Reduci La Deuda en el Hogar de Manera Facil.

Why take this course?

🌟 Reduce Your Home Debt Effortlessly: A Step-by-Step Guide 🌟

Course Title: Reduci La Deuda en el Hogar de Manera Facil 🚀

Course Description: Are you struggling to manage your household finances and find yourself overwhelmed by debt? Vanesa Leyes is here to guide you through a simple, yet effective strategy to Efficiently Reduce Your Expenses using the Pareto Principle (80/20 rule). This course is designed for those who wish to cut down on their spending without the need for additional work. 💡

Here's what you'll learn:

-

Understand Your Spending: Identify your expenses by category and pinpoint the highest-cost areas where you can make significant savings. 🧐

-

Prioritize Your Savings: Focus on reducing the high-cost categories using your savings to make a tangible impact. 💸

-

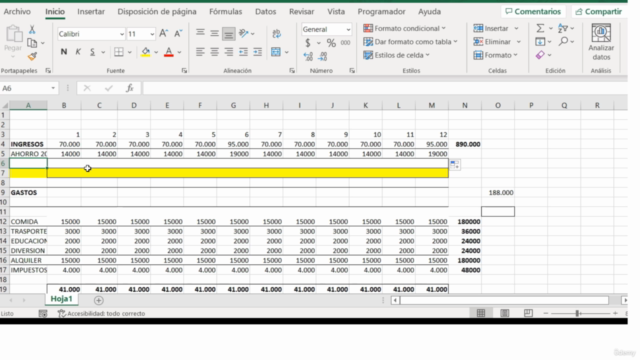

Achieve Consistent Savings: Learn how to save a percentage of your income every month and apply those savings to further reduce your expenses. 📈

-

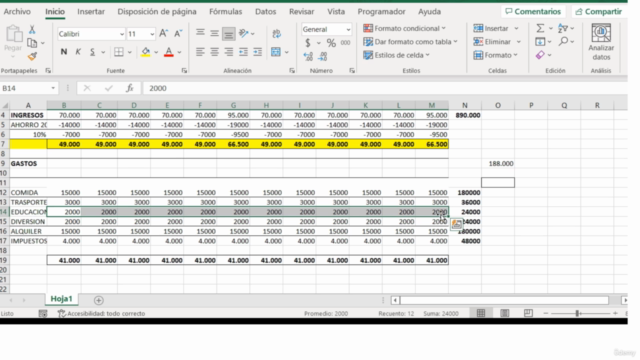

Reduce High-Cost Categories: Use your savings to diminish the categories that have the highest impact on your budget by up to 80%. 💫

-

Plan for the Future: Learn how to anticipate future expenses and make plans to avoid falling back into debt. 📅

Course Structure: This course is structured into 5 comprehensive classes, each designed to build upon the previous one:

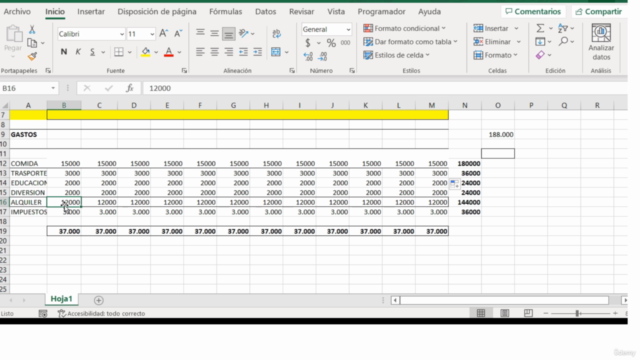

1️⃣ Class 1 - Identifying High-Cost Categories: Learn how to track and identify where your money is going. This may take a month or less if you already have this information, otherwise, you can optimize it by measuring and recording another month's expenses.

2️⃫ Class 2 - Designing Your Paydown Plan: Create a strategic plan to tackle those high-cost categories and adjust the rest of your budget for maximum efficiency.

3️⃣ Class 3 - Rewarding Yourself as an Administrator: Learn how to compensate yourself as you manage your finances effectively, rewarding your performance as the administrator of your own financial success.

4️⃣ Class 4 - Financing Without Credit Cards: Discover ways to use your savings to finance your needs, making you your own bank.

5️⃫ Class 5 - Planning for Imprevistos and Avoiding Future Debt: Understand how to prepare for unexpected expenses and strategies to prevent falling back into debt.

Your Participation Matters: After completing the course, we encourage you to leave your feedback. Your opinion is crucial for us to continue improving and creating relevant content for our community. Share your experience, suggest new topics, or let us know if there's anything else you'd like to see in future courses. 📝🌟

Join Now and Start Your Journey Towards Financial Freedom! 🆘

Remember, managing debt doesn't have to be complicated. With the right knowledge and a simple plan, you can achieve significant reductions in your spending and create a sustainable financial future for yourself and your loved ones. Enroll today and take the first step towards financial stability and peace of mind! 💳➡️💰

Course Gallery

Loading charts...