M&A and Restructurings for Entrepreneurs and Advisors

Why take this course?

🌟 Course Title: Investment Banking Secrets: How to Sell Your Business, Sell-Side Mergers and Acquisitions Perspective 🌟

Course Description:

Why Now? In the wake of global challenges such as the Covid-19 pandemic, the Big Resignation, geopolitical conflicts like the war in Ukraine, and shifts in global supply chains and prices—change is the only constant. These events have set the stage for a significant uptick in mergers and acquisitions (M&A) activity. As an entrepreneur or advisor, understanding the intricacies of M&A and restructurings has never been more critical. This course is your compass in navigating these complex waters.

Course Overview:

Understanding the Entrepreneurial Challenge:

- Ideal Business Avatar: Learn how to prepare your company for sale, beyond just "cleaning the books." We'll explore enhancing your branding, sales strategy, and creating a strong administrative infrastructure that can thrive independently of you. 🎯

- Improving Performance: Get practical tips on boosting sales and optimizing costs to ensure your financials stand out. 🚀

Mastering Valuation:

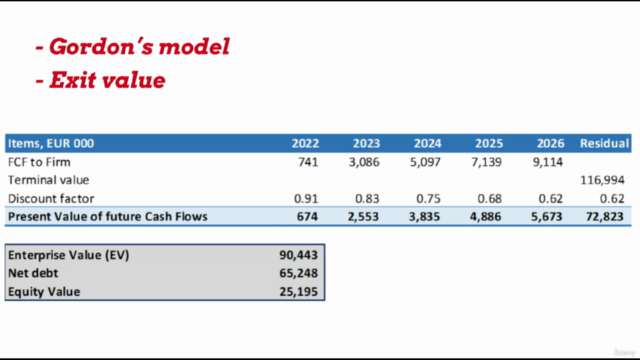

- Assets-Based, Market-Based, and Income-Based Valuations: Dive into the different methods of valuing your business, including an in-depth look at Discounted Cash Flows (DCF). 💸

- Defending Your Number: Learn how to justify your business valuation and decide whether to sell as a whole or in parts. 🧮

Navigating the M&A Process:

- Document Preparation to Closing: From marketing your business to surviving due diligence, we'll cover all aspects of an M&A deal. 🖨️

- Post-Closing Considerations: Understand potential price adjustments, earn-out agreements, and Contingent Value Rights to protect yourself in stock deals. 📄

Insights from Restructurings:

- Divestitures, Spin-Offs, and More: Gain knowledge on various restructuring methods like equity carve-outs, voluntary liquidations, and other strategic options. 🔄

Course Benefits:

- Practical Strategies: This course is packed with actionable strategies and tricks to streamline your M&A process.

- Confidence in Decision Making: You'll gain the confidence that you're making the right decisions at each step of the way.

- Risk Mitigation: Learn how to protect yourself legally, financially, and operationally during the sale process.

- Tailored for Entrepreneurs and Advisors: Whether you're selling your business or advising a client, this course is designed to provide valuable insights.

What You Will Learn:

- How to make your company more attractive to potential buyers

- Various methods to value your business and defend that number

- The intricacies of structuring an M&A deal, from preparation to closing

- Key considerations in post-closing adjustments and agreements

- A variety of restructuring options to consider for your business

Why Choose This Course?

This course stands out due to its comprehensive coverage of the M&A process with a focus on practicality. It's not just about learning theory; it's about gaining real-world skills that you can apply immediately. Plus, with Udemy's 30-day money-back guarantee, there's no risk in investing in your education and future.

Enroll Now and Transform Your Approach to M&A!

Don't miss out on this opportunity to master the art of mergers and acquisitions. Whether you're an entrepreneur considering a sale or an advisor guiding clients through the process, this course is your key to unlocking the potential of investment banking. 🗝️

See you inside the course—let's navigate the M&A landscape together!

Best regards, Boris J. Fontezca 🚀✨

Enjoy the journey and the knowledge that awaits you in this comprehensive guide to M&A success! 🎉

Course Gallery

Loading charts...