explanations help visualize graph formations in real-time situations.

- Instills a strong foundation for trend analysis, traders' sentiment reading, and trade entry positioning.

- Updated as recently as 2024, ensuring the content remains relevant for learners.

Potential Drawbacks

- Lacks hands-on coursework or projects to apply learned concepts in real-world scenarios.

- The absence of clear differentiation between suitable charts (e.g., 4H or Daily) can lead to confusion.

- Limited focus on the application of distinct reversal candlestick patterns in real charts.

- Does not adequately address avoiding false signals and fake out situations.