Machine Hour Rate

Why take this course?

🌟 Machine Hour Rate - Cost Accounting 🌟

Course Description:

What is the Machine Hour Rate?

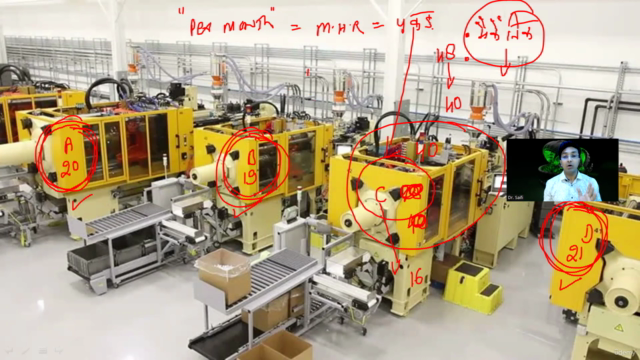

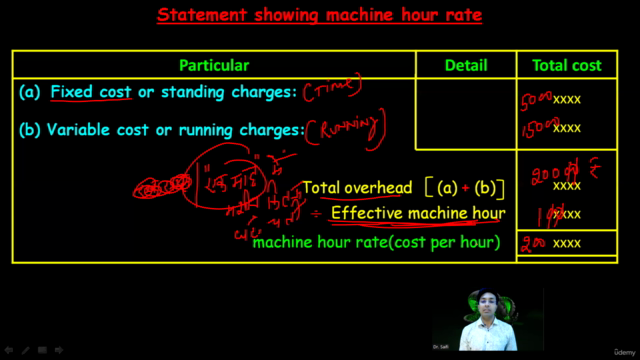

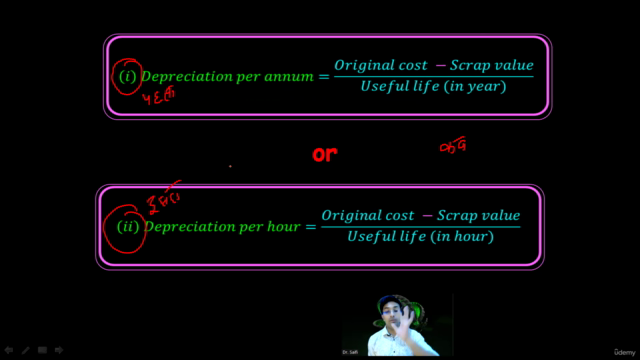

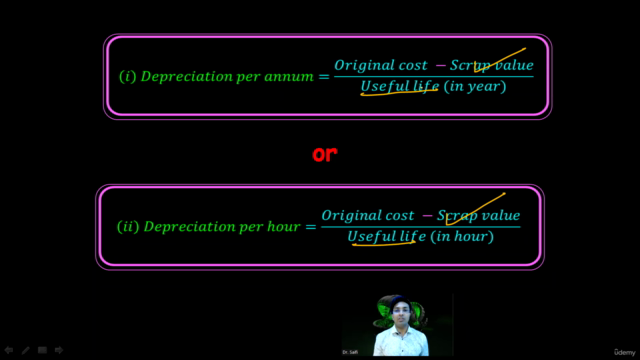

Machine Hour Rate (MHR) is a critical concept in cost accounting, representing the cost of operating machinery per hour. It's a scientific approach to managing machine usage and costs, especially useful in businesses that rely heavily on machines for production.

Advantages/Merits of Machine Hour Rate:

- 🏫 Scientific Method: Ideal for industries with significant machine usage, providing a systematic approach to cost tracking.

- 📊 Fixed vs Variable Expenses: Helps in classifying costs into fixed and variable expenses, which is essential for accurate financial planning.

- 🔍 Efficiency Measurement: Offers insights into the efficiency of machines by analyzing the cost incurred against the production output.

- 📈 Estimation Facility: Enhances the accuracy in estimating future costs and savings.

- ⚖️ Machine vs Manual Work: Assists in comparing the productivity and costs between machine operations and manual labor.

Disadvantages/Demerits of Machine Hour Rate:

- 🤝 Not Suitable for Labour Intensive Processes: Less effective in industries where human labor is the primary cost driver.

- ✏️ More Calculation Work: Requires meticulous calculation and record-keeping, which can be time-consuming.

- 🧐 Difficulty in Apportionment: Some operational costs may be challenging to allocate accurately between machines and other overheads.

Understanding Machine Hour Rate in Financial Statements:

Learn how to calculate and present the machine hour rate in financial statements, ensuring clarity and accuracy.

Practical Questions for Practice:

A set of practical questions designed to test your understanding of MHR and its application in various scenarios.

Meaning of Cost Accounting:

Cost accounting is the branch of accounting that measures and analyzes the costs associated with production. It's a detailed process involving the systematic recording, classification, accumulation, and analysis of all costs incurred by a company during the production of goods or services.

Difference between Financial Accounting and Cost Accounting:

- Financial accounting focuses on the financial statements (like balance sheets and income statements) for external users.

- Cost accounting provides detailed cost data for internal decision-making purposes.

Characteristics of Cost Accounting:

- 🔬 Scientific System: Employs a systematic approach to record, analyze, and allocate costs.

- 🎨 Integral Part of Accounting: An essential tool in the accounting framework.

- 🤔 Both Science & Art: Combines quantitative data with qualitative judgment.

- 💰 Recording & Ascertaining Costs: Records all types of costs and determines per unit or total costs.

- 📊 Use in Manufacturing, Commercial Enterprises: Applicable across a variety of business operations.

- 🚀 Managerial Decisions: Aids managers in decision-making processes.

- 📈 Cost Accounting is Scientific: It follows a well-defined methodology.

Objects of Cost Accounting:

To assist in the control and management of costs, to provide accurate cost information for internal decisions, and to aid in pricing products competitively.

Advantages or Importance of Cost Accounting:

- 🧑🤝🧑 To the Producer & Manager: Helps in cost control, profit planning, and budgetary purposes.

- ⚗️ To the Employee: Ensures proper wage determination and incentive schemes.

- 🏷️ To the Consumer and Society: Leads to products priced fairly and helps in maintaining market stability.

- 💰 To Creditors & Investors: Provides a clear picture of financial health, reducing investment risk.

- ⚖️ To the Government: Aids in taxation, economic planning, and regulatory compliance.

Different Methods of Cost Accounting:

Cost accounting methods vary widely, from direct costs to indirect costs, and include:

- 🏗️ Total Costs: All expenditures incurred to produce a product or render a service.

- 🛠️ Elements of Cost: Direct Material, Direct Labour, and Direct Expenses; Indirect Material, Indirect Labour, and Indirect Expenses.

- 🌍 Overhead: Encompasses Factory Overhead, Office Overhead, Selling Overhead, and Distribution Overhead.

Join our online course led by Dr. Mohd Saifi Anwar to master the intricacies of Machine Hour Rate and Cost Accounting. With a comprehensive curriculum and practical examples, you'll gain the skills necessary to apply these principles effectively in your organization.

Enroll now and take the first step towards becoming a cost accounting expert! 🚀

Course Gallery

Loading charts...